Don’t Gamble on the Fed… Do This Instead

By Nate Bear, Lead Technical Tactician

Before yesterday’s Fed announcement, I saw that a group of traders slammed into more than $12 million of the S&P 500 ETF (SPY) $515 puts… a bet we’d see a market sell-off.

As of the time of this writing, those puts are nearly worthless…

Poof…

And that’s the problem with most traders today: they’re GAMBLING.

Instead of guessing about things we cannot control, I prefer to focus on A+ setups and let the probabilities play out.

Like this gem I had in Carvana (CVNA):

My members got a chance to see this in action during today’s Daily Profits Live morning session.

Rather than play the guess-and-hope game, I rely on a methodical strategy and an amazing AI scanner that helps me quickly identify high-quality trades, just like Carvana.

Don’t worry if you missed out on this one.

Because I’m going to show you exactly what I did so, you can scoop up the next opportunity.

Let’s rewind the clock back to Monday night when this all started.

I recorded a video discussing the markets, the Fed, and, specifically Carvana.

It might seem weird that I’m putting together a strategy video at 10 o’clock at night.

But there are two things you need to know.

First, I wanted all the kids asleep so there weren’t any distractions. After all, I’m Papa Bear first and foremost.

Second, the AI scanner is so robust that I can look back in time, whether it be earlier in the day or the week before, and see how each stock on my list sets up.

And when I pulled up the results for Carvana, this is what I saw:

Carvana had setups across three different timeframes: the 195, 130, and 60-minute.

Looking at each one, I decided that the 195-minute timeframe was my favorite of the three.

This is what I saw…

In this screenshot, there are three elements I always look for in my setups.

First is a nice upward trend. In this example, Carvana gapped higher after some stellar earnings.

I’m good calling a stock in an upward trend whether it gaps up and holds the majority of its gains, or grinds higher over time.

Next, we get the pattern part of my setup. All I need is the price to start consolidating, with the range squeezing together over time, or at least not widening.

This doesn’t have to be exact to the wicks, so don’t get caught up in perfection.

As long as the majority of the price action falls in the pattern, then I’m happy.

Last up is the squeeze, shown at the bottom with the red dots. This tells me when the Bollinger Bands have moved inside the Keltner Channel. Effectively, this is my timing indicator.

Now, this trade had an extra kick that many of the others I’ve played lately did not – a high short float.

The short float tells you the percentage of shares available for trading that are sold short.

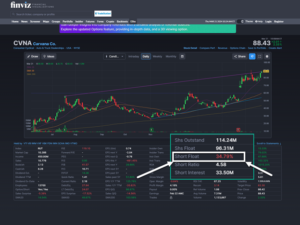

If you went to FinViz, you’d see the following:

When traders hold short positions, they risk margin calls leading to a short squeeze.

We saw this happen all over the place during the meme craze in early 2021 with GameStop, AMC, etc.

Essentially, when a stock’s price rises too much, the broker forces the short seller to exit their position by buying the stock to close the trade.

This creates buying pressure, sending the stock up higher, leading to a cascade of buying.

My favorite is when I get a setup like this near all-time highs because, as you might know, many short sellers have their stop-loss orders at the highs.

But, even with stocks like Carvana, they’ve been down so long that short sellers will put their stops against the recent highs.

Normally, I would have put this trade on Tuesday. However, I wasn’t near my computer.

And by Wednesday, the squeeze and setup were still valid.

However, I had to be careful because with the Fed announcement at 2:00 p.m., I didn’t want to hold a full position.

Thankfully, I put the trade on at 9:45 a.m. and was out twelve minutes later.

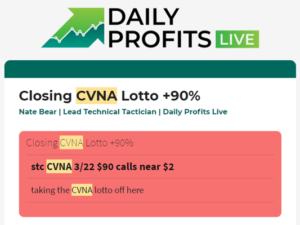

However, I still liked this setup and actually added a lotto trade just before the close yesterday.

And by this morning, I was able to lock in a profit getting out at $1.66 off an entry of $1.05.

And that’s the key here.

I didn’t want to trade THROUGH the Fed. But I’m perfectly fine trading AROUND it.

Because I can work trades like normal before the announcement or react to the price action after it hits.

I just don’t want to gamble on the market’s reaction.

This methodical approach, combined the power of the Stock Accelerator Monitor (aka S.A.M) is the same process that I used to take my $37,000 account into $2.7 Million in just four years…

…and it still works to this day.

I love teaching folks how to trade the market.

I want everyone to mechanically make money so consistently they get bored.

And I want you to join me.

More from Wake-up Watchlist

NVO Just Fumbled – Here’s Who Picks up The Ball

Feb 24, 2026

How to Prepare for a 20% Drop (Yes, It Could Happen)

Feb 23, 2026

OPEX Week or Not – I Have a Chart That’s Flying High

Feb 20, 2026