Take the Leap and Invest in Brazil

Editor’s Note: You may be familiar with the saying “There’s always a bull market somewhere.” Well, even in the throes of the coronavirus crisis, we have not only a bull market but a gold rush – all thanks to a special kind of technical indicator called “Power Channels.”

Marc Lichtenfeld, our longtime friend and Chief Income Strategist of The Oxford Club, has been tracking these Power Channels for 25 years – and now he wants to share his knowledge with everyday investors through a special free training event.

Learn to know at first glance where a stock is headed next…

Learn how anyone can master options trading with one simple tip…

And learn how you can see more than 50 opportunities to profit from Power Channels over the next 12 months.

Just click here to access Marc’s free training now.

– Ryan Fitzwater, Associate Franchise Publisher

I began my career as an emerging markets specialist. Starting in the early ‘90s, I often found myself in places like Turkey, Indonesia, China, Argentina, Egypt and more than 70 other countries.

I still follow these markets in The War Room. Our mantra is to follow the opportunity wherever it takes us. And this week, it took us to Brazil, the hypergrowth basket case of South America.

There is always something going on in Brazil, and it’s usually tied to inflation, government corruption or both!

So why take the leap to invest in Brazil for a trade?

Precisely because it is volatile, and if we can catch it at the right time – and give it some time – we could make out like bandits.

Brazil has suffered as a result of COVID-19, but that can be said about pretty much every country. With a would-be authoritarian in power, the country has been slow to react, preferring the path of ignoring the pain instead.

With a vaccine on the horizon, Brazil can go back to its old ways of printing more money, lending even more and then inflating away its debt. It’s the perfect time to jump into the Brazilian banking sector. If this really is the early stage of a global recovery, the banks will benefit.

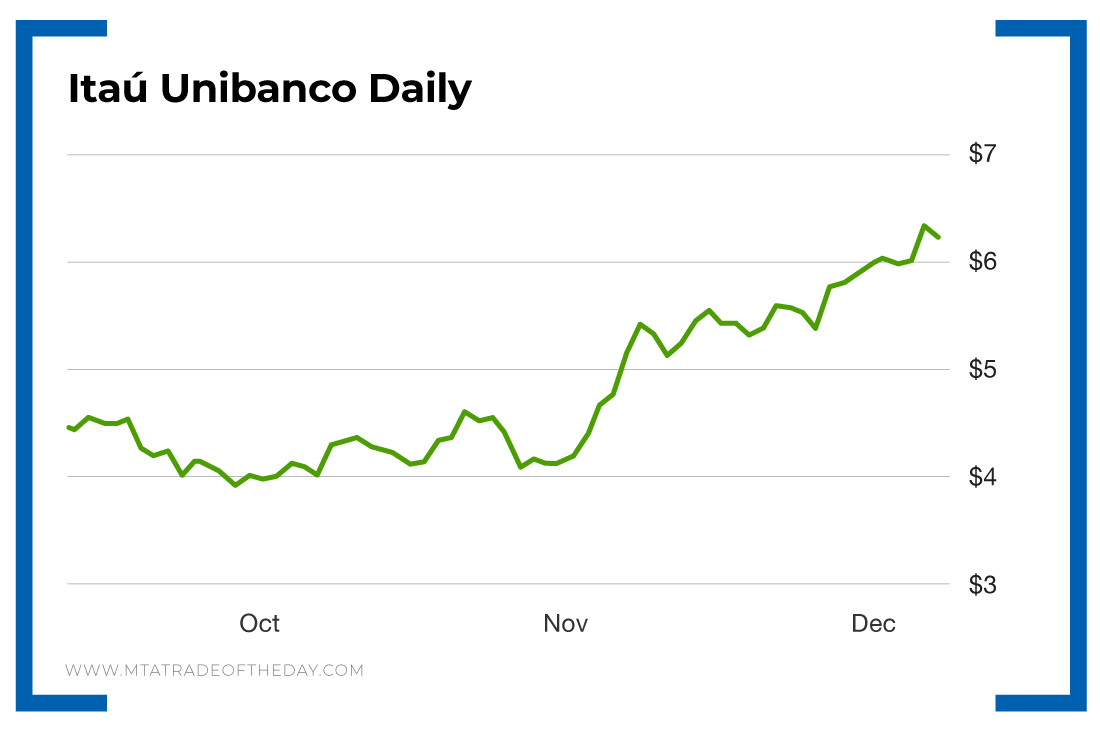

My favorite Brazilian bank is Itaú Unibanco (NYSE: ITUB), and that’s exactly what War Room members invested in using Long-Term Equity Anticipation Securities (LEAPS) options that don’t expire for a while.

Itaú is one of the biggest banks in Brazil and will benefit from any growth moving forward. It also has a management team experienced in dealing with corruption and inflation!

Action Plan: I can’t give you the exact trade, as that would be unfair to War Room members, but I do recommend that you take a position in Itaú if you think, as I do, that a global economic recovery is around the corner.

Better still, join me in The War Room today and get the exact details in real time!

More from Trade of the Day

Nov 1, 2024

This ONE Strategy will be Key during Election Week

Oct 31, 2024

Crypto Mining Play’s Election Setup

Oct 30, 2024

The Next Two Weeks Will be Huge…

Oct 29, 2024