Best Chip Stock on Earth: Now on Sale

Editor’s Note: Readers constantly write in to ask, “Can we see what The War Room looks like?”

Well… ask and you shall receive!

For the first time ever, I’m doing a LIVE War Room Demo… 100% FREE!

Join us on Thursday, August 4, at 2 p.m. ET.

I’ll personally walk you through all the features of our live-trading chat room.

Plus… we’ll have a LIVE Q&A where I’ll take your questions…

I’ll even reveal a special $300 discount for those who attend.

As a Trade of the Day reader, you’ll get FREE access.

Just look for a Zoom link in your email 10 minutes before we go live on Thursday.

You can also add the event to your email calendar by clicking here.

Note: Our Zoom room is limited to 1,000 participants. Spots are first come, first served!

-Ryan Fitzwater, Associate Publisher

By now, I’m sure you’ve heard all about the great chip shortage of ’22.

Some estimates say that 169 industries have been impacted. And no wonder…

Because semiconductors are the building blocks of modern-day computing – they impact everything from smartphones and TVs to laptops and cars.

Basically, anything you use right now that has an on/off switch depends on them.

And thanks to a strange combination of events, the automotive industry has been one of the biggest losers of the chip shortage.

But as you’ll see, that presents us with an opportunity…

As I’m sure you know, the automotive sector was decimated in 2020 by COVID-19, which caused travel restrictions that crushed demand for new cars.

In response, automakers overcompensated.

They trimmed their production plans and dramatically reduced their orders for new microchips.

But then we rapidly recovered – and here we are today… stuck without chips.

Why don’t the seat warmers on every new 2022 Cadillac work?

I’ll tell you why… NO CHIPS!

GlobalFoundries (the largest U.S.-based chipmaker) recently said that wafer capacity is sold out through 2023 – yet it plans to boost its production capacity by 50%!

So clearly the demand for chips will be off the charts well past 2023.

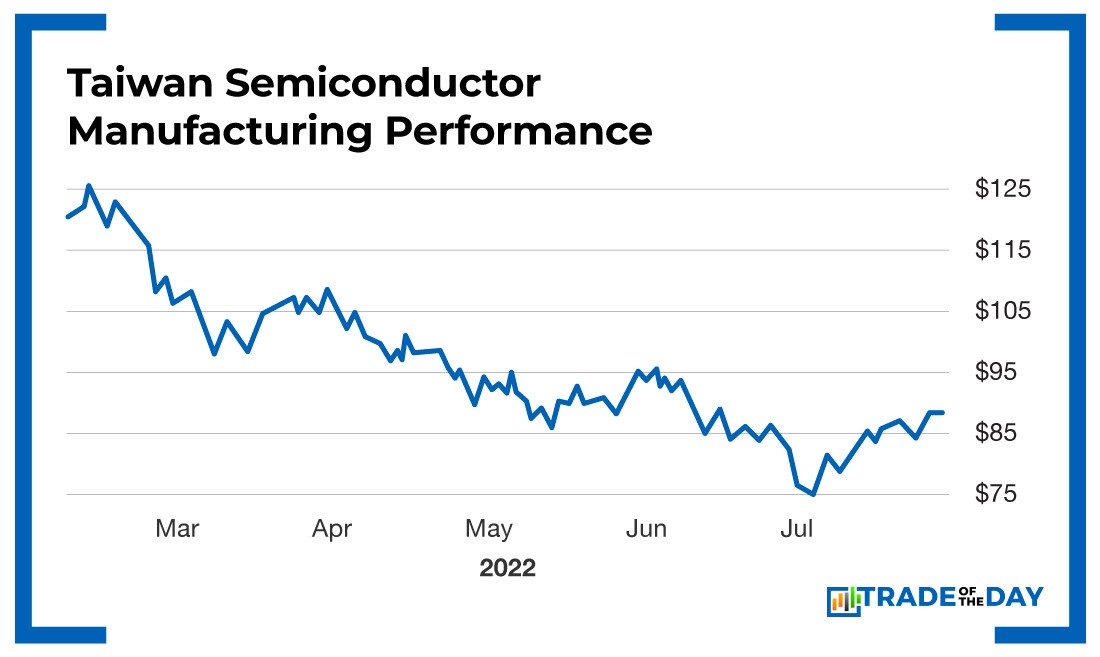

That’s why I believe there’s such a tremendous opportunity right now in Taiwan Semiconductor Manufacturing (NYSE: TSM).

Since the company is based in Taiwan, not many investors realize that it’s the world’s leading semiconductor manufacturer.

Earlier this month, the company reported fantastic earnings…

- Second quarter revenues shot up 36.6% year over year to $18.16 billion.

- Gross margins increased to 59.1% (up from 50% in the prior-year period).

- This led to a 67% year-over-year increase in Taiwan Semiconductor’s earnings to $1.55 per share – which beat the analyst estimate of $1.44.

With a customer bases that includes Apple, Qualcomm and Advanced Micro Devices – all of which rely on the company for their semiconductor processing technology – Taiwan Semiconductor is in a massively powerful position.

Plus, the company just upped 2022 guidance to 30% year-over-year growth.

And best of all… Taiwan Semiconductor is cheap.

Right now, it trades for less than 20X trailing earnings.

In comparison, the average stock in the Nasdaq 100 trades for 25X trailing earnings.

Action Plan: If you want to own the best chip stock in the world – which will be see booming demand into 2023 and beyond and which trades at a discount to the Nasdaq 100 – then you should consider adding Taiwan Semiconductor Manufacturing (NYSE: TSM) to your portfolio right now.

P.S. If you like this pick and want to get more of our TOP picks delivered to you every Wednesday, then you’re invited to level up and join Trade of the Day Plus right now.

Monday Market Minutes

- Can the Rally Be Trusted? We just had the best month since November of 2020. Does it feel like everything is all better? Barron’s says, “This rally can’t be trusted,” primarily because the 12% jump in the Nasdaq is in line with the average historical bear market rally, dating back to 1950. In other words, what we just saw in July qualifies as a textbook bear market rally – a pop within a downward trend. Tracking.

- Check Out This Staple ETF! If you want to remain safe in this market – but still get upside exposure – the Consumer Staples Select Sector SPDR Fund (NYSE: XLP) might be the answer. With holdings that include Procter & Gamble (NYSE: PG), Coca-Cola (NYSE: KO), PepsiCo (Nasdaq: PEP), Costco (Nasdaq: COST), Walmart (NYSE: WMT) and Colgate-Palmolive (NYSE: CL), this ETF is a nice way to play the U.S. consumer.

- Big News for Boeing! The company’s 787 airplanes are back on schedule for delivery. We could see a $200 handle on Boeing (NYSE: BA) by the end of this year if it avoids any further screw-ups.

- Bally’s Inks Deal! Bally’s (NYSE: BALY) just became the official sports betting partner of the New York Yankees. This marks Bally’s first sports team partnership in New York. In July, the company became the ninth online sports betting operator in the state.