Big Pharma Group Refiles Bankruptcy Petition

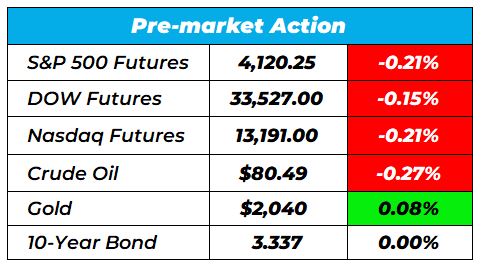

Good morning Wake-up Watchlisters! While you’re sipping coffee you’ll see stock futures slid on Wednesday. Hawkish messages from New Zealand and Australian central banks signaled the fight against inflation isn’t over yet. Plus, new economic data shows we could be in for weak demand over the next 3-4 months as the US march ISM manufacturing index fell to 46.3 to 47.5.

With more volatility potentially in store, it’s important to consider investments outside of the stock market, which is why our friend Marc Lichtenfeld is letting readers in on a unique financial strategy. The average return on this unusual class of investments was 196% last year… and Marc believes that his current pick is poised to see the same profit potential this year.

Click here to discover how he’s playing the latest oil and gas surge.

Here’s a look at the top-moving stocks this morning.

Johnson & Johnson (NYSE: JNJ)

Johnson & Johnson is up 2.85% premarket after the consumer healthcare giant re-filed a bankruptcy petition on behalf of subsidiary that would payout billions in claims to allegations that its talc products caused cancer. The new filing follows a decision from the 3rd U.S. Circuit Court of Appeals in Philadelphia. This filing invalidated LTL’s first bankruptcy filing in New Jersey, which pegged talc settlements at around $2 billon, earlier this year.

Walmart (NYSE: WMT)

Walmart is down -0.50% premarket after the world’s largest retailer confirmed its full-year profit and sales targets ahead of an investor day presentation later this morning in Tampa, Florida. Walmart said it expects adjusted April quarter earnings, of between $1.25 and $1.30 per share, with sales rising between 4.5% and 5%.

$mid_ad_zone

InflaRx N.V. (IFRX)

InflaRx N.V. is up 15.38% premarket after the U.S. Food and Drug Administration granted emergency-use authorization to Inflarx NV’s monoclonal antibody for the treatment of hospitalized COVID patients. The injection goes by the name Gohibic and targets a part of the immune system that may play a role in the inflammation that leads to COVID-19 disease progression.

Western Alliance Bancorporation (NYSE: WAL)

Western Alliance Bancorporation is down 4.59% premarket. The recent failures of two regional U.S. banks eroded trust in the country’s banking industry, prompting the Biden administration to tighten rules and ask midsized banks to boost their liquidity. The company said on Tuesday that unrealized losses on securities and held-for-investment loans for the first quarter have narrowed since the end of 2022. The company also said it has no borrowings outstanding from the Federal Reserve’s discount window after balance sheet repositioning.

When stocks tank and there’s fear in the markets, it’s important to stay rational and focus on companies with strong fundamentals. These are the companies that will withstand market headwinds, and our Head Fundamental Tactician Karim Rahemtulla specializes in finding long play value stocks like these. Right now he’s pounding the table on what he’s calling “The Last Great Value Stock.” It saw a 20% rise in January and Karim believes it still has a lot of room to potentially grow.

Click here to unlock this under $2 stock.

Those are the biggest stock movers for today.

Happy trading!

The Wake-Up Watchlist Research Team