How to Trade Cleveland-Cliffs Options for Free

There is no better trade on Wall Street than a free ride. A free ride refers to a trade that goes your way to the point that you can take your initial investment off the table and still have exposure to the upside.

In this case, not only did War Room members take their initial investment off the table…

They took some profits too, enough that they’re being paid to be in the trade.

Let me explain…

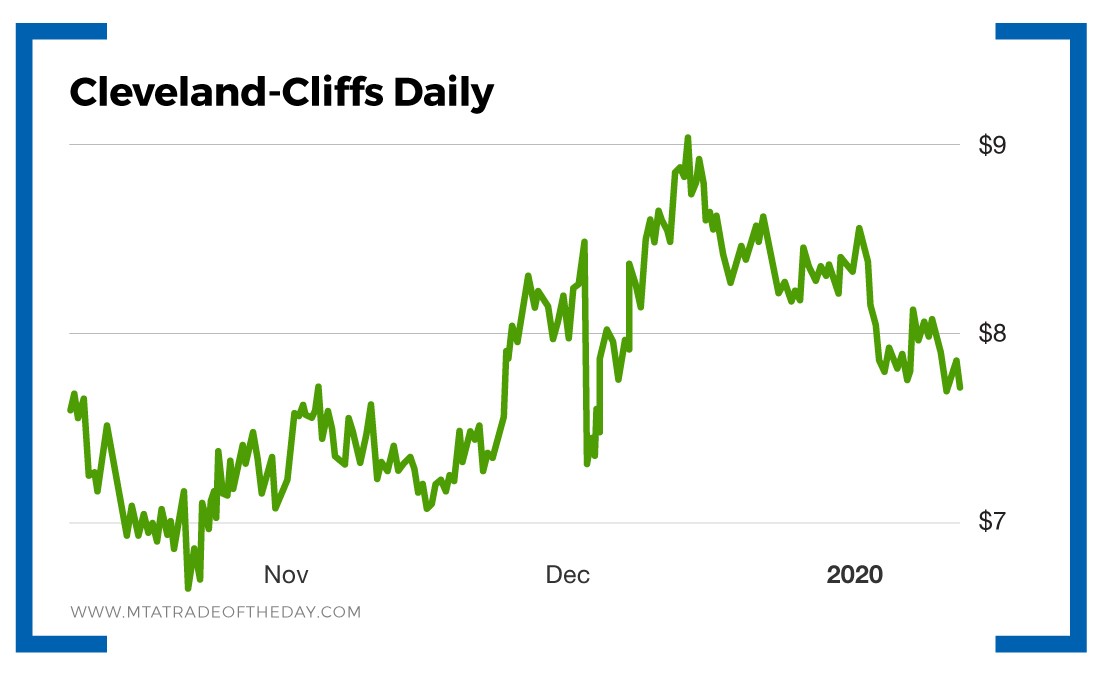

Last week War Room members took a position in Cleveland-Cliffs (NYSE: CLF). This is the second time in less than a month members traded this stock and won both times!

Members bought Cleveland-Cliffs stock, and a couple of days later it moved up enough for members to take their money and profits off the table.

But they didn’t stop there…

Members took part of the profits and put them back into a Cleveland-Cliffs call option that expires on February 7, a week before the company is estimated to report earnings. The profits from the first Cleveland-Cliffs trade were enough to buy the new options outright.

Normally, we would advise members to just take the profits and run. But in this case, something interesting popped up that prompted me to recommend a second trade.

One of my wire services showed this message:

Cleveland-Cliffs call volume above normal and directionally bullish. Bullish option flow detected in Cleveland-Cliffs with 42,669 calls trading, 7x expected, and implied volume increasing almost seven points to 57.51%. February 7 weekly “▮▮” calls and February 20 “▮▮” calls are the most active options, with total volume in those strikes near 30,500 contracts. The put-call ratio is 0.12. Earnings are expected on February 7.

Sorry, but I had to black out the strike dates so War Room members don’t get mad at me for sharing the same picks they’re paying for.

Someone is betting big on Cleveland-Cliffs moving in the weeks ahead…

Now, this isn’t foolproof…

The trades could have been part of a strategy like covered or naked calls. One never knows for sure.

But it really doesn’t matter much for War Room members. They’re in the trade for free. If Cleveland-Cliffs moves higher, they could be in for a quadruple-digit gain!

If it moves lower, there’s no skin off their back.

Action Plan: The free ride is a very rare occurrence on Wall Street. The last one members made returned them 3,700% on their money at risk. That was a legged spread on AbbVie, and not everyone could participate in it since it was a spread trade, which requires a higher options clearance.

But this trade on Cleveland-Cliffs was open to everyone in The War Room. There is no upside cap like there is in a spread, and that makes the potential for humungous profits even sweeter.

Isn’t it time you joined me in The War Room so you can be in line for the next free ride?

More from Trade of the Day

These 2 “Amazon-Proof” Stocks Ignore Market Chaos

Feb 23, 2026

How My “Lotto” Strategy Makes 1,000% Gains Possible

Feb 20, 2026

Why Smart Traders Avoid These Stocks Like the Plague

Feb 19, 2026

Two Footwear Stocks Ready to Follow CROX Higher

Feb 18, 2026