An American-Made EV Dividend Play? With a Supercharged Bonus???

Everyone focuses on high growth when they talk about electric vehicles (EVs).

But the truth is…

There’s a way investors can enjoy the best of all worlds.

What if you could get high growth and a strong 4% dividend to boot?

It’s possible to get both – and even more!

I am going to share a play with you that will not only pay you a dividend but give you a supercharged bonus “dividend” and growth as well.

It’s the kind of play I usually reserve for The War Room… but I want you to get in on it too.

The company is Ford Motor (NYSE: F) – yes, that one.

The company just released earnings, which came in better than expected.

Then it let investors in on a couple of pieces of news that bolstered the case for investing in the company.

Here is the important information…

- Ford is increasing its dividend to $0.15 per share, which will bring the company back to pre-pandemic levels.

- The company sees the Ford+ plan as the biggest opportunity since the scaling of the Model T.

- Demand for EVs is overwhelming, and the company has strong multiyear order banks.

- More than 3,000 electric E-Transit Vans were sold in the second quarter, giving the company a 95% share of the electric van market.

CEO Jim Farley said…

We’re moving with purpose and speed into the most promising period for growth in Ford’s history – to innovate and deliver great products and connected services, raise quality and lower costs. We’re giving customers great experiences and value, improving our profitability and making Ford the next-generation transportation leader.

Ford affirms guidance for full-year 2022 adjusted EBIT (earnings before interest and taxes) of $11.5 billion to $12.5 billion and affirms a full-year 2022 adjusted free cash flow view of $5.5 billion to $6.5 billion.

These are huge numbers. Ford is leading the way in the electric van market, and it will be the leader in the truck market too with its F-150 Lightning model.

Meanwhile, shares are trading $10 below their 52-week highs.

Action Plan: Here’s the strategy – it’s called a covered call, or a buy/write. Either buy Ford stock and hold it (while collecting the dividends and any future capital gains), or buy shares of Ford and sell the Ford January 2024 $20 calls for $2.10, giving you two annual 4% dividends and an extra 13% “special dividend,” along with any capital gains.

Your gains are capped at the strike price, or $20 per share. You could also do a hybrid play and hold half the position free of calls and use covered calls on the second half.

Unique trades that generate consistent returns are what we pride ourselves on in The War Room. In July, we posted a 70% win rate and hit 21 total winners. We’ve made 197 winning trades so far this year, and right now, we’re guaranteeing members will receive 322 winners in their first 12 months of membership.

Click here to unlock those trades.

Fun Fact Friday

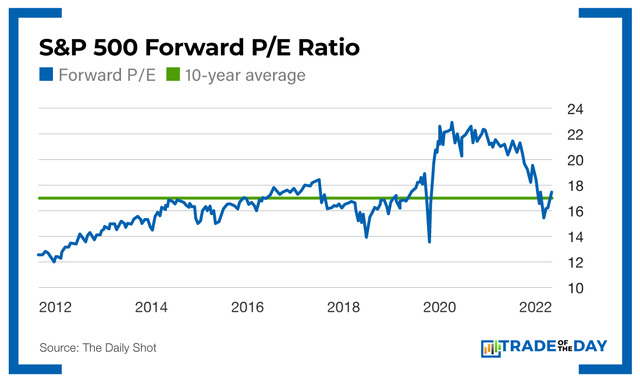

The S&P 500’s forward price-to-earnings (P/E) ratio, a measure of valuation, is now near the 10-year average. The recent sell-off has brought stocks back into a more reasonable trading range.