Tug-of-War With General Electric

War Room members are currently in a strangle position with General Electric (NYSE: GE).

A strangle is an options strategy that involves using put and call options to bet on a sharp move one way or the other in an underlying stock. The objective is to make enough from the move in one direction that it covers the cost of the strangle and then some.

Strangles are best used around specific binary events, resulting in two possible outcomes.

An earnings report is just one example…

Another example is the announcement of a drug trial, or events like the Brexit deal.

These “one-off” events can really move the price of a stock up or down. Now, nothing is guaranteed, and the worst-case scenario could cost you both sides of a play.

For example, if the stock doesn’t move at all and you’re very close to expiration, both the put and call option could lose all of their value quickly.

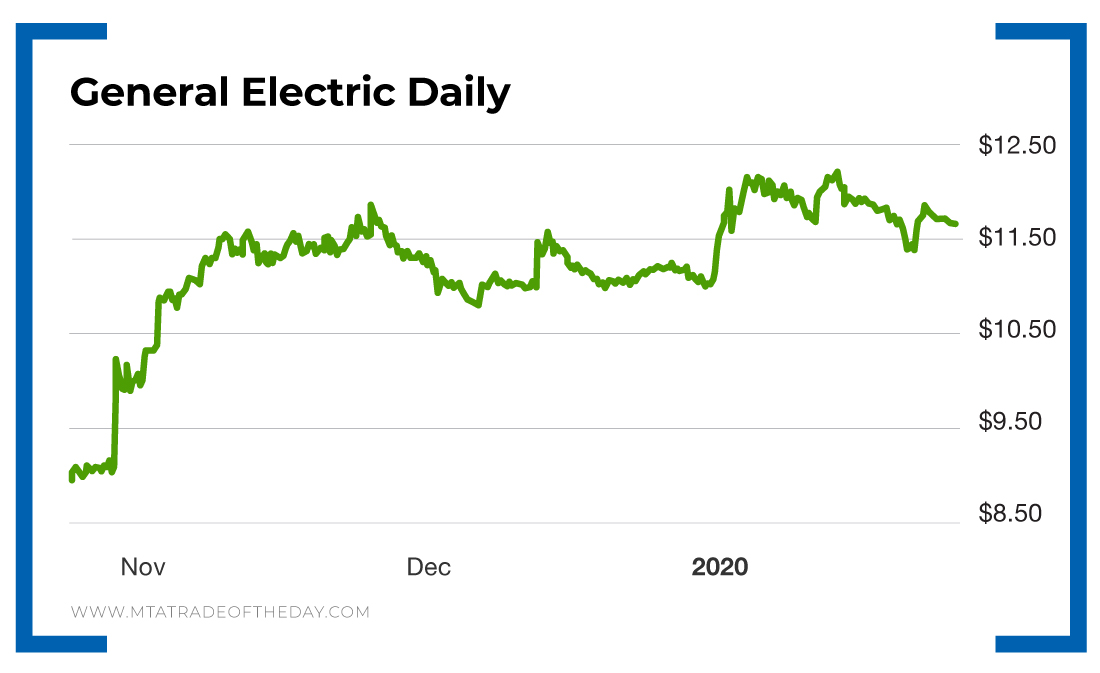

Let’s get back to General Electric…

The upcoming earnings report is one that could set the tone for the shares for the rest of the year. And it’s got a lot of uncertainty surrounding it.

Here’s a glimpse from a leading financial publisher of what one of the top analysts covering the shares is saying:

J.P. Morgan’s analyst Stephen Tusa says narrative around 737 Max into GE guidance is wrong. While the prevailing sell-side narrative as GE guidance approaches is that the 737 Max production cut is negative, the “simple math” suggests it should have a positive influence, both in 2019 and in 2020, up to $600M in segment profit versus the guidance issued in last March… Tusa tells investors in a research note, titled “Max Math: Should Be a Positive Near Term, Negative Long Term, Opposite of Prevailing Narrative.” The key is the difference between engine production, engine deliveries to Boeing (BA) and Boeing deliveries to customers, “with several moving parts suggesting near-term upside,” says Tusa. However, this performance is unsustainable and timing-related, the