As we Go Nuclear, so Could This Stock

Last Friday, nuclear stocks got a boost after the White House announced it’s to meet the country’s growing nuclear needs.

The orders would involve the Defense Production and direct the Departments of Energy and Defense to help speed the construction of nuclear reactors.

Some of the companies that saw a boost included reactor companies Oklo and NuScale.

But there’s one company I’ve been bullish on for several years – and I’ll be looking for a trade on a pullback in The War Room this week.

That company is Cameco (CCJ).

Cameco is a one of the world’s largest uranium producers, and it’s well-positioned to benefit from the President’s latest executive order.

The nuclear provider also operates two uranium mines in Canada, at Cigar Lake and McArthur River, and manages one of the world’s largest commercial refineries in Ontario.

Last year, CCJ produced 23.4 million pounds of uranium and it’s projected to produce 29 million pounds annually through 2029. So this is a potential long-term play that could produce repeat buy opportunities.

Aside from the White House backing, there’s also massive AI implications with nuclear energy.

As energy demand to power AI data centers is expected to increase. Goldman Sachs estimated that these data centers will consume 8% of total U.S. electricity demand by 2030, compared to 3% today.

Action Plan: As the global shift toward nuclear energy continues, Cameco is a stock that’s on my radar for a trade in The War Room.

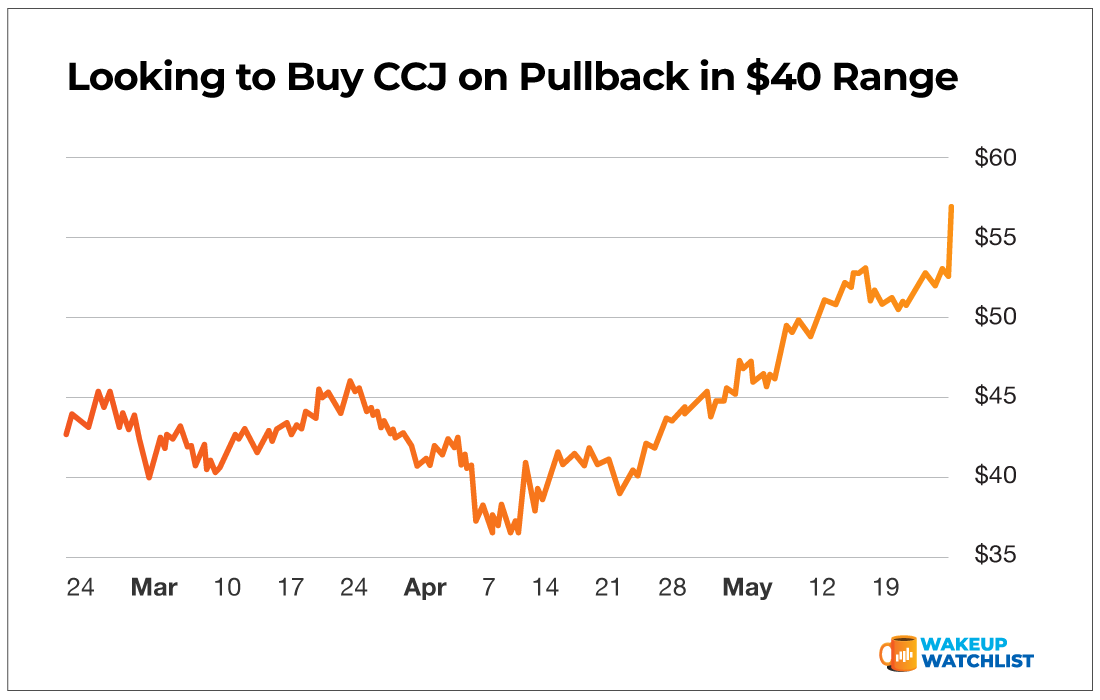

At the time of this writing on Friday, the stock was up 8% and is currently priced around $57.

However, it’s a volatile stock, and I’ll be looking to enter on a pullback into the mid $40s.

Click here to receive my trading strategy and exact entries and exits.

More from Wake-up Watchlist

OPEX Week or Not – I Have a Chart That’s Flying High

Feb 20, 2026

5 Trades. 5 Winners. Same Ticker.

Feb 18, 2026