Shot Clock Trade: Risk $3 to Make $13 Before August 7th

Hey Gang,

While everyone’s chasing these extended momentum plays at new highs, I’ve been consulting with my bed buddy SAM and hunting through my watch list.

SPY just pushed into that dangerous +3 ATR territory – that’s rare air that usually leads to a pause.

So instead of chasing stretched names, I sort my scanner by A+ squeezes to find setups the crowd is ignoring.

And DataDog just shot to the top of my list.

The Setup That Has Me Excited

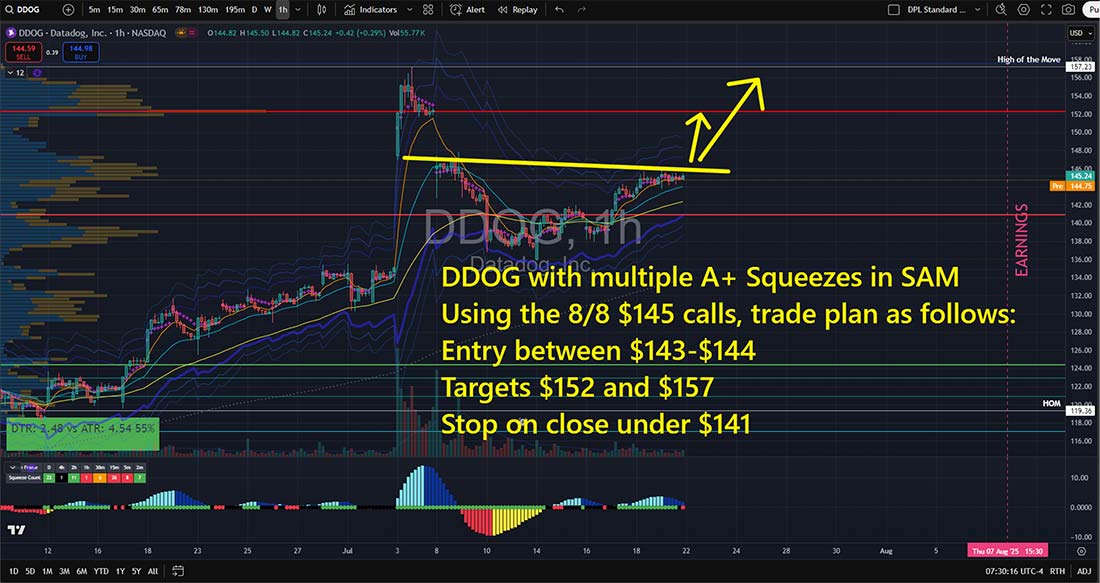

DDOG is sitting at $144 with a textbook cup and handle formation. After that massive spike when they got added to the S&P 500, it pulled back, closed the gap perfectly, and now we’re rounding up into earnings.

Here’s what caught my attention: My scanner is lighting up with multiple A+ squeezes stacking in this handle. That’s the kind of technical setup that makes me stop what I’m doing.

The Shot Clock Trade I Love

Earnings hit August 7th – that’s our shot clock. I love trades with built-in exits because I’m not gonna get married to this thing for six months making excuses while theta decay eats me alive.

Here’s my game plan:

- Entry: August 8th $145 calls around $144-145

- First Target: $152 (gap fill)

- Stretch Target: $157

- Stop: Close below $141 pivot

Risk $3 to make $8, with upside to $13. Those are odds I’ll take.

CLICK THE IMAGE BELOW TO WATCH THE FULL BREAKDOWN

Why This Works Right Now

The options chain tells the story – IV jumps from 38% to 55% for August 8th expiration. The market knows earnings are coming and is pricing in the volatility event. That’s exactly what we want for a pre-earnings momentum play.

![]()

YOUR ACTION PLAN

Watch for entry around $144-145 on any morning dip. We’re not holding through earnings – pure momentum play into the event.

Remember, individual names with strong setups like this can run independent of broader market chop.

More from Uncategorized

How I Turned Market Chaos into a Trading Triumph

Oct 4, 2024

The Best Investors Clone Other People’s Ideas

Dec 10, 2021

Bryan + Karim Chat – PWS 2020 Park City

Jul 28, 2020