Are You Ready for 2023? (This Could Be Big)

The market is offering you an opportunity… if you can see it.

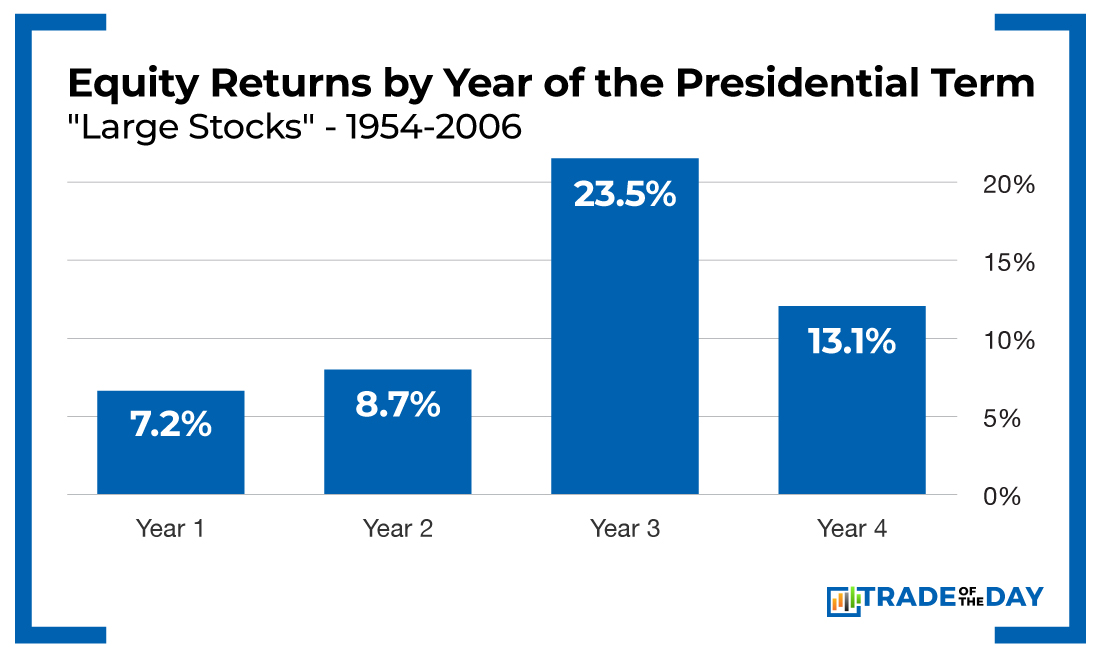

The second year of a presidential term is often one of the poorer of the four years in terms of stock market performance.

Add to this trend a war, inflation fears, an active Federal Reserve, and a market that was for all intents and purposes oversold, and you have the makings for a really good year… next year!

Data shows the returns in the last two years of a U.S. presidential term far surpass the returns in the first two years.

As you can see, year three shows a vastly different result from years one and two, with average gains of 23.5%. And since 1947, year three hasn’t produced a single down year.

To extrapolate further…

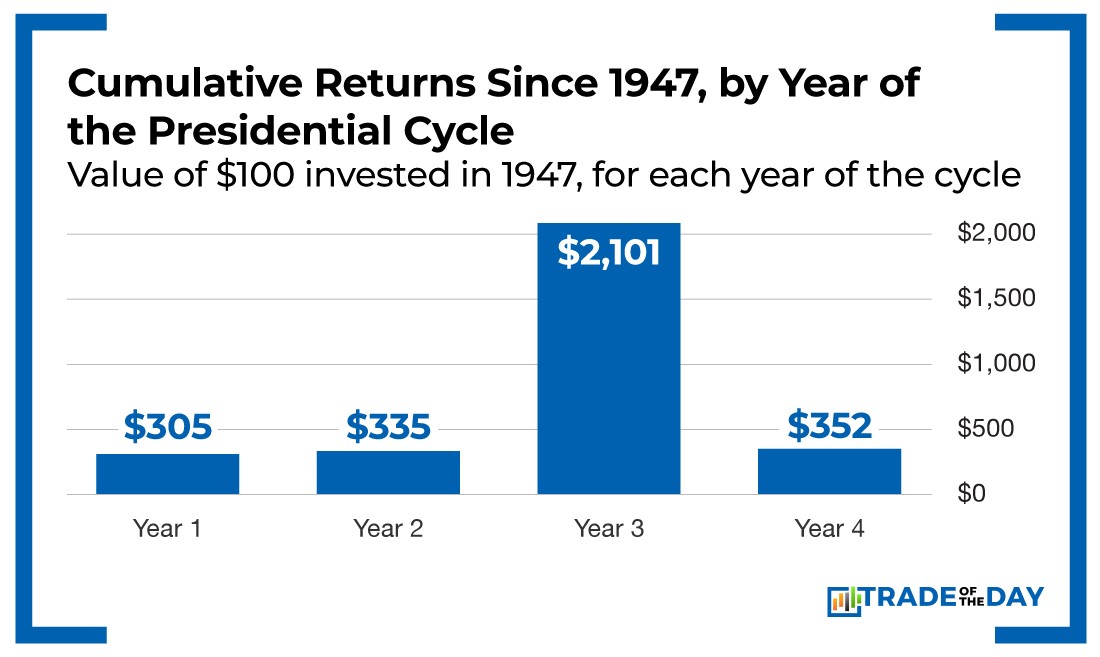

From 1947 through 2011, years one, two and four of a presidential cycle returned about a 200% gain. Year three returned a 2,000% cumulative gain!

