Buy This $10 Stock

In many bar discussions/debates, I’ve argued that the next blockbuster sci-fi movie franchise should be based on the Legend of Zelda franchise, the popular Nintendo series whose first game was released in 1986. The series features the exploits of Princess Zelda and the elf-like warrior Link – and has sold 125 million copies worldwide since the release of its first edition.

Created by the Japanese game designers Shigeru Miyamoto and Takashi Tezuka, the series centers on Link, a courageous young man of the elf-like Hylian race; and Zelda, a magical princess who is the mortal reincarnation of the goddess Hylia. They fight to save the magical land of Hyrule from Ganon, an evil warlord turned demon king.

Here’s how Zelda and Link looked when I used to play the game…

Here’s how they look now…

But I digress… Back to the main argument.

Unlike Disney, which has leveraged its library of characters to develop cash-generating entertainment franchises such as Star Wars and Avengers, Nintendo has focused solely on making the best video games possible.

Ignoring the opportunities to leverage characters such as Mario, Luigi, Donkey Kong, Link and Zelda has been a missed opportunity. But now Nintendo might be coming around. The Super Mario Bros. Movie, released in April, has grossed $1.16 billion worldwide. Not only that, but Nintendo just released The Legend of Zelda: Tears of the Kingdom, which could be the company’s biggest software release in years.

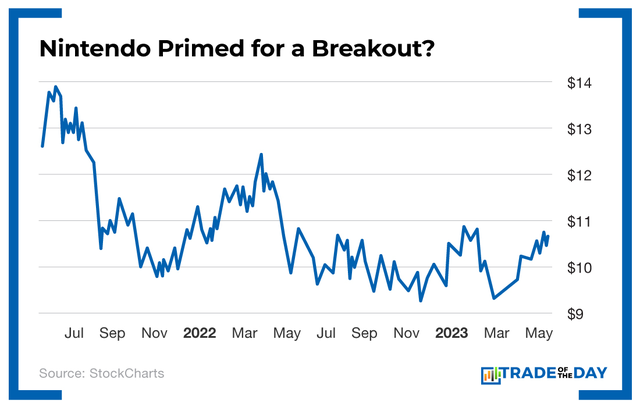

![]()

YOUR ACTION PLAN

If Nintendo (OTC: NTDOY), which trades for around $10, can combine the profitability of its software with movie franchises, it will look like a bargain. A move back up to its ’21 highs around $15 seems more than reasonable.

P.S. Here’s why I believe we’ll soon see the “Next Major American Index.”

When the Dow was created in 1885 (well before computers and the internet), the only way to calculate a market indicator was to add up its components’ share prices and divide by the number of components. So that’s exactly what Charles Dow did with the 30 components. And that’s how the index’s value is calculated to this day.

When the S&P 500 was launched in 1956 (still a long time ago, in the grand scheme of things) technology had advanced to the point that the S&P could base its new market metric on its component companies’ total stock market values – rather than on their share prices. But that methodology still has flaws. For instance, in the first quarter this year, just seven (7) stocks supported the entire market: Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla. Combined, they accounted for 82% of the S&P 500’s return in the quarter – a statistic that I find both shocking and alarming.

Takeaway: Why You’ll Soon See the “Next Major American Index”

The S&P 500, which is widely considered the broadest market exchange on the planet, was created 67 years ago. Since then, a lot has happened – which is why we need a new major American “index” to reflect today’s new market environment. And I have reason to believe that I know which asset will soon assume that role. I posted a new video explaining my reasoning and revealing the exact pick, which you’re invited to view below:

Yes! Show Me the “Next Major American Index”

MONDAY MARKET MINUTE

- How Strong Are the Markets, Really? As mentioned above, in the first quarter, just seven stocks supported the entire market. Until more stocks support the major indexes, we’ll remain light and nimble with our trades. Tracking.

- Big Insider Buy on GD Is Good for DFEN. General Dynamics recently hit a 16-month low, and director Mark Malcolm bought $1 million worth of shares at an average price of $214.47.

- Is the World Reserve Currency the U.S. Dollar? As the debt ceiling debate continues to escalate, it’s time to really reconsider the status of the U.S. dollar – and take a different approach altogether. And that approach is this: The U.S. stock market is the world’s reserve currency – not the U.S. dollar.

- Aging Population Good for This Stock. One stock that will make a lot of sense as the global population continues to age is Stryker (SYK), a leader in hip and knee replacement devices. The $108 billion company also sells hospital equipment and performs robot-assisted surgeries for joint replacements. The stock has seen support from the $65-$67.50 level dating back to February, so this could be a name to pick up on weakness.

- Tech Group Gets Bought. NeoGames (NGMS) was up 114% in premarket trading after announcing it had entered an agreement to be acquired by Aristocrat Leisure for $29.50 per share in an all-cash transaction, representing an enterprise value of approximately $1.2 billion.