A Perfect Small Cap Trade

In today’s volatile markets, trading small cap and microcap stocks can be very lucrative.

However, it can also be a quick way to lose your shirt because these stocks move so fast.

Today, I’ll cover an example of a perfectly executed small cap trade on Jasper Therapeutics (Nasdaq: JSPR).

I will follow it up with an explanation of a key strategy that is critical to making trades like this consistently.

This will likely be one of the most important tips I’ve provided.

Let’s get into the trade.

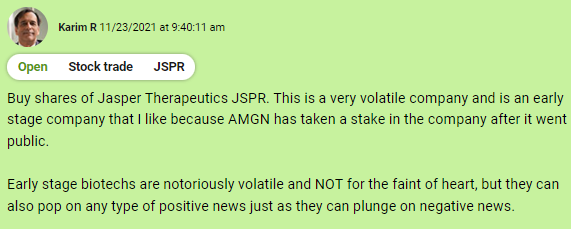

On November 23, I was alerted that Jasper Therapeutics had dropped below my entry target. I immediately recommended that War Room members buy the turbulent biotech stock.

We patiently held as the stock bounced around and even had a second opportunity to get into the position when it dropped to our entry price again on Monday.

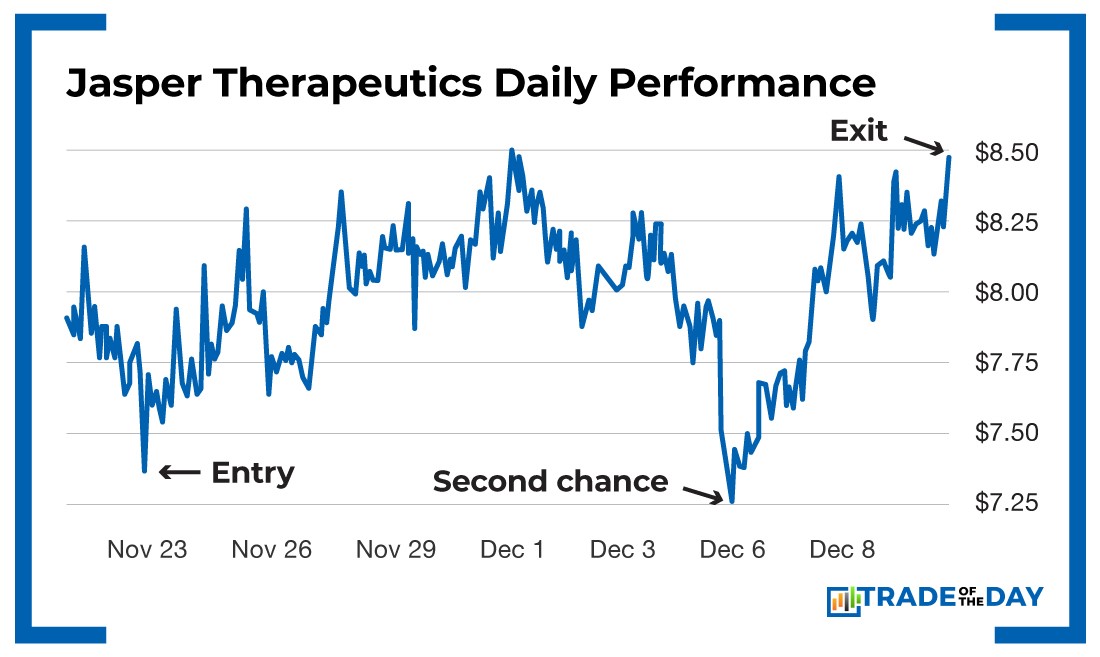

Now check out Jasper’s chart during the trade…

We nailed the perfect entry – twice!

Talk about awesome timing.

We rung the register two days after that second chance to get in, and members walked away with gains of up to 29%. That’s more than 1% for every day since the initial entry date.

Peter G. 12/9/2021 at 10:52 a.m.

Thx, Karim. JSPR final sell today at $9.73, bought at $7.53. 29% in a week.tonywdcvr 12/8/2021 at 1:08 p.m.

Absolutely. Out at $8.40. 14.25%. TKS, Karim.Kevin V. 12/8/2021 at 11:23 a.m.

Go JSPR!!! Now at $8.50.JerryOJC 12/8/2021 at 11:20 a.m.

I closed the 100 Shares/Contracts I opened at $7.30 for $8.45.Rob K. 12/8/2021 at 11:34 a.m.

Out earlier at $8.48 for a 16.3% gain.Adrian G 12/9/2021 at 2:41:42 pm

Have to thank Karim on the JSPR stock buy signal on 11/23/21 in at 7.70 out at 9.80 for a 27.3% and bought some Options today also up…..Patience is correct

There’s a lot more to this story. When we went to sell Jasper on the December 8, I was clear with our members:

The current bid/offer is $8.43 by $8.50. If you don’t exercise discipline and patience, you will knock the price lower.

Why would I say that? Well, if you trade small caps and microcaps as long as I have, you learn a thing or two about pricing.

The Key Is Pricing

On large cap stocks like Apple (Nasdaq: AAPL) – and even on AAPL options – liquidity is not an issue. We don’t have enough buying or selling power to affect the price, and paying or getting an extra penny or two will not really impact the situation.

BUT on small caps, microcaps and thinly traded options, every cent matters. We CAN affect the price, and if you don’t follow directions, the market makers will take you to the cleaners.

If they see you coming, they will raise or lower the price depending on the order flow of buys or sells that they are seeing.

When the market makers see a bunch of buy orders suddenly pop up, they raise the price, knowing that undisciplined investors will pay more and panic-buy.

This effectively shorts the shares, which will fall back lower absent any news.

Their goal is to average up, or scale up, the stock’s cost as more buy orders come in.

When the buying stops, they know that some will panic-sell because the shares aren’t going higher.

This can set off a chain reaction, pushing the price lower, which then makes new buyers panic even more, thinking they bought into a bad play. And then bag holder syndrome kicks in.

Action Plan: Knowing how to trade can be as important or even more important than knowing what to trade.

Don’t be a kneejerk, newbie investor. Pick your price and stick to it. We walk our members through small cap and microcap trades like the one on Jasper every day in The War Room. Stop missing these wins and join us here now!