Bank on These Stocks Now!

A whirlwind of confusion – that’s what these past few weeks have been for investors.

War…

Energy prices…

Geopolitics…

The U.S. Federal Reserve…

All of them vying for headlines.

Throw in a few major down weeks for the indexes – including a bear market for tech – and it’s little wonder most investors are running for cover.

But I’ll shout this from the rooftops…

DON’T BE LIKE MOST INVESTORS!!

As we enter earnings season again, the focus will be on which sectors are managing to succeed and what each sector’s outlook is.

Things will be grim for some sectors, as supply chain issues will continue to dominate.

But for one sector, the outlook is better than ever.

The banking sector is looking at sunny days ahead, with the slight possibility of a major thunderstorm (nothing is ever 100% in investing).

But here’s the truth…

Banks have been making money hand over fist in an environment where interest rates have been at zero for what seems like a decade.

Ever since the housing bust in 2008, interest rates have really gone nowhere.

That’s all changed now.

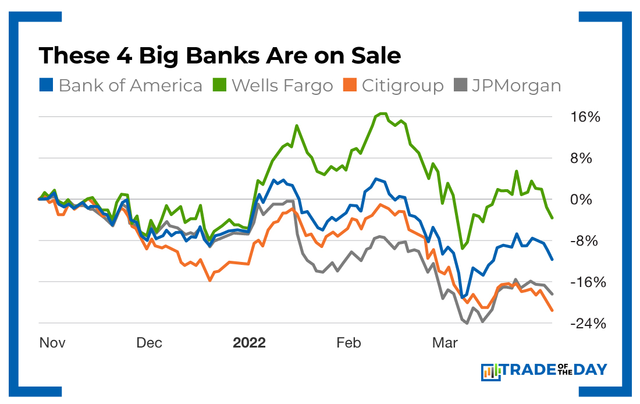

Rates are rising AND the economy is booming. For banks, this is the best of all worlds. And for investors, bank stocks have been hit hard lately on fears of stagflation (high inflation and high interest rates, which in tandem usually cause a recession).

But over the next 12 months, we’re more likely to see a strong recovery than we are to see stagflation. And the market is not paying attention to that side of the equation.

Sure, inflation is an issue. But there is no sign of demand slowing down – and that is what ultimately makes the economy and banks hum with glee.

If you want to make some dough, go to where the dough is deposited! Four big banks are on sale right now, and each has its specialty:

- If you want the biggest play on the consumer, buy Bank of America (NYSE: BAC).

- If you want a play on consumer and investment banking, buy JPMorgan Chase (NYSE: JPM).

- If you want deep value and a turnaround play, buy the cheapest of the bank stocks, Wells Fargo (NYSE: WFC).

- If you want some sizzle in your portfolio with the addition of an “end of the war in Ukraine” play, then look to another undervalued banking giant, Citigroup (NYSE: C), which has exposure to Europe.

Action Plan: There’s always a sector on sale, and today that sector is banks. Each one of the plays I mentioned has LEAP options going out to 2024, and those options would put you in at 15% to 20% of what you would pay to buy the stocks. And that’s exactly how I would play these banks today!

If you want to know exactly how we’re helping people make winning trades in today’s confusing markets, click below to join The War Room. We’re currently guaranteeing that members will receive 322 winning picks this year.

More from Trade of the Day

Why Santa Could Bring the Bulls Soon

Dec 16, 2025

One of The Best Trades I Ever Made (1,130% Winner)

Dec 12, 2025