How Smart Traders Play the U.S.-Iran Tensions

Let’s kick off my first Trade of the Day issue of 2020 by addressing the major catalyst affecting the markets right now…

The newest flare-up in U.S.-Iran tensions.

Quite honestly, as I’ve said countless times, trading geopolitical reactions is one of the hardest aspects of trading, and right now we’ve got another one to contend with.

For instance…

Will the war tensions – and the possible retaliations – continue to push the markets lower?

Or…

Will dip buyers use the weakness as an opportunity to buy into their favorite momentum names – and continue the bullish party?

Honestly, the answers to those questions all depend on the news flow any particular day, which is something that nobody can consistently predict. It’s nothing more than a coin flip.

So how do top traders play this coin-flip scenario?

That answer revolves around our “Overnight Trades” methodology.

I explain the entire strategy for you in my newest video – click here to watch it.

But as a quick explanation, playing an overnight earnings play – with exposure to both the call and the put side – eliminates any guesswork on the directional move. Right now, in the midst of such geopolitical volatility, this strategy offers you exactly what you need.

After all, you can expect to get hit with more geopolitical news every single day. Sometimes it could drive the premarket futures lower. Other times, it could spark a massive bounce…

You never know…

But that’s exactly why playing two-sided earnings plays makes so much sense. After all, with this methodology, you’re covered for a move in either direction. You don’t have to perfectly time a bounce – or guess which way the news will push the markets.

You’re covered either way!

With that, here’s what you really want to know…

Looking specifically at this week’s Overnight Trades opportunities, you have three companies reporting earnings before market open on Wednesday.

Overnight Trades Target No. 1: Constellation Brands (NYSE: STZ)

I’m leaning toward making a possible play here – simply because Constellation Brands’ $4 billion investment in cannabis leader Canopy Growth Corp. has been a total loser. As I’m sure you know, Canopy Growth shares have plummeted…

How will this affect its results?

The volatile price swings we’ve seen from Canopy Growth Corp. lately are the reaction we’re looking for when it comes to Constellation Brands. Therefore, this is one of my top targets this week.

Overnight Trades Target No. 2: Walgreens Boots Alliance (Nasdaq: WBA)

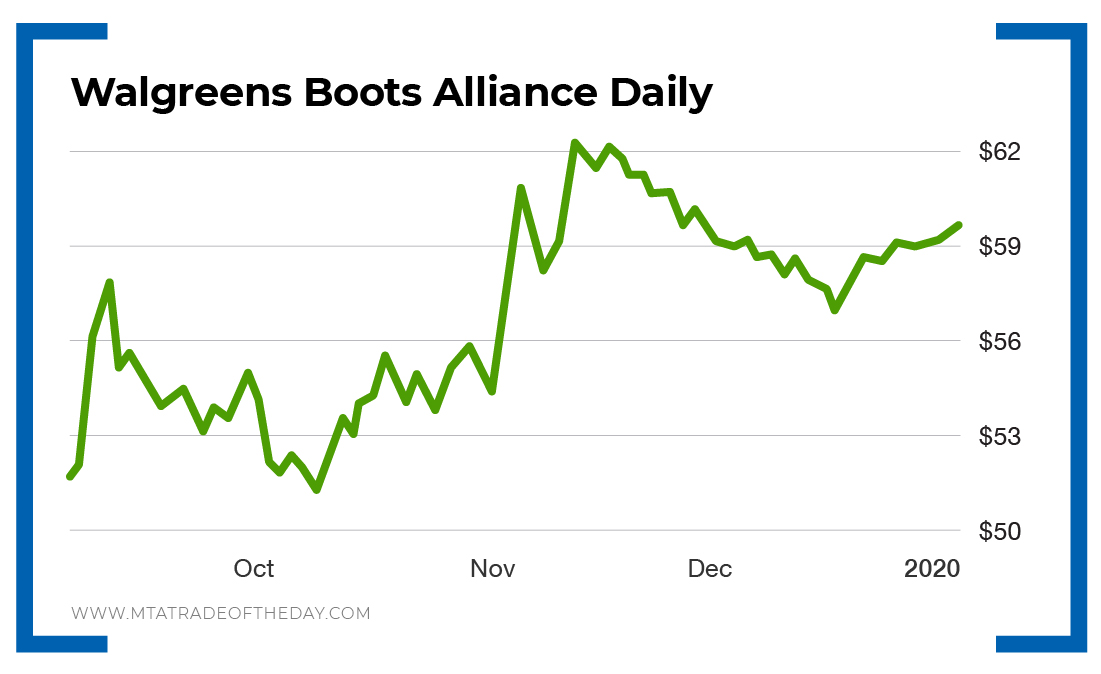

Not to be overlooked, Walgreens Boots Alliance has gained 20% since touching a six-year low in late August, but it’s still been a laggard. In fact, it was the biggest loser on the entire Dow in 2019…

Will its earnings report kick-start the bounce – or revert the stock back to even more losses? Who knows?

Luckily, we don’t care. As long as the earnings reaction is large enough – War Room members will profit. Headed into tomorrow, Walgreens Boots Alliance could be one stock to play – especially with lingering takeover rumors still swirling.

Overnight Trades Target No. 3: Lennar Corporation (NYSE: LEN)

And finally, we have Lennar Corporation, the nation’s largest homebuilder, which quietly pulled back 11% off its October highs – but still gained 42% in 2019…

Will its earnings report trigger a big move up or down?

Barron’snoting that the company trades at 9.3 times 12-month forward earnings, which is far below the 18.4 times 12-month forward earnings of the average S&P 500 component. Lennar Corporation is currently the cheapest of the four other homebuilders on the S&P 500 – setting up a potentially large earnings move for War Room members to profit off.

Action Plan: Starting tomorrow, if any of these three plays officially trigger as an Overnight Trades candidate, I’ll make the official recommendation in our live trading portal, The War Room. If you have any interest in getting “in” on these plays and possibly hitting a big overnight winner to start your 2020 investing year, I invite you to join our trading community today!

For more information on Overnight Trades, please review my newest video – which was just posted for the first time here.