Steel Tariffs Are Back – And This Stock Could Skyrocket

As we approach April 2, 2025, with new steel tariffs set to reshape the market, a rare opportunity is emerging for investors to position themselves strategically.

While tariffs often bring uncertainty, one sector stands out as a potential winner: U.S. steel.

Domestic producers could see significant gains as demand shifts away from expensive imports and foreign competition declines.

And at our upcoming LIVE “Tariff Emergency Briefing,” I’ll be revealing my top steel stock pick-a company uniquely positioned to thrive under these new conditions.

To help you navigate this changing landscape, Bryan Bottarelli and I will be hosting this LIVE event on Wednesday, March 26, at 2 p.m. ET. We’ll reveal five stocks we believe are “EXTREME BUYS” in today’s market and share the strategies we’re using to capitalize on the current volatility.

Here’s what we’ll cover:

- Why these tariffs could unlock the best buying opportunity in years.

- Five stocks poised to outperform-even in volatile markets.

- My top steel pick that could thrive as tariffs reshape the market.

- Pro trader strategies for capitalizing on market swings.

- Live Q&A to answer your most pressing questions.

This is a can’t-miss opportunity to get actionable insights and prepare for what’s ahead. Reserve your spot now – it’s free.

Now, let’s break down the facts and explore why domestic steel producers are uniquely positioned to thrive under these new tariffs.

Tariffs Level the Playing Field for U.S. Steel

Starting April 2, 2025, a 25% tariff will be imposed on imported steel from major exporters, including the European Union, Canada, and Mexico.

This move significantly raises the cost of foreign steel entering the U.S. market. As a result, domestic steel producers gain a competitive edge – offering buyers an alternative to avoid these inflated prices.

When foreign steel becomes more expensive, it’s not just a numbers game; it’s a shift in demand dynamics.

Buyers in industries like construction, manufacturing, and automotive naturally gravitate toward U.S. suppliers, ensuring steady demand for domestic steel producers.

