This Insider Just Dropped $11.6m – Here’s Why I Care

Editor’s Note: Nate Bear just dropped some serious market intel that every trader needs to hear.

He’s identified what Forbes is calling “The Great Rotation” – and he’s going live Wednesday, July 23rd to reveal exactly how to profit from it.

🎯 Here’s what you’re getting:

- Live intel on the “epic sector rotation” already underway

- Nate’s complete 3-step battle plan for his Sector Strike strategy

- The AI-powered tool he uses to spot these setups in under 30 minutes per month

- Free access to his August Sector Strike picks (sectors AND specific stocks)

The numbers are insane: 85% win rate with average gains of 165% over just 26 days. Peak exits have hit 260%, 435%, and even 723%.

With $7+ trillion sitting on the sidelines and rate cuts coming, smart money is rotating OUT of overperforming sectors and INTO forgotten ones.

Bottom line: Some stocks in your portfolio could get crushed while “dead” sectors explode higher.

Nate’s beaten the S&P 500 by 22X this year using this approach. Wednesday, July 23rd at 2 PM ET, he’s showing you how.

Fair warning: When these rotations hit, they move FAST.

– Ryan Fitzwater, Publisher

I track every single insider transaction…

You know what I was doing yesterday morning? Same thing I do every morning – scanning insider transactions.

And I see this name: Vladimir Galkin. Newegg (NEGG). Three buys in three days. $11.6 million total.

Now, I didn’t trade this one. But I’m watching it.

And I want to show you exactly why insider transactions should be on your radar for every potential position you’re considering.

Here’s What Most People Get Wrong About Insider Buying

See, most people think insider buying is just “nice information to have.” But here’s what I’ve learned over the years – insiders don’t drop millions of their own money on hope.

They do it on information.

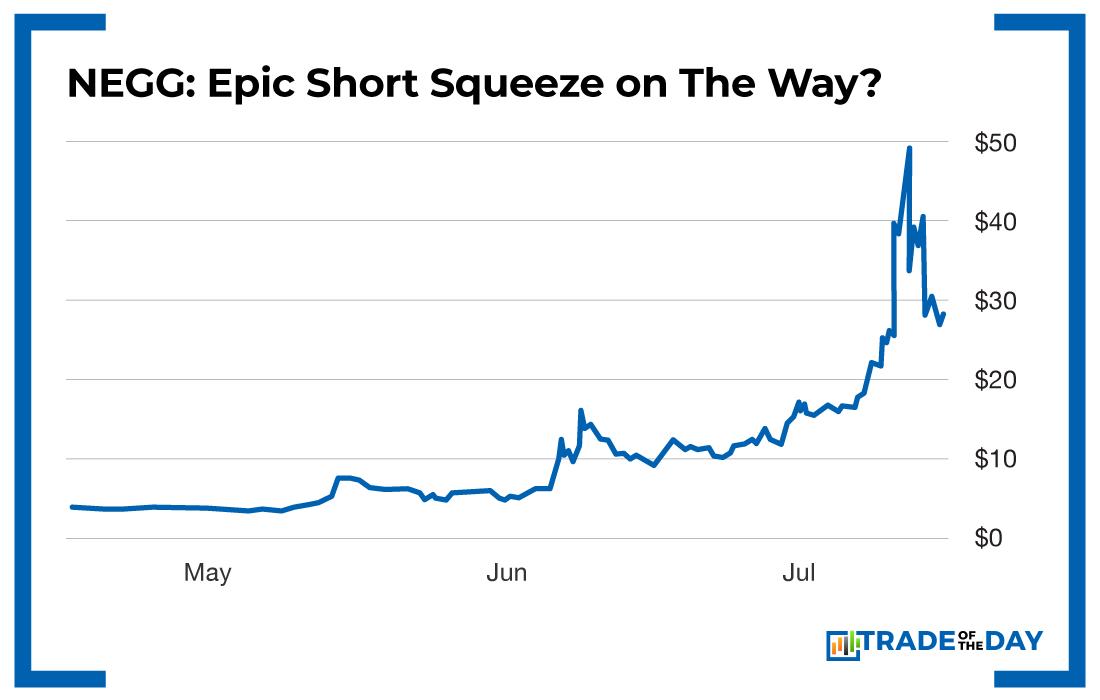

Take NEGG. This stock went from $3.32 to $56 in the past year. That’s a 1,600% move.

And this insider, Galkin, he’s still buying. Most of his recent purchases? At $41 and above.

- July 8th: 64,199 shares at $18.10

- July 9th: 57,920 shares at $21.77

- July 14th: 222,222 shares at $41.14

Now, this isn’t some random guy throwing money around.

Galkin made serious money during the 2021 GameStop rally, and he’s currently sitting on a $212 million position in JetBlue where he’s pushing for board changes.

This is someone who knows how to spot opportunities and isn’t afraid to put real money behind his convictions.

Think about that for a second.

You’ve already seen the stock go up 1,500%, and you’re still adding to your position at much higher prices?

That’s not speculation. That’s conviction.

Why This Setup Reminds Me of the Perfect Storm

This is the same pattern I spotted with SNOW back in June 2024.

While everyone was panicking about Berkshire dumping their position, I was watching the insider buying.

The smart money was loading up while institutions were selling. That insider buying gave us the conviction we needed when we positioned in those January 2026 LEAPS spreads, and our War Room members crushed it when earnings hit.

But NEGG has something even more interesting going on.

You know what else I noticed? According to the data, there are basically no shares available to short.

NEGG: Short float is showing over 135% on Finviz.

That means anyone who wanted to bet against this company is already trapped.

Now you’ve got analysts calling this “speculation” and saying the stock “reeks of heightened speculation.”

Maybe they are right about the fundamentals.

But here’s what I know – when you combine heavy insider buying with a situation where shorts have nowhere to run, that creates some explosive dynamics.

The Questions You Should Be Asking

When you’re looking at any potential position, ask yourself: What are the insiders doing?

Are they selling? That’s usually not a great sign, though sometimes it’s just portfolio management.

Are they buying token amounts? OK, that’s mildly encouraging.

Or are they backing up the truck like Galkin did with NEGG?

That’s when you really pay attention.

Because here’s the thing – I’m not telling you to run out and buy NEGG right now.

What I’m telling you is to understand how to use insider transactions as part of your research process.

![]()

YOUR ACTION PLAN

This is exactly why we track this stuff in the War Room.

Not to chase every insider buy, but to understand when the people with the best information are putting serious money to work.

You know what’s wild about this whole NEGG situation?

The analysts are calling it speculation, the fundamentals might not support the valuation, but that insider is still buying at $41+ after seeing a 1,500% move.

Either he’s completely wrong, or he knows something the rest of us don’t.

And when you throw in that short squeeze potential? That’s the kind of setup where things can get really interesting, really fast.

Because here’s what I’ve learned: The market can stay irrational longer than most people can stay solvent.

But when insiders are buying with conviction and shorts are trapped, you get situations where logic goes out the window and momentum takes over.

So next time you’re researching a potential position, don’t just look at the charts and the fundamentals.

Look at what the insiders are doing. It might just save you from a bad trade, or point you toward a great one.

In the War Room, we track these signals every day.

Not to chase every move, but to understand when the smart money is positioning for something big.

More from Trade of the Day

Why Smart Traders Avoid These Stocks Like the Plague

Feb 19, 2026

Two Footwear Stocks Ready to Follow CROX Higher

Feb 18, 2026

Are the Banks Destroying Your Savings?

Feb 16, 2026