Three Defense and Aerospace Bargains

The calendar has flipped from September to October…

What a relief!

U.S. equities just had their worst month of the year, as the Dow fell 3.5%, the S&P 500 fell 4.9% and the Nasdaq dropped 5.8%.

Let’s not mince words – September was brutal.

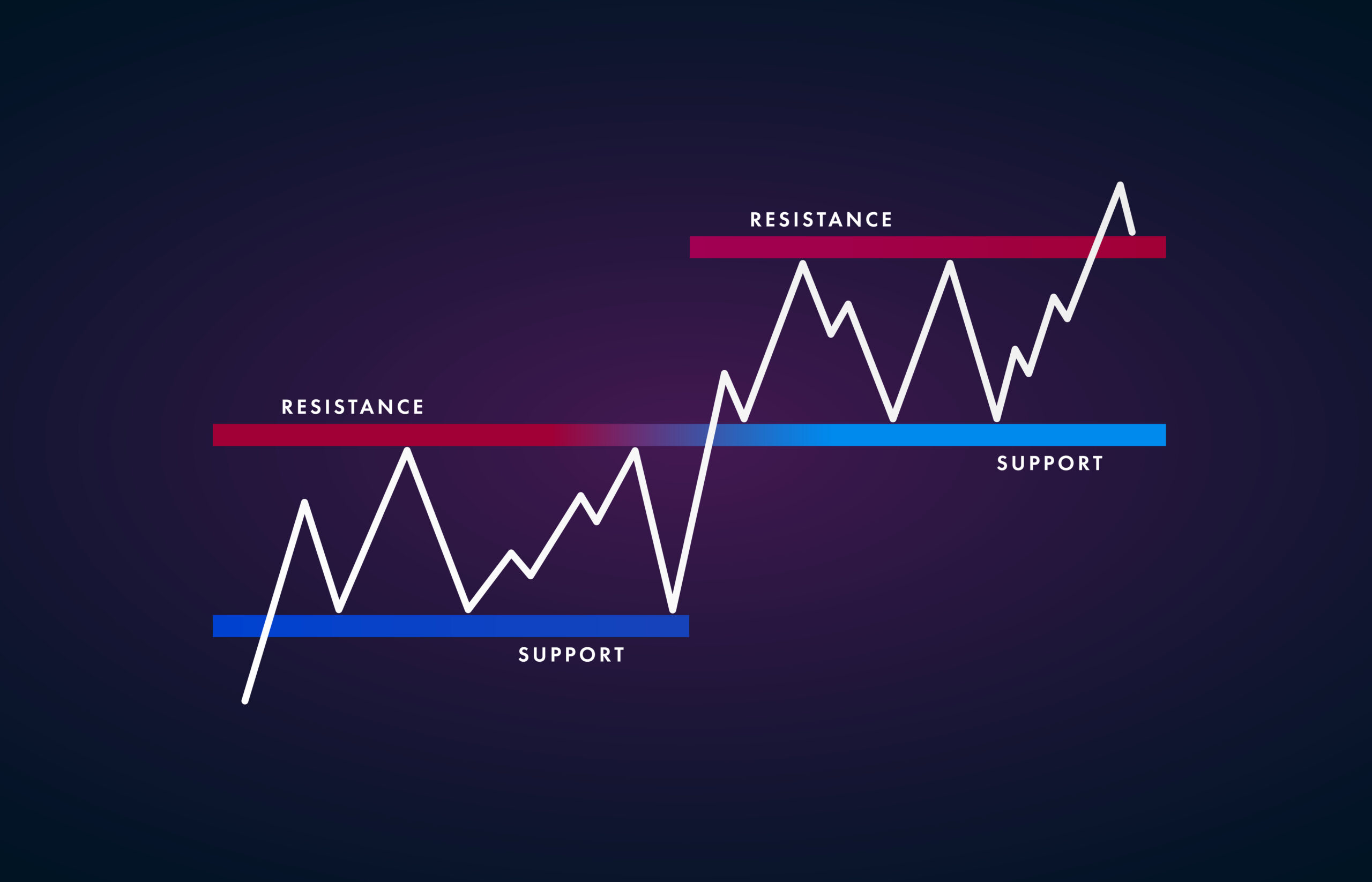

However, last month’s weakness has now presented us with opportunities to buy some very attractive stocks at bargain levels. Today’s alert points you to three names within the defense and aerospace industry.

First off, shares of The Boeing Company (BA) have traded lower in 19 of the last 21 trading sessions – a monthlong sell-off unlike anything the stock has seen in years.

Secondly, Barron’s just noted the opportunity in General Dynamics (GD). It has a record backlog of $91 billion as of the end of Q2 and a total contract value of $129 billion, which equals three years’ worth of revenues. The shares have dropped 10% year to date and pay a 2.4% dividend yield, so this seems like a risk/reward scenario that’s squarely in your favor.

And the third stock is RTX (RTX), formerly known as Raytheon Technologies. If Russia is indeed planning to test a nuclear-powered missile (which satellite imagery from a remote Arctic region indicates), then owning the defense play that manufactures the most sophisticated anti-ballistic missile technology in the world seems like a savvy move.

![]()

YOUR ACTION PLAN

All three of these stocks – The Boeing Company (NYSE: BA), General Dynamics (NYSE: GD) and RTX (NYSE: RTX) – appear to be trading at bargain prices right now. These are three solid trades to capitalize on the September weakness.

If you’d like to see how we’re trading these companies inside The War Room using options, we invite you to join our pro trading community! While the markets were all doom and gloom last month, we stayed calm and delivered the goods. We went 16 for 20 on our trades in September for an 80% win rate, and we notched several sizable winners, including 133% on Oracle (ORCL) in one trading day.

Are you ready to start trading along with us? Click here to unlock The War Room.

MONDAY MARKET MINUTE

- Welcome to October! As we kick off a new trading week, the worst month of the year for the stock market is finally behind us. On top of that, Congress narrowly avoided a government shutdown by passing a temporary funding bill late Saturday night – so until mid-November, we have one less market stressor to worry about.

- Dollar Tree a Bargain. As shares reached a two-year low, director Daniel J. Heinrich bought 1,650 shares on the open market for an average price of $105.24. Does he know something we don’t? If anything, this shows you that he believes the shares are undervalued. Tracking.

- The Sphere’s Early Reviews Are In. If you follow LeBron James on Instagram, then you know how the best basketball player of this generation felt about opening night at the new Sphere entertainment venue in Las Vegas. In short, the reviews have been amazing. The venue has been called a “stunning spectacle,” “utterly astonishing” and “[an] admirably raw Vegas extravaganza.” This buzz should help shares of Sphere Entertainment (SPHR) continue trending upward.

- No More Rate Hikes? Pershing Square Capital Management founder Bill Ackman says the Fed is likely done hiking interest rates, as the U.S. economy is starting to slow.

More from Trade of the Day

Nov 21, 2024

How Markets Could React to Nvidia’s Earnings

Nov 19, 2024