Palantir Is About to Collapse. Again.

For the third time in five years, this cult favorite is setting up for a 50%-60% wipeout.

The warning signs are flashing red. Technical breakdown? Check. Sentiment unwinding from euphoric levels? Check. Valuation stretched beyond reality? Double check.

Palantir Technologies (PLTR) is in the early stages of a collapse that could strip more than 60% of its value from November 2025 highs. And if you think that sounds extreme, you haven’t been paying attention to this stock’s history.

- 2021: Down 80% from highs.

- 2022: Another 60% decline from recovery peaks.

- 2026: Here we go again.

For what it’s worth, I’m a long-term bull on Palantir’s mission and market position. But ignoring the warning signs here would be reckless.

The combination of bearish technical signals, sentiment rotation, and an overextended valuation puts the stock at immediate risk for a full retracement to $100 – or even $75.

The Most Dangerous Setup: When Everyone’s Bullish

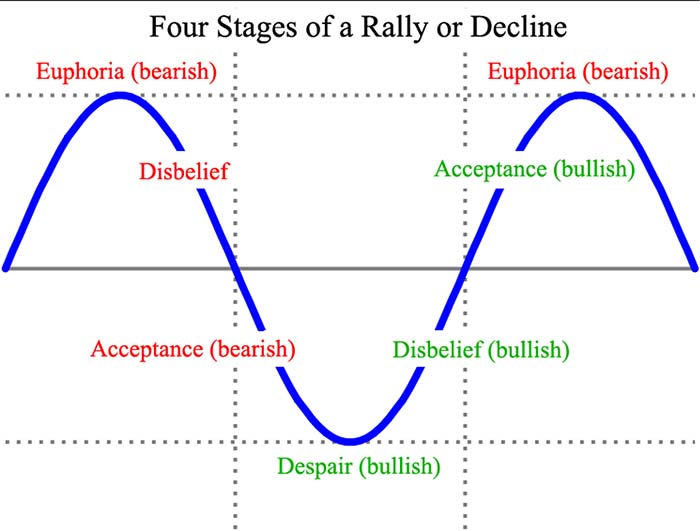

The most dangerous component of Palantir’s setup isn’t the chart. It’s the sentiment.

Palantir spent most of 2024 and 2025 evolving into a retail investor cult favorite. High-conviction “buy the dip” traders became the norm. Their faith was rooted in strong fundamentals and CEO Alex Karp’s defiant attitude toward Wall Street skeptics.

Karp treats earnings calls like philosophical monologues. He taunts bearish analysts on CNBC. That intensity energized Palantir’s base and created an “us against them” mentality that retail investors loved.

But here’s the problem: When everyone’s bullish, there’s nobody left to buy.

Wall Street analysts never fully embraced Palantir as a core AI stock. Ironically, that outsider status made PLTR even more attractive to contrarian traders. The “buy the dip” strategy worked repeatedly for nearly two years. It trained the crowd to buy weakness and get rewarded.

That dynamic ended with the most recent earnings report.

Suddenly, the crowd’s belief in unlimited upside met a dose of valuation reality. EPS beat percentages shrank. Forward guidance came in less aggressively bullish. Add macro-level AI exhaustion and a shift toward value rotation, and you get a violent reversal.

Euphoric stocks don’t correct slowly. They collapse.

The Technical Breakdown Confirms the Sentiment Shift

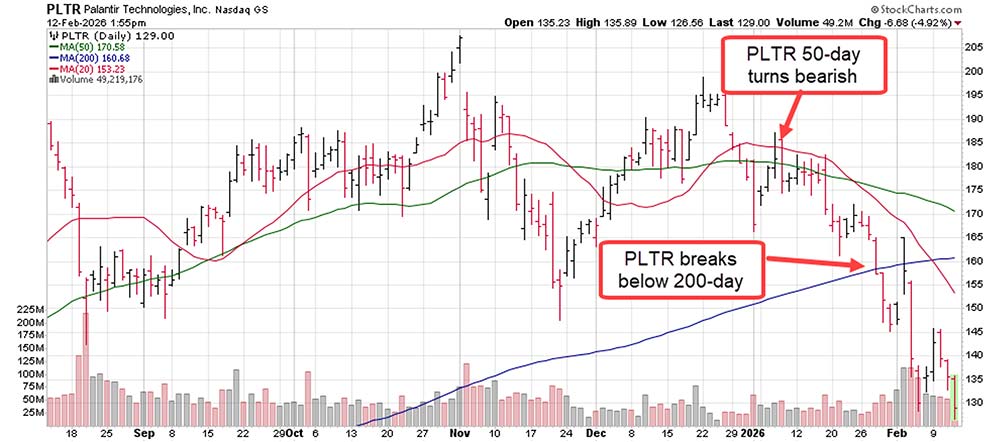

From a trading standpoint, the red flags started waving on January 8, 2026, when Palantir’s 50-day moving average shifted into a declining pattern. That’s the line in the sand – a falling 50-day MA signals a verified bearish trend.

