Breaking Down an Earnings Strangle

Let’s dig into one strategy we use in The War Room – the earnings strangle.

What Is an Earnings Strangle?

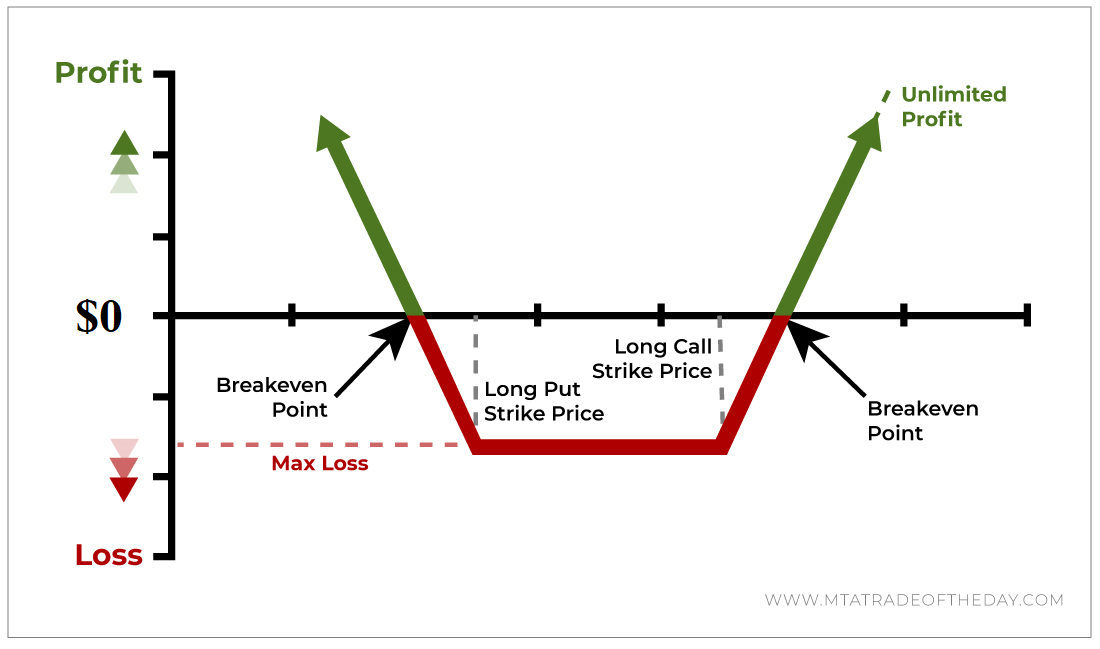

An earnings strangle is a maneuver executed just prior to a company’s earnings announcement, wherein a balanced position of calls and puts is established on the same underlying asset and expiration date, but with different strike prices. Put simply, getting positioned on both sides of a trade is called a strangle.

How It Works

An earnings strangle is initiated by simultaneously buying an out-of-the-money call option paired with an out-of-the-money put option. This establishes a position with (theoretically) unlimited profit potential to the upside while limiting any downside losses to a predetermined amount.

The goal is to profit off a big earnings reaction in either direction – up or down. When executed correctly, traders can profit off a sizable price movement without knowing the direction.

Here’s a Real-Life Example

Let’s say Caterpillar (NYSE: CAT) stock is trading for $96.75, and the company is scheduled to report earnings on April 25.

You could establish a $3 earnings strangle by buying the following options…

- Caterpillar April $97 calls expiring April 28 for $1.50

- Caterpillar April $96.50 puts expiring April 28 for $1.50.

Prior to the earnings release, you don’t know whether Caterpillar will beat earnings or disappoint. However, you do know that as long as the stock moves at least 5% on earnings day – either up or down – you will turn a profit on your strangle position.

As it happens, Caterpillar surprises with strong earnings, and the stock jumps from $96 to $104 – an 8.3% gain. In turn, your calls gain 367%, while your puts expire worthless.

Altogether, this total trade moves up to $7, good for a 133% profit. That’s because the substantial gain from the calls far outweighs the small loss from the puts.

Alternatively, if Caterpillar disappoints with weaker-than-expected earnings numbers and the stock falls from $96, as long as it falls at least 5%, you also make money on your trade!

Advantages

Earnings reactions are often the largest single-day moves a stock makes all year. That’s precisely when you want to be involved because that’s when the money is made.

Earnings strangles have distinct advantages…

- You know the exact timing of every trade ahead of time. Every earnings announcement is scheduled in advance, allowing you to plan your entry and exit orders accordingly. This way, you’ll never miss a trade.

- You have zero directional risk. While most traders look to predict a stock’s post-earnings direction, this strategy removes all of the guesswork. By playing both directions together, all you care about is the magnitude (again, not the direction) of the move. In the example above, if the stock moves 5% (or more) on earnings day, you win.

- You don’t need to act fast or quickly trade in and out to get the best price. As long as the stock reacts enough to move the needle, the gains will be sustained throughout the session on earnings day.

- You can manage and allocate your capital more efficiently. Because you know the buy and sell dates in advance, you can anticipate what will be tied up in the market versus what’s available in cash. This way, you’ll know how much to put into each trade.

In our experience, earnings strangles are consistently the most profitable trading strategy.

Takeaway: If you’d like to start trading earnings strangles but could use some guidance, we invite you to join The War Room.

When it comes to earnings, most traders swing for the fences and speculate on one direction – either up or down. Sometimes they win. Other times they lose. It’s always a coin flip.

By trading earnings strangles with us, your odds increase significantly. Instead of guessing the right direction, you play an inexpensive call option and an inexpensive put option simultaneously. This way, the directional risk is eliminated. When done correctly, if the stock moves enough on earnings day, you always win. Even factoring in some earnings clunkers, the chances of 100%, 200% or even 450% returns are in your favor.

Still not convinced? Then listen to these real War Room members!

“Bryan, based on your comment yesterday I bought FedEx only for $1.00. I just sold it for $4.38!!!! Now that is another amazing War Room morning! I think I am becoming a morning person. Thank you :)” – R

“In FedEx at 3.45 out at 17.10 = 496% – Thanks BB and all the WR chatter.” – Dale A.

“Bought FedEx for 4.27, sold this morning for 21.00. Also yesterday finally sold REAL I bought for .46, sold for 2.80. Not a bad week so far.” – Ronald G.

“In FedEx at 4.13 and out at 21.01. I will need a calculator to figure these profits. Boom! Thanks to Bryan and the great folks in the War Room.” – Hall