Take Advantage of the Market’s Breakneck Pace in 2026

Over the past few years, I’ve written a lot about zero day to expiration (0DTE) options trades for one simple reason…

And while I no longer trade them on JOLTS/government reports in Catalyst Cash-Outs Live (soon to be Monument Trend Advisory)…

They are still an integral part to my Dark Ticker strategy and with some of my trades in The War Room.

Why?

The fact is, 0DTE trades have taken over Wall Street.

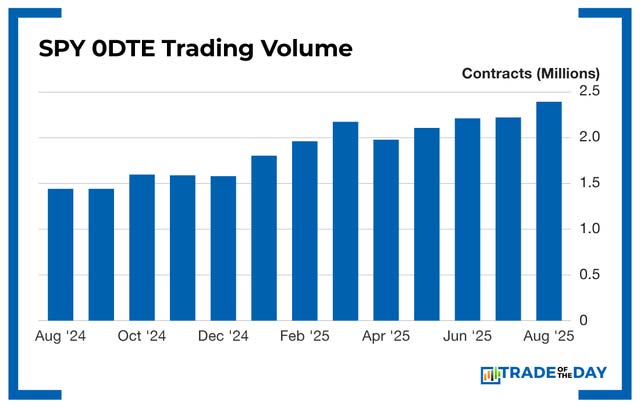

Check out the recent data…

As you can see, 0DTE trades have been on the rise.

In December 2025, SPX options trades averaged 3.9 million contracts per day, with 0DTE options making up 2.3 million of those contracts.

That’s nearly 60% of trades coming from 0DTEs last month.

Plus, with the way AI is evolving, we’ll only see the 0DTE trend get bigger in 2026.

What Are 0DTEs?

0DTEs are “zero days to expiration” options trades.

All it means is that the trade expires that day.

You open the trade in the morning, and by the closing bell, it’s over.

The big benefit from these trades is the potential gains.

Since time decay goes nuclear on expiration day, this can lead to huge option swings… with gains as high as 2x, 5x or 9x – all within hours.

How Wall Street Uses AI to Profit From These Fast Moves

Old-school investing was built for a slower world.

Not today’s world.

Headlines are what move the markets.

Social media influencers and politicians are manipulating data. That creates more uncertainty… which drives further volatility.

Add in AI models, and now Wall Street can…

- Process millions of data points in real time

- Monitor thousands of stocks simultaneously

- React instantly without bias

- Stay calm under extreme volatility

This is where retail traders lose, no matter how smart they are.

Win BIG in the Age of 0DTEs

While Wall Street has the speed and better predictive models, you can still use tried-and-true strategies in the age of 0DTEs.

One of my favorite strategies is the zero-day options strangle.

A strangle is simple – you buy a call or you buy a put.

If the stock stays flat, you break even or take a slight loss.

But the 0DTE strategy is designed to take advantage of volatility spikes happens (which is what 0DTEs are designed to do), and where you can take a massive gain.

This positions you to take advantage of volatility without trying to outsmart the market.

![]()

YOUR ACTION PLAN

As Wall Street continues to use speed to its advantage, we’re bringing a legend into the house on Thursday, January 22 so you can learn how to take advantage of these fast-paced markets.

Frequent CNBC/Fox Business contributor and Options Hall of Fame Member Jon Najarian will be joining senior analyst Chris Johnson LIVE inside of the Monument Traders Live Chatroom.

Jon has been on the cutting edge of algorithmic trading.

He’s developed patented trading applications and algorithms used to identify unusual activity in stock, options, and futures markets.

I think you’re going to learn a lot from this session.

Click here to join him and Chris LIVE on Thursday, January 22 at 2 p.m. ET.

More from Trade of the Day

Cracking the Code of the Market’s Seasonal Cycles

Jan 19, 2026

How Long Can This Silver Run Last?

Jan 15, 2026

Inside the Amazon Decision That Lost Millions

Jan 14, 2026