The damage deepened as shares broke below both the 50- and 200-day moving averages, accelerating downside momentum. The last time Palantir sustained this pattern was 2022, when the stock lost more than 80% of its value.

The $125 level now stands as critical support. If this breaks, the chart targets $100, followed by psychological support at $75. These aren’t speculative targets – they’re historically valid zones where Palantir has found buyers before.

Priced for Perfection in an Imperfect Market

Palantir’s fundamentals haven’t collapsed, but they no longer justify the extreme valuation.

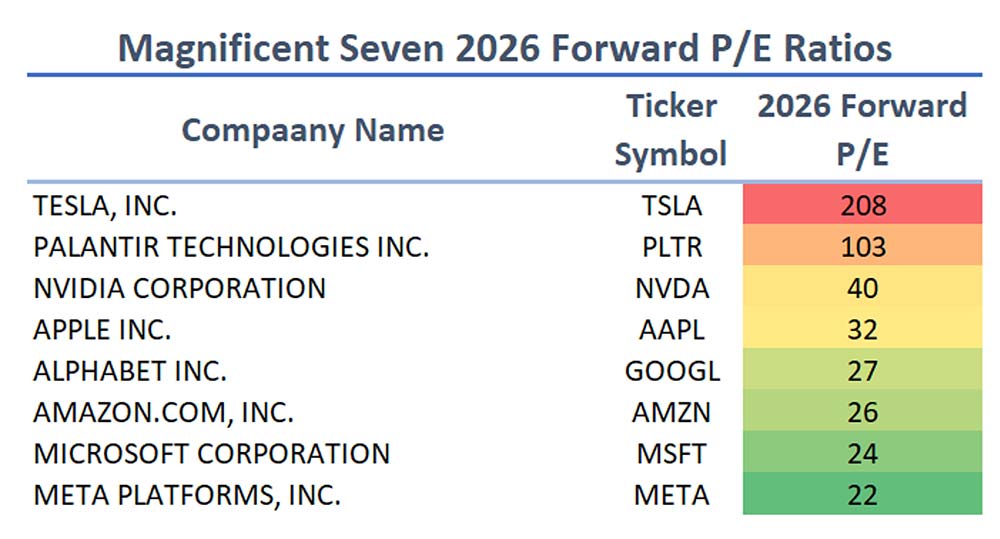

As of February 2026, Palantir trades at a forward P/E of 108 – making it one of the most expensive names in the entire market. For context, the rest of the Magnificent Seven average a forward P/E around 29.

That valuation gap is now under scrutiny as non-government revenue growth shows signs of slowing. Add potential government contract headwinds if budget negotiations target federal spending, and you have a recipe for multiple compression.

The long-term thesis remains intact. But short-term fundamentals don’t support current prices, especially in a market rotating away from hypergrowth multiples.

![]()

YOUR ACTION PLAN

Investors need to stop thinking like bagholders and start thinking like traders.

Long-Term Investors: Take profits now. Re-entering at $100 or $75 isn’t giving up – it’s playing the historical rhythm of this stock. These are high-conviction buy zones.

Hedging/Inverse Play: The Direxion Daily PLTR Bear 1X Shares (PLTD) provides clean exposure to Palantir’s decline without managing options complexity.

Aggressive Traders: Consider June 18, 2026, $125 puts, currently priced at $1,465 per contract. Slightly out of the money with ample time for the trend to develop. Exit before next earnings (projected May 11) to avoid positive surprise risk.

Don’t Get Caught Holding the Bag

Palantir’s path from $125 to $100 – or even $75 – isn’t hypothetical. It’s historical.

It happened in 2021. It happened in 2022. And it’s setting up to happen again in 2026.

The difference this time? Retail investors have more to lose. The cult following is bigger. The conviction is deeper.

Which makes the fall potentially more devastating.

History doesn’t repeat, but it rhymes. And right now, Palantir is rhyming with its own past collapses.

The smart money isn’t panicking. It’s positioning.

I talked about this in greater detail with Bryan Bottarelli during our MTA Live broadcast on Wednesday. If you missed it, you can check it out here.

FUN FACT FRIDAY

Palantir is named after the “palantíri” – the all-seeing crystal balls from J.R.R. Tolkien’s Lord of the Rings. These were mystical stones that allowed users to see across vast distances and communicate with each other. Pretty fitting name for a data analytics and surveillance company that helps governments and corporations “see everything” in their data.