So if you’re a savvy investor, you know that we’re not far away from year three of the current presidential cycle… and that planning is a big part of success.

And I’m going to show you where the buying opportunities are for 2023!

So far this year, the Nasdaq is down more than 14%, and it was down more than 20% earlier in the year.

The S&P 500 was down more than 10% at one point but has since recovered about half that loss.

The downside for both could continue. But, fortunately for you, the indexes are hiding an even bigger truth!

That truth is…

A lot of great companies are down way more than 10% or 20%.

But that’s where the bargains of 2023 will be found. And the way to take a position in them is to use cheap LEAP options that expire in 2024.

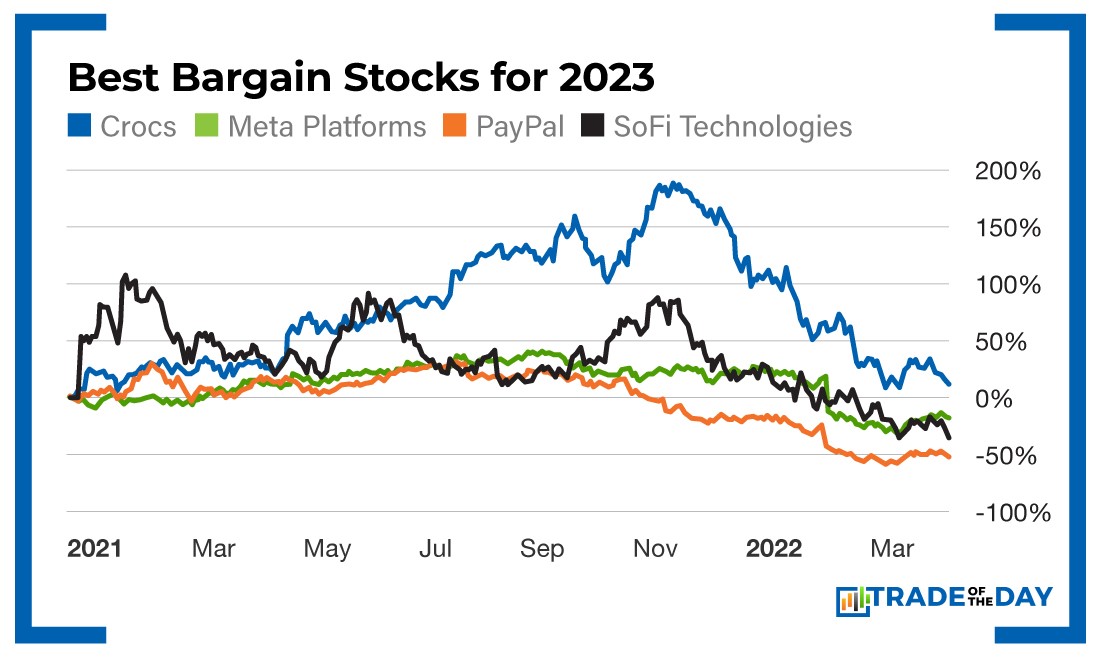

Here’s my list of bargain stocks:

- PayPal (Nasdaq: PYPL), the world’s largest payment platform, has been decimated. It’s down from more than $300 to close to $100. Don’t tell the insiders, though. They’ve been scooping up shares, and so should you.

- Meta Platforms (Nasdaq: FB) is a cash machine, and a couple of mediocre quarters is not going to change that.

- SoFi Technologies (Nasdaq: SOFI), the millennial’s bank, is down on news that the government is extending the student loan repayment moratorium – not canceling loans, just delaying payments. This one could blast off once the repayment moratorium is over – probably after the midterm elections.

- Crocs (Nasdaq: CROX) is another insider favorite that is trading at less than eight times 2022 earnings, making it a great value play.

Action Plan: These are just four examples of stocks that have been hammered by the market. They’re down 30% to 60%, but these companies are fundamentally sound and are ready to rebound. Each one has LEAP options that allow you to bet less than 20% of the share price. So what are you waiting for?!

We’re currently showing War Room members exactly how to prepare for 2023 with trades like these. Last month, we hit 47 wins out of 54 trades for an 87% win rate. Click here to discover those trades.

More from Trade of the Day

Why Santa Could Bring the Bulls Soon

Dec 16, 2025

One of The Best Trades I Ever Made (1,130% Winner)

Dec 12, 2025