I Thought This was a Typo When I Read it….

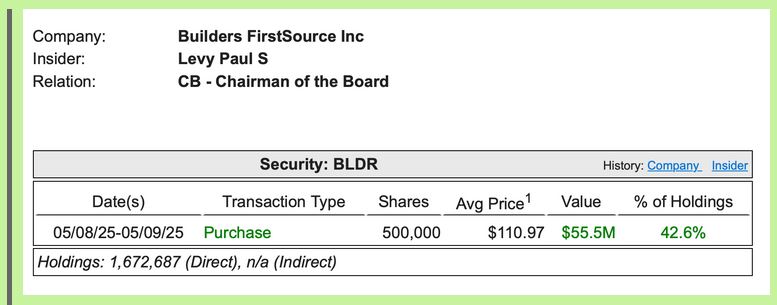

I came across an insider buy on Builders FirstSource (BLDR) back in May that made my eyes pop.

At first, I thought it was a typo.

$55 million worth of shares?!

I don’t see an insider buy that large very often.

As I’ve said many times, insiders buy for only one reason – they think their shares are cheap and going higher in the future.

While this BLDR share purchase wasn’t a cluster buy (where several high-ranking officials pour in all at once), it was an exceptionally large buy in a sector that I believe could outperform if interest rates tick lower.

Here’s why…

If interest rates go down, (markets have been pricing in a 90% chance of a 25 basis point cut this month), then home builder stocks like BLDR could go up on the sentiment that it’s easier for families to borrow money and purchase homes.

After reporting lower earnings back in May, BLDR gave an outlook that was obviously dependent on the single family and multifamily sector recovering.

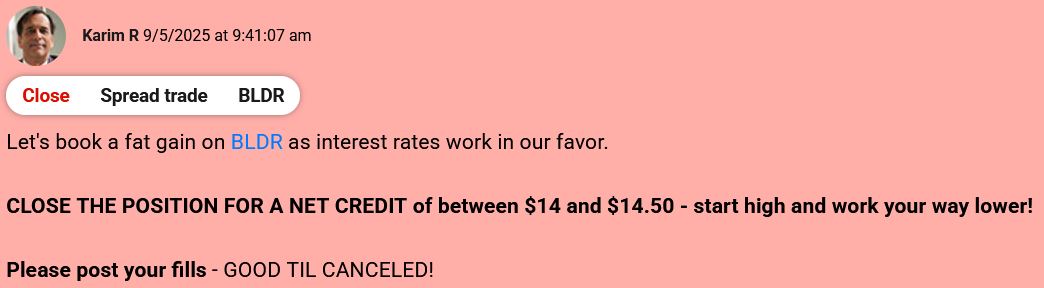

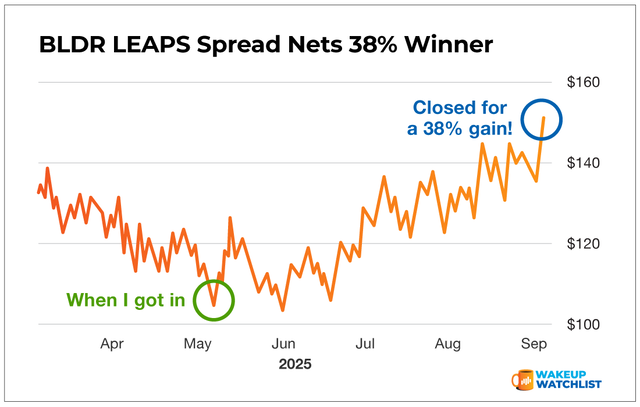

So I got positioned on a LEAPS spread trade in The War Room.

Over the last four months, BLDR has been trending up on that recovery sentiment.

How I traded BLDR in The War Room

In my experience – insider buys work 80% of the time. But they don’t always work, so you must position size.

Which is why I love using vertical LEAPS spreads.

LEAPS stands for “long-term equity anticipation products.” They’re options that expire 1 year, 2 years, and sometimes even 3 years.

Since insiders cannot sell their shares for at least six months, a LEAPS spread gives me time for things to work out in my favor.

Spreads also allows me to lower risk while still reaping rewards on a big move. In the case of BLDR, I was risking around less than 10%.

I waited 115 trading days before closing the BLDR LEAPS spread for a 38% gain.

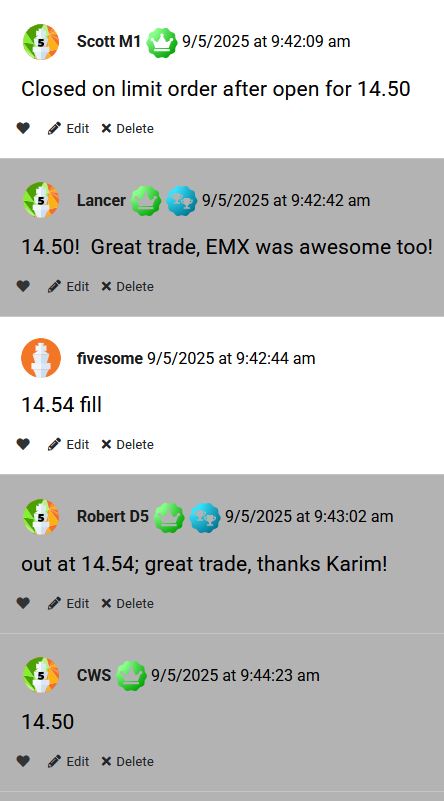

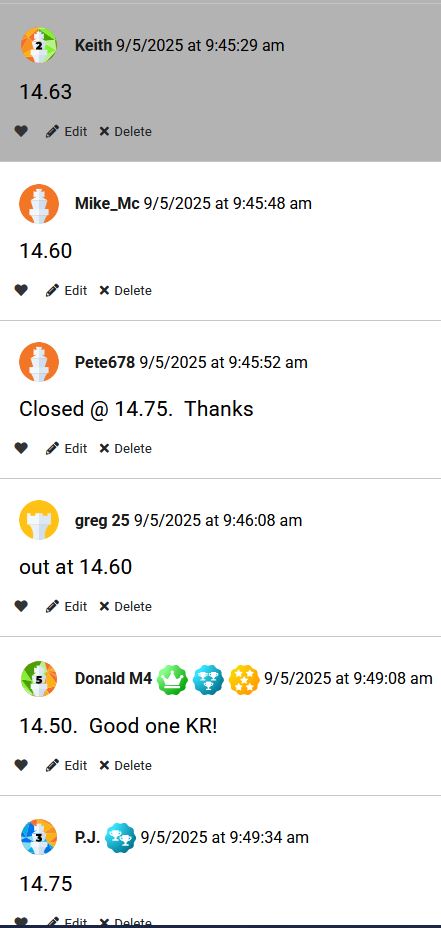

What members said about the trade

Several War Room members also rang the register on BLDR.

Here’s what they had to say…

Action Plan: LEAP Spreads are a great way to minimize risk and take profits over the long-term without risking more in short-term trades. I teach this LEAPS strategy to War Room members every day.

With the upcoming FOMC meeting coming up, I believe the Fed’s decision on rate cuts could trigger another move in BLDR. So it’s on my watchlist for a trade.

More from Wake-up Watchlist

OPEX Week or Not – I Have a Chart That’s Flying High

Feb 20, 2026

5 Trades. 5 Winners. Same Ticker.

Feb 18, 2026