Using Strangle Trades to Win on General Electric

This is the fourth time we’ve made money on General Electric (NYSE: GE) in the past nine months.

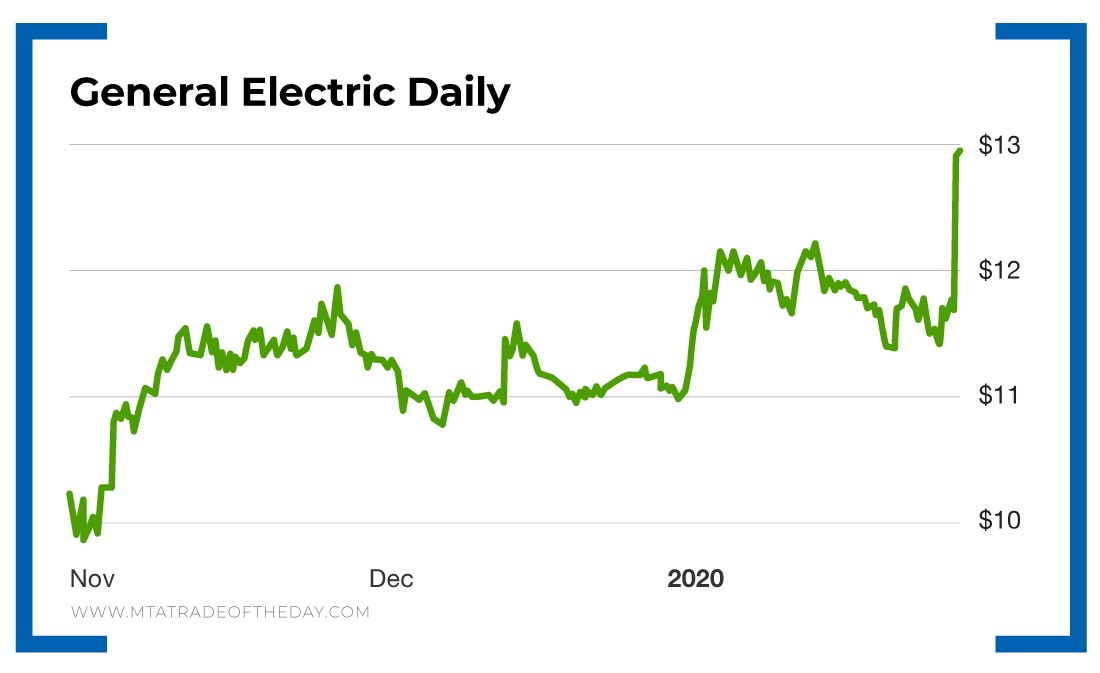

Ever since Larry Culp, former Danaher CEO, took over the reins at General Electric, the shares have been on a tear. It was no different today, with shares setting a new 52-week high after releasing great numbers this morning.

The shares moved up more than 10% on news that General Electric beat earnings and revenue estimates. Of course, this is just a game on Wall Street. The earnings and revenue estimates had been lowered several times last year.

So in reality the numbers weren’t that great, but they were better than expected – make sense? That’s Wall Street reality for you!

Regardless, War Room members took home some sweet profits, since many were in a strangle trade ahead of time.

A couple of weeks back members bought the $11.50 puts and the $12 calls on General Electric. The high for General Electric stock today was $13, which meant the calls traded as high as $1.03. Some members did only calls and walked away with triple-digit gains! Others who did the strangle walked away with solid double-digit gains.

“Thanks Karim, out at 0.93 for the strangle, +24% profit.” – Gerardo N.

“$0.95 for entire trade – Out for 25% +, Another WAR Room/Karim Trade right on Target!!” – Christopher S.

“First time here and first trade was GE. Got my call at .33 and sold this morning at .99. YEAH” – Wilkinson

A strangle involves buying a put and a call, so you may be wondering what happened to the put.

The put was sold for anywhere from $0.01 to $0.04. The whole point of a strangle is for one side of the trade to make more than enough to cover the price of the put and the call.

In this case that’s exactly how it worked out!

Right now, we are in the middle of earnings season, and that is the absolute best time to be in strangle trades.

They’re a specialty of our Head Trade Tactician, Bryan Bottarelli.

Action Plan: If you are looking for a strategy that can win “both ways,” then the strangle is the technique for you. It’s not going to win every time, but it can offer unlimited upside potential on a spectacular earnings beat or miss. How spectacular? Last year when FedEx missed earnings, one War Room member made enough to buy his daughter a car! That’s no small sum!

“Awesome trade for FDX made enough to pay for my daughter’s car!” – Mark D.

Join us now in The War Room while we are entering the heart of earnings season!

More from Trade of the Day

How My “Lotto” Strategy Makes 1,000% Gains Possible

Feb 20, 2026

Why Smart Traders Avoid These Stocks Like the Plague

Feb 19, 2026

Two Footwear Stocks Ready to Follow CROX Higher

Feb 18, 2026