The Range-Bound Strategy That’s Beaten the AI Hype Train Four Times This Year

Most people see a biotech AI stock and think “moon or bust.”

I see a pattern.

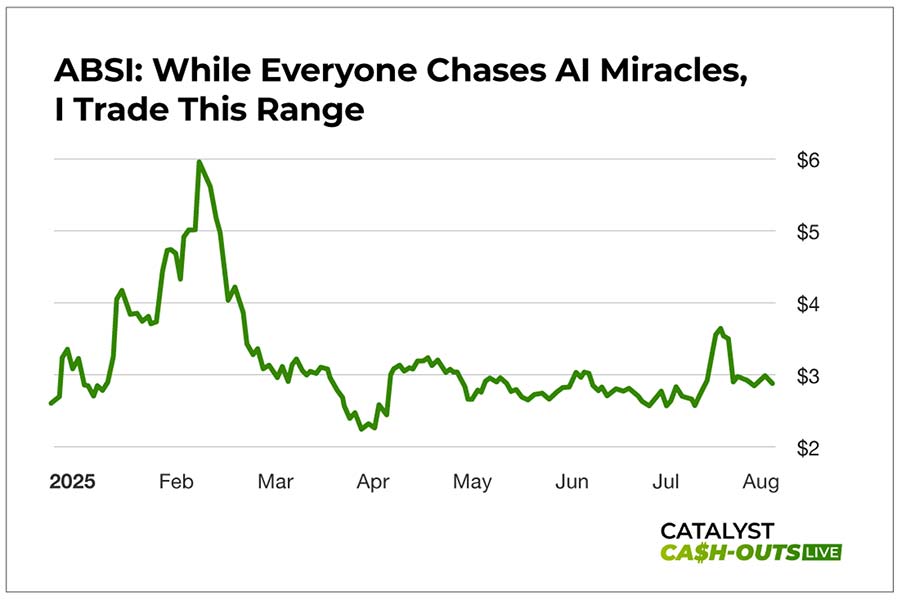

While everyone’s gambling on whether AbSci’s artificial intelligence will cure cancer or crash and burn, I’ve been quietly trading the same range four different times this year for profit.

Here’s what I know about ABSI that the moon-shot crowd doesn’t: This stock trades between $2.50 and $4.50. Period.

I’ve done this dance all year, and I keep showing up to collect.

The AI Biotech Reality Check

AbSci uses artificial intelligence to develop new drugs. Sounds revolutionary, right? Maybe it is. Maybe it isn’t.

What I know for certain is that they’re an early-stage company burning cash on clinical trials and AI development. No revenue from actual drug sales yet. Just hope, potential, and major company investments keeping the lights on.

Every time there’s news—good results, partnership announcements, whatever—the stock rockets higher. Then reality sets in. They need more cash for operations, so they do another secondary offering below market price, and down we go again.

Rinse and repeat. That’s the pattern.

The $2.90 Setup Nobody’s Talking About

Right now, ABSI is sitting near $2.90 after their latest secondary offering drama. They recently raised $15 million between $3.00 and $3.25.

Classic biotech move: Get everyone excited, pop the stock, then immediately dilute shareholders with discounted shares to fund operations.

But here’s what the complainers miss—this creates our entry opportunity.

The Covered Call Sweet Spot

Instead of betting everything on AI drug discovery miracles, I’m using covered calls to generate returns while we wait for the next move.

The Trade:

- Buy ABSI stock at current levels

- Sell November $4 calls against the position

- Target net debit: $2.60-$2.65

The Math: At a $2.65 net cost, we make money if ABSI is above $2.65 at November expiration. That’s it.

If it runs to $4 by November, we get called away and make about 50% in a few months. If it stays flat around $3, we still profit from the time decay on the calls we sold.

If it crashes back to $2.50, we’re only down 15 cents from our cost basis instead of the 45 cents someone who bought at $2.95 would lose.

Why This Beats the Hype Game

Look, ABSI might eventually develop some miracle drug using AI. Or it might burn through investor cash for years like most biotechs do.

I don’t need to predict the future of artificial intelligence drug discovery. I just need to trade the pattern.

This stock has shown me the same behavior four times this year. Each time, patient entry points and covered call strategies generated profits while the buy-and-holders rode the roller coaster.

Position Sizing Reality Check: Nothing in my portfolio except income-generating positions exceeds 4% allocation. This is speculation money, not retirement money.

ABSI has tremendous beta and backing from major companies, but it’s still burning cash on unproven technology. Size accordingly.

![]()

YOUR ACTION PLAN

Range trading ABSI is just one type of opportunity we exploit in Catalyst Cashouts LIVE.

While the crowd chases AI hype and earnings surprises, we’re systematically trading the patterns they ignore.

More from Trade of the Day

How My “Lotto” Strategy Makes 1,000% Gains Possible

Feb 20, 2026

Why Smart Traders Avoid These Stocks Like the Plague

Feb 19, 2026

Two Footwear Stocks Ready to Follow CROX Higher

Feb 18, 2026