Did Kodak Tip Us Off to the Tune of 2,000% in a Day?

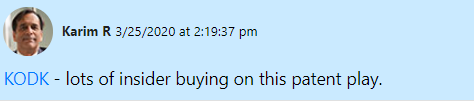

In case you didn’t notice, on July 27, Eastman Kodak (NYSE: KODK) was trading at $2.50, and it rose to more than $50 yesterday. That type of move doesn’t come by very often. But if you’ve been a War Room member since March, you would have seen this message…

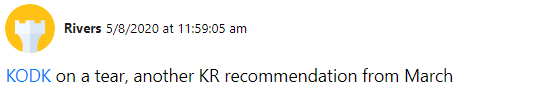

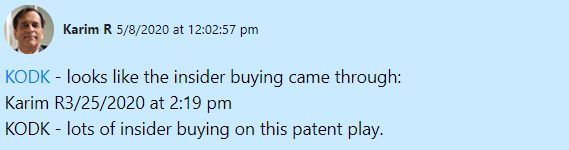

Then in May, you would have seen this…

Rivers made at least four times his money on that play!

“KODK Aug 21 ’20 $7.50 Call; in yesterday at $2.35. out at $11.50… +388%… thx war room.” – Rivers 7/29/2020 at 9:50 a.m.

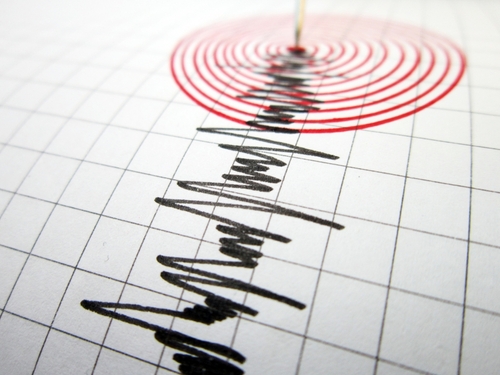

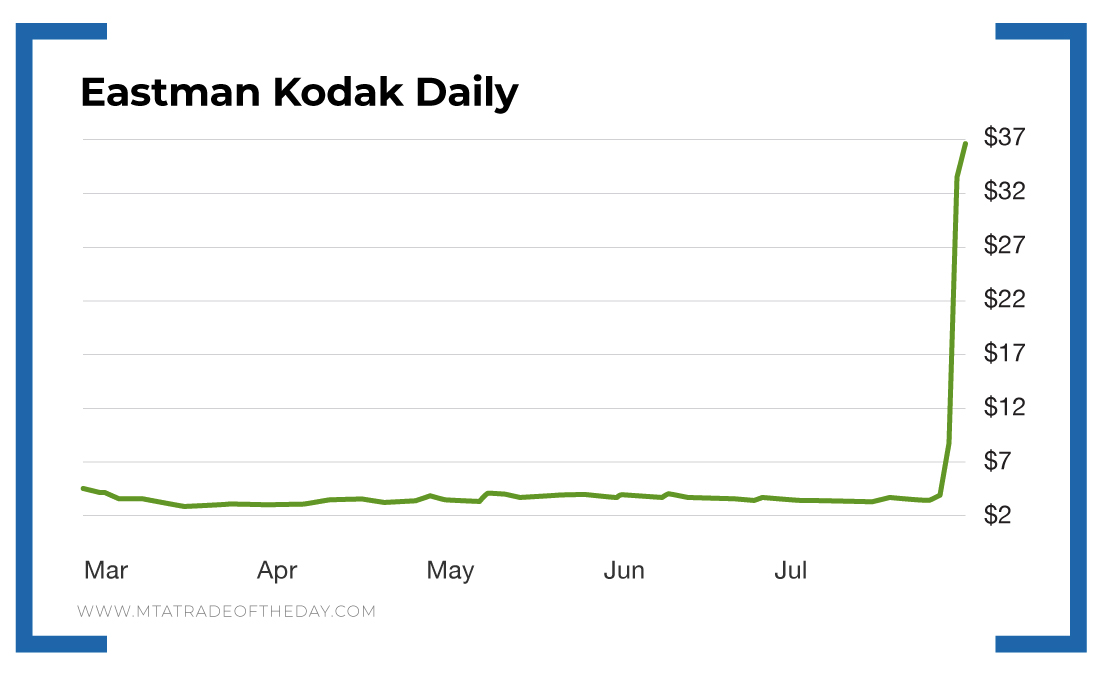

Look at this chart – it’s parabolic!

