Why Conventional Investing Won’t Work This Time

Are you a conventional investor?

Are you happy with knowing a couple of investment strategies… mostly buy and hold?

Well, I’ve got some bad news for you. This market doesn’t take prisoners, and in order to win the war, you need to be well-versed in how to trade through this period of uncertainty.

In The War Room, we use a range of strategies… and we teach you how to use them too. Without a doubt, the most popular strategy we use is short-term options trading. Bryan Bottarelli specializes in getting in and out of trades… quickly. And our 80%-plus success rate year to date is a testament to that.

But if options trading isn’t your preferred method, don’t worry because we recommend other strategies too. And this year, those strategies have provided our members with great gains!

So far, we’ve recommended covered calls to generate wins on companies like Inseego (Nasdaq: INSG), vertical call spreads to generate fat profits on Barrick Gold (NYSE: GOLD), Long-Term Equity Anticipation Securities (LEAPS) options to close out wins on a number of companies and even diagonal call spreads to take advantage of market inefficiencies.

Now, you may be thinking – what the heck is a diagonal spread, or a bull call spread? This all sounds too difficult.

It isn’t.

Let me explain a bull call spread to illustrate what it is and why it’s a critical type of strategy that you must understand in order to succeed.

A bull call spread is bullish, meaning that we are looking for an upside move. It uses call options, hence the bet that the move is going up and not down. And it’s a spread, which means we want to make an amount that equals the distance between two prices. So if the options we use are $5 and $10, we want to make the difference, or $5.

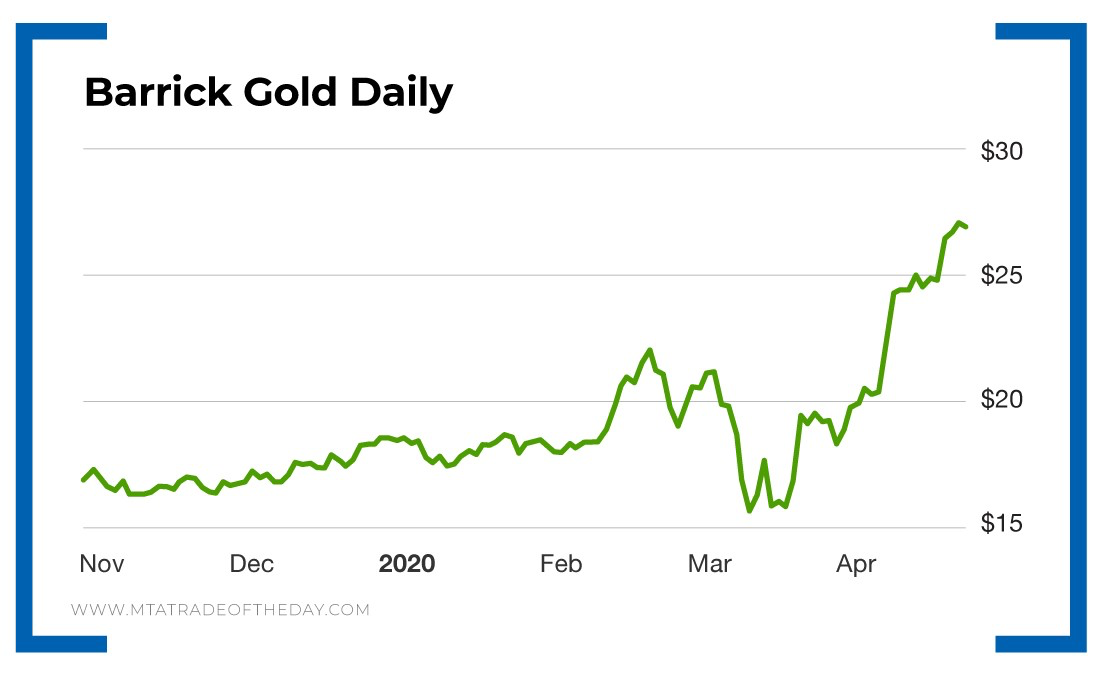

So this is how it worked on the Barrick Gold bull call spread that I recommended to War Room members…

Last year, I thought gold was going to move higher. And members had been taking winner after winner as a result. This time, I wanted to trade a senior gold producer called Barrick Gold, which is one of largest gold companies in the world, along with Newmont Corp. (NYSE: NEM).

But as gold began to get popular, the prices of the options on both companies increased. So let’s look at an example of a trade and how the numbers would work – again, this is just an example…

When Barrick Gold was trading at $17, the $17 LEAPS were trading for $4 – this means the stock would have to move to $21 for that trade to break even. I wanted to reduce the outlay to as little as possible in terms of premiums paid, thereby reducing my breakeven.

As I looked across the options chain, I saw that the $25 call options were trading for $2. So I recommended this trade to War Room members. They bought the $17 option and sold the $25 option. The net cost was $2 ($4 minus $2).

That is the power of doing a spread, as we cut the trade cost in half from $4 to $2. At the same time, we limited our upside to $8 (the spread between $17 and $25).

Ultimately, Barrick Gold moved higher, and the trade I recommended for $2 was now worth more than $3.40 on a net basis. Members took that 70% short-term gain!

By using a spread, members reduced their risk from $4 to $2. They kept a nice upside of $8, which could have resulted in a 300% gain if they held for a much longer period. But members also reduced their maximum possible loss to $2, or 11%, versus $4, or 23.5%.

Action Plan: Having different strategies makes sense in any market but even more so in a market like this one.

And in The War Room, we’ll show you exactly how to do it!

More from Trade of the Day

Are the Banks Destroying Your Savings?

Feb 16, 2026

Palantir Is About to Collapse. Again.

Feb 13, 2026

How I’m Playing the Dollar’s 10% Drop

Feb 12, 2026