The Best Way to Protect Yourself From Inflation

The market’s recent gyrations have more to do with the bond market than the stock market.

Let me explain…

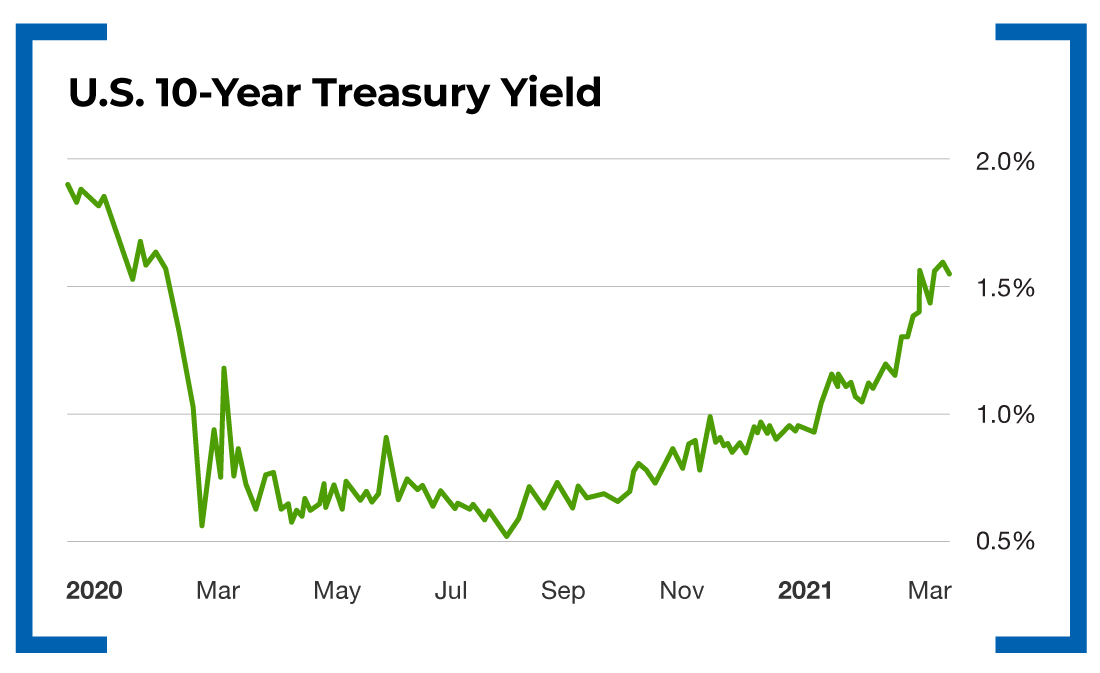

The chart below shows that the yields on bonds, particularly the 10-year Treasury note, have increased by more than 60% since the end of 2020. That is a HUGE move.

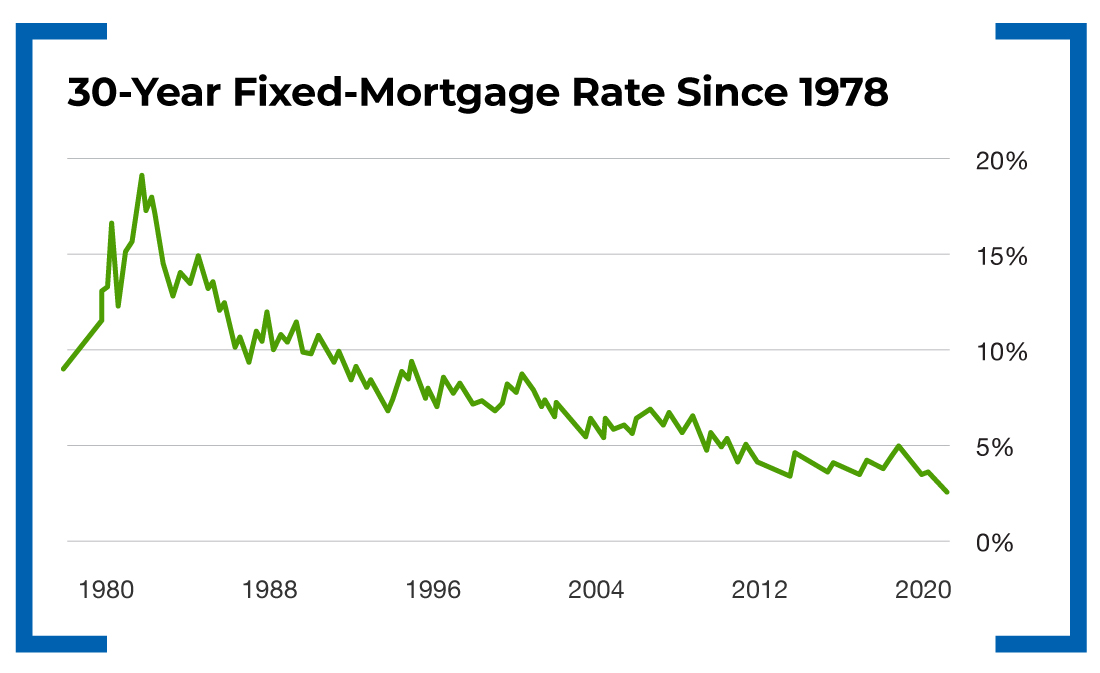

But in real terms, it’s not much at all. Paying 2.8% on a 30-year mortgage is still peanuts compared with historical rates.

