Airliner Takes Off…

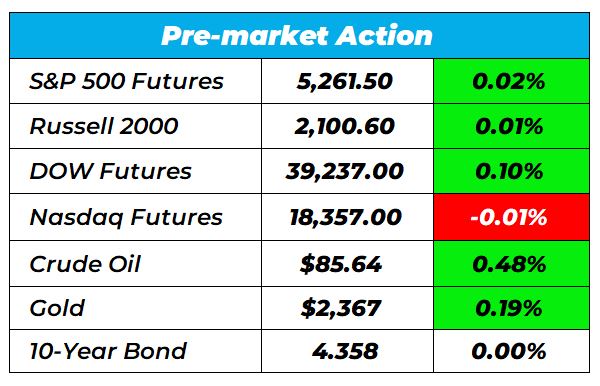

Good Morning Wake-Up Watchlisters! While you’re sippin coffee you’ll see stock futures held steady on Wednesday ahead of a key inflation report. The CPI report is set for release at 8:30 a.m. and is expected to show annual inflation of 3.4% compared with 3.4% of February. First earnings season also kicked off with results from Delta (more on that below).

{% unless user.extended_attributes.customer_active_subscriptions contains “TPU” %}

With the key inflation reading coming out, it’s important to know how government reports can lead to big trading opportunities in the market. Right now our Head Trading Tactician Bryan Bottarelli is showing traders a government loophole that could lead to huge overnight profits.

Click here to discover the “JOLTS” loophole. {% endunless %}

Here’s a look at the top-moving stocks this morning.

Delta Airlines (NYSE: DAL)

Delta Air Lines is up 4.84% in premarket trading due to a bullish outlook for the second quarter, driven by strong travel demand. The company anticipates an adjusted profit between $2.20 and $2.50 per share, surpassing analyst expectations. Delta aims for a 14% to 15% operating margin and a 5% to 7% increase in second-quarter revenue year-on-year, supported by a forecast of 4.7 billion global travelers in 2024. This outlook underscores Delta’s positive momentum and operational performance, along with robust bookings for international trips and corporate travel.

Earnings reports can often serve as a trigger for a stock’s swing in either direction. However, the truth is there are plenty of opportunities to trade stocks AFTER earnings. Our Lead Technical Tactician Nate Bear follows what he calls the “post-earnings surge” for maximum potential gains. So far in 2024 he has a 100% win rate using this strategy on 27 trades.

Click here to get Nate’s next “One Ticker Payout” today.

Hexcel Corporation (NYSE: HXL)

Hexcel Corporation is down 7.94% in premarket trading after its Q4 earnings and revenue not meeting analyst expectations. The company reported Q4 earnings of $0.43 per share, which was below the Zacks Consensus Estimate of $0.49 per share, marking an earnings surprise of -12.24%. Additionally, their Q4 revenue amounted to $457.5 million, also missing the Zacks Consensus Estimate by 2.05%.

Moderna (Nasdaq: MRNA)

Moderna is up 0.83% premarket due to positive trial results for its cancer vaccine developed in collaboration with Merck’s Keytruda. This vaccine, aimed at head and neck cancer, demonstrates potential beyond melanoma, sparking optimism for accelerated approval processes. However, opinions on the trial’s significance vary, with some analysts urging caution due to the small scale of the study.

More from Wake-up Watchlist

How to Prepare for a 20% Drop (Yes, It Could Happen)

Feb 23, 2026

OPEX Week or Not – I Have a Chart That’s Flying High

Feb 20, 2026

5 Trades. 5 Winners. Same Ticker.

Feb 18, 2026