China Wants its Own Chips…

Attention Traders: It’s Monday and our Lead Technical Tactician Nate Bear is giving you his weekly stocks to watch. He’s also showing you an A+ trade setup using his Ai trading tool, SAM. Click the image below to see his picks.

Nate has been trading like gangbusters in Daily Profits Live. Last week he closed a 128.81% winner on RILY in 1 trading day.

Click here to see how Nate’s unique chart pattern trading system works.

Good Morning Wake-Up Watchlisters! While you’re waiting in the drive-thru for a McDonald’s hash brown you’ll see stock futures were down slightly on Monday. This is the last trading week of March and the markets are on track for a fifth consecutive month of gains. This week, investors will learn more about inflation as the February personal consumption expenditures price index comes out.

No matter what the inflation report says, we’ll be ready with our own strategies for consistent winning trading in The War Room. Last week Bryan and Karim went a perfect 10-for-10 for a 100% win rate, with Karim closing a 59.43% winner on RTX in 143 trading days.

Click here to learn more about The War Room.

Here’s a look at the top-moving stocks this morning.

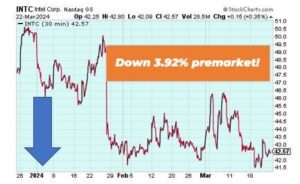

Intel Corporation (Nasdaq: INTC)

Intel Corporation is down 3.92% premarket after a report that China would limit chip usage and servers in government computers. The move could result in billions of dollars in losses for the U.S. companies. The Financial Times also reported that China wants to sideline Microsoft’s Windows and foreign-made database software in favor of domestic options.

Masimo Corp. (Nasdaq: MASI)

Masimo is up 13.39% in premarket after Politan Capital Management (an 8.9% shareholder of Masimo) announced that it’s nominating two candidates for election to the Masimo Board of Directors. Politan is supporting a strategic review to evaluate a separation of the Consumer Business, as evidenced by our ongoing efforts over the last 18 months.

More from Wake-up Watchlist

NVO Just Fumbled – Here’s Who Picks up The Ball

Feb 24, 2026

How to Prepare for a 20% Drop (Yes, It Could Happen)

Feb 23, 2026

OPEX Week or Not – I Have a Chart That’s Flying High

Feb 20, 2026