And the Federal Reserve continues to be dovish in its tone, slanted toward keeping rates stable in relation to inflation.

This brings us to the real issue…

Where is inflation going?

You see, the bond market doesn’t care what the Federal Reserve does because it knows that the Fed is reactive, not proactive. This means the Fed will always react to a situation that may get out of hand as opposed to being proactive to prevent a situation from getting out of hand in the first place. It’s always playing catch-up.

Interest rates are rising because the bond market sees inflation ahead. More than 35% of U.S. annual GDP has been printed since March 2020, and that money is finding its way into the economy.

However, it takes a while. Usually, the effect of massive stimulus is felt six to 12 months after it’s injected. It’s not an overnight process. This means that in 2021, we are going to see the full effects of the 2020 stimulus (more than $4 trillion), and by the end of this year, we’ll see the effects of the $1.9 trillion stimulus.

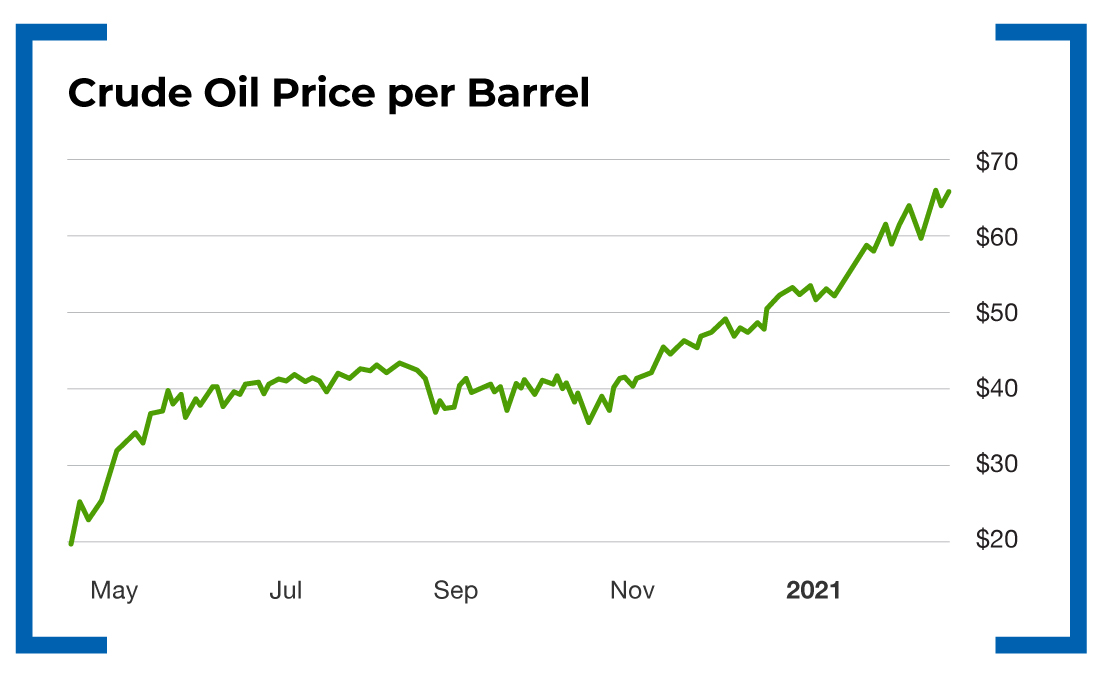

The result will almost certainly be too much money chasing too few goods, and that should result in prices going higher for just about everything. We’re already seeing the early signs in the oil market as the price of oil has doubled since the crash last year.

So to protect yourself from inflation, you have to keep up or beat it, and that’s not going to happen if you’re sitting in cash. The best inflation hedges in the last 100 years have been hard assets like gold and investing in companies through the stock market. Today, you have another potential but unproven inflation hedge – cryptocurrencies. While they haven’t tested the 100-year record of the stock market or the 5,000-year record of gold, they may be a good addition to your inflation hedges.

Action Plan: In The War Room, we cover all the burning topics out there and give you actionable ways to combat the ravages of inflation now – proactively! So what are you waiting for? Join me today!

P.S. Everyone watching the market has asked themselves this: Will the market go higher? Should I stay in cash, or go all-in?

A shocking video reveals why “Stockflation” could change everything. Watch this FREE presentation HERE.

More from Trade of the Day

Flying High – Is This the Future of Commuting?

Jan 9, 2026

Use This Trading Strategy in an Expensive Market

Jan 7, 2026

Jan 5, 2026