Why Most Tail Risk Advice Is Garbage (And What Actually Works)

Most tail risk advice is garbage because it’s written by people who’ve never lived through a real crash, OK?

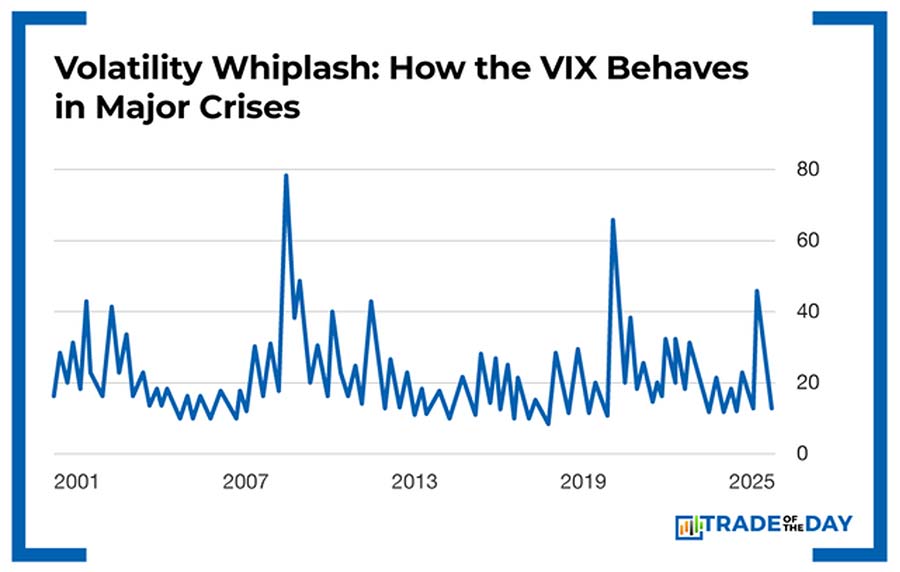

Look at March 2020: VIX exploded from 15 to 82 in three weeks – that’s a 5x volatility shock. The S&P 500 dropped 34% in just 23 trading days, the fastest bear market on record. When that kind of chaos hits, diversification doesn’t save you. Everything falls together.

So here’s how I actually approach this stuff.

What Tail Risk Really Means

I’m not hedging against some 5% pullback. I’m hedging against the real sh*t – the 30-50% crashes that wipe out portfolios. The kind where even “safe” dividend stocks get cut in half.

Tail risk is when correlations go to 1.0 and your growth stocks, value stocks, REITs – everything – falls at the same time.

The Hedge Types That Actually Work

Long Volatility Plays

A common tool is VIX call options when volatility is relatively low; these can scale when VIX spikes to 40-80+. March 2020 proved this. VIX went from 15 to 82 in three weeks. That’s exactly what long vol strategies are designed for.

Deep Out-of-the-Money Puts

Practitioners often use 20-40% OTM S&P 500 puts with 6-12 months to expiry as crash insurance. They’re cheap because everyone thinks those strikes are “impossible.”

But in March 2020, the S&P fell 34% in 23 trading days. Suddenly those “impossible” strikes weren’t so impossible.

The Treasury Question (Here’s Where I Disagree With Everyone)

Historically, long Treasuries hedged deflationary crashes (e.g., 2008), where 30-year Treasuries gained 26% while the S&P crashed 57%. But they lagged in 2022’s inflation shock – TLT got destroyed, down 31% while the S&P fell 19%.

Some prefer holding cash/T-bills to avoid duration risk. Cash doesn’t lose 31% when the Fed changes its mind.

Credit Markets – The Hidden Risk

Credit spreads can widen rapidly (hundreds of bps in weeks), and broad HY ETFs have seen 10-20% drawdowns in those windows when credit markets freeze up.

When that happens, having dry powder matters more than being “fully invested.”

Tail Hedge ETFs

There are funds like TAIL and CYA that do this systematically. They’re always hedged, always paying the insurance premium. Might be worth looking at if you don’t want to manage this yourself.

How to Size This Stuff

Many frameworks keep tail hedges to roughly 1-5% of portfolio value. You’re paying an insurance premium every month. Most of the time, you’re “losing” money on decay and time premium.

But when the real crash comes, that small allocation can save your entire portfolio.

The Hardest Part

The psychological torture is real. Your hedges expire worthless month after month. Your friends are making money in growth stocks while you’re “wasting” money on insurance.

But here’s the thing: you never know when you’ll need it. And the best time to have insurance is right before you need it.

![]()

YOUR ACTION PLAN

I’m not trying to time crashes.

I’m just acknowledging they happen every 3-5 years like clockwork. And when they do, I want to be positioned to not just survive, but maybe even profit.

Because when everyone else is forced to sell, that’s when the real opportunities show up.

And that’s exactly what we try to capitalize on in the War Room.

More from Trade of the Day

How My “Lotto” Strategy Makes 1,000% Gains Possible

Feb 20, 2026

Why Smart Traders Avoid These Stocks Like the Plague

Feb 19, 2026

Two Footwear Stocks Ready to Follow CROX Higher

Feb 18, 2026