Kodak was loaned $765 million by the U.S. government to produce drugs stateside. Then President Trump got in on the action and mentioned the deal favorably. That plus a small float of trading shares and lots of media coverage led to this historic move for Kodak!

The executives say that the deal was made a week ago. Maybe so. But in my opinion, the groundwork for the deal was laid out months ago. You can’t just turn a faucet on and say you’ll produce drugs.

Maybe that’s why the executives were loading up on shares in March after the crash in the market. Good call, right?

Actually, there’s some science behind insider buying. It’s an indicator I use in The War Room all the time!

There are few feelings better than knowing you have an edge in the market over your fellow investors. Yet most people don’t believe you can have an edge. Most people believe in a market where every piece of information is available to all investors all the time, where the stock is always “perfectly” priced.

Then a bombshell comes, and suddenly the rules are different. It could be an accounting investigation, a positive trial from a cancer-fighting drug, a huge contract win, earnings that blow away the street, a takeover or countless other occurrences.

For investors, these types of announcements are the holy grail for stocks… if they own the stocks, that is. Others look at these announcements and wish they knew the information ahead of time. “Someone knew,” they think.

They’re right.

In many cases, someone does know before something is going to happen. They know months before something happens, and they don’t just sit on the information. They buy stock with the information and then wait patiently for the news to come out – news that they know, most of the time, will come out.

It sounds illegal doesn’t it? Too good to be true?

It’s not. It’s perfectly legal, and it happens every single day.

If you know where to look, you too can be privy to this type of trading information. It’s called insider trading. But it’s the legal type.

When a company insider buys shares of the company, they must report the purchase within a couple of days, by law. That’s one of the “tells” that I use to decide whether the opportunity is worth taking. However, there are other more important tells that you need to know about.

Most insiders buy for one reason… They know something good is coming down the pike. Other insiders buy because they know people are watching insider buys, therefore influencing the market for their shares.

We are going to focus on the first reason. When an insider buys because they know something is going to happen, they may not know the exact date it will happen, but they don’t care because they know the shares bought are going to scream higher whenever that announcement or event occurs.

The big variable is the market itself. If it’s a 2008 type of market, what insiders did the year prior is not going to matter much. But those types of markets are not the norm.

I look for that first insider to buy – and buy in size. By that, I mean they are buying thousands of shares on the open market with real money. This real money has to be in the tens of thousands if not hundreds of thousands of dollars.

The catch is they have to be an executive at the company, not a director. They’ve got to earn their money.

The next thing I look for is at least two more executives buying shares on the open market chronologically – with size and at market prices.

Then I want to see some director buys. In all, I want to see at least five insiders buying shares in size before even looking at the company.

Sometimes the underlying company is not doing well and is a turnaround candidate. This is the most dangerous type of insider buy, and it’s important to note that the buy would be very speculative. In this case, the returns can be phenomenal, but so can the risk. Because it’s speculative, you won’t want to buy very much!

Other times I’ll look at companies in the healthcare or biotech sectors. When insiders buy here, it’s usually because they have good information from clinical trials long before the FDA or the public knows about the trial data.

While not as speculative, these types of insider trades do hinge on a final outcome of a trial, meaning they do carry more-than-average risk.

There might be situations where there are massive buys by insiders that are greater than the norm – buys that are in the millions of dollars, for example. But those buys are by shareholders who already own a large chunk of stock. This type of buying, while attractive, also makes me wary. These are long-term investors – value investors – who can wait years. I’m not interested in waiting years.

Action Plan: Most insider trades that meet the tests I described above come to fruition in a year or less. Those are the ones I want to focus on.

For all of this expert information and more, join me in The War Room. You may be the next Rivers!

P.S. Did you hear about The War Room UPS trade today? Members reported gains as high as 900%… OVERNIGHT! And that was just ONE winner our War Room members have seen.

For the past few days, I wasn’t promising ONE winner like this… but GUARANTEEING 300 winning recommendations. Unfortunately… you missed the deadline. But in light of this monster winner… I’m extending it just for you.

Get your chance to make your own overnight doubles all year long.

Claim Your 300 Winners Guarantee Before The Link Expires.

More from Trade of the Day

Market Mayhem? Here’s How to Make 157% Overnight

Apr 3, 2025

Gold is Shattering Record Highs…

Apr 2, 2025

The Chart That Has My Attention Today

Apr 1, 2025