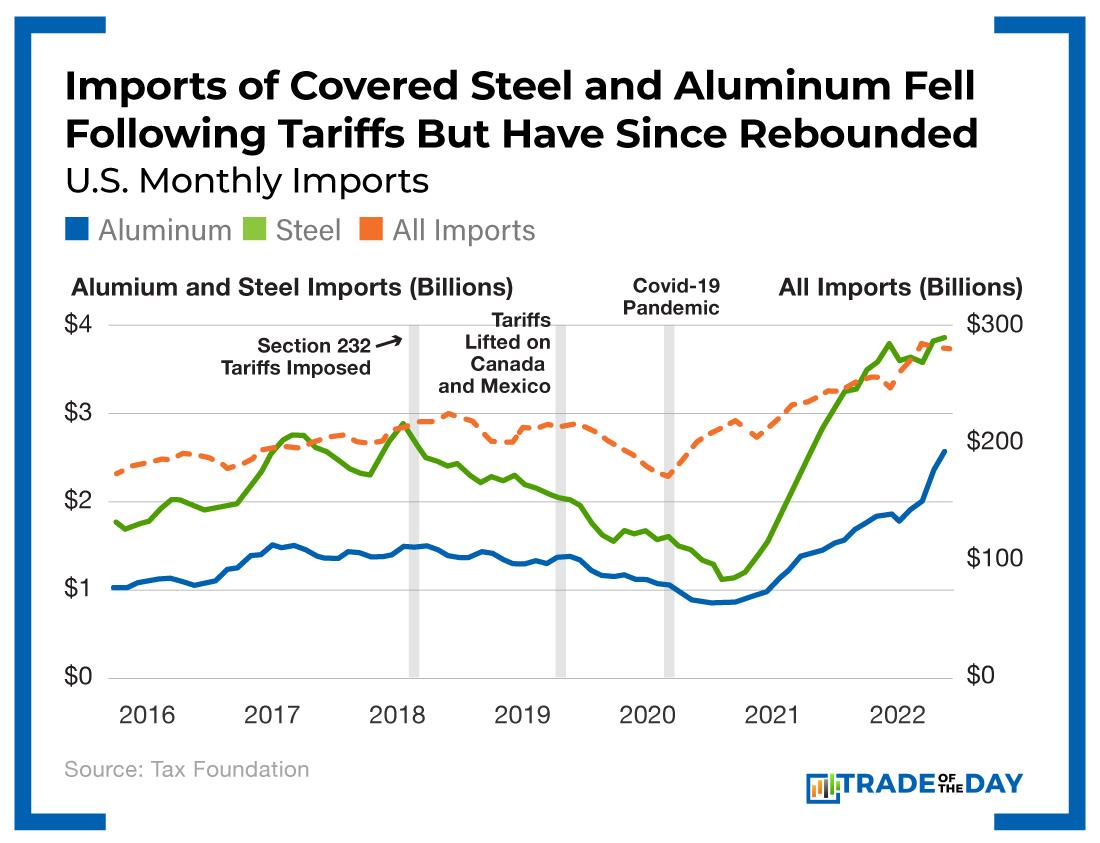

A Historical Roadmap: Lessons from 2018

This isn’t the first time tariffs have impacted the steel sector. In March 2018, the U.S. imposed a similar 25% tariff on steel imports.

The results?

Domestic steel mills saw utilization rates climb from 70% in 2018 to 85% by 2022. Leading firms reported record profits, as reduced foreign competition allowed them to capture more market share and boost prices.

The 2018 precedent shows us that tariffs don’t just protect some U.S. industries – they can ignite growth.

With a similar policy framework unfolding in 2025, the steel sector’s trajectory could follow the same pattern.

Shrinking Foreign Competition: A Clear Advantage

The tariffs will directly reduce competition from key steel-exporting nations.

Take Canada and Mexico, for example: In 2024, these two countries accounted for 35% of U.S. steel imports (23% from Canada and 12% from Mexico).

With these suppliers now facing higher costs due to tariffs, U.S. producers are in prime position to fill the gap, gaining market share and pricing power.

The Profit Margin Boost

One of the most compelling reasons to watch U.S. steel stocks is the potential for higher prices and expanded margins.

During the 2018-2019 trade war, tariffs pushed up domestic steel prices, with hot-rolled coil margins averaging over $400 per tonne. Similar market conditions in 2025 could allow companies to raise prices without fear of losing customers to cheaper foreign alternatives.

Improved margins mean higher profitability, which is exactly what drives investor interest in cyclical sectors like steel.

Policy Support and Investor Sentiment

The incoming Trump administration has made it clear: protecting U.S. industries is a top priority. This policy stance creates a favorable environment for domestic steel producers, as investors expect sustained or even expanded tariff policies.

Historically, industries that align with pro-American manufacturing policies have seen stock price gains during periods of strong government support.

For the steel sector, this could mean higher valuations as optimism builds.

Supply Chain Adjustments Favor Local Producers

Tariffs don’t just raise prices – they disrupt global supply chains. For U.S. manufacturers in critical industries like automotive and construction, sourcing steel locally becomes the most efficient and cost-effective solution.

This ensures U.S. steel producers benefit from increased order volumes as companies prioritize domestic suppliers to avoid delays and additional costs.

![]()

YOUR ACTION PLAN

With tariffs set to disrupt the steel market, U.S. producers stand to gain a competitive edge, higher margins, and increased demand. The April 2, 2025, tariffs may create challenges for some industries, but for the steel sector, they represent an opportunity to thrive.

For investors, this is the time to take a closer look at domestic steel stocks like Nucor, Steel Dynamics, and U.S. Steel.

History has shown us that tariffs can drive profitability and growth in this sector – and the current conditions are aligning for a repeat performance.

As always, it’s crucial to evaluate your risk tolerance and investment goals.

But if you’re looking for a sector that could benefit from the tariff landscape, U.S. steel might just be the strongest play in the market.

To dig deeper into these opportunities, join us for the Tariff Emergency LIVE Briefing this Wednesday, March 26, at 2 p.m. ET. We’ll reveal five “EXTREME BUY” stocks – including one under-the-radar steel stock pick that could thrive under the new tariffs – and share the strategies we’re using to turn today’s volatility into profitable opportunities.

Reserve your spot now – it’s free, and we’ll be answering your questions live during the session.

More from Trade of the Day

How My “Lotto” Strategy Makes 1,000% Gains Possible

Feb 20, 2026

Why Smart Traders Avoid These Stocks Like the Plague

Feb 19, 2026

Two Footwear Stocks Ready to Follow CROX Higher

Feb 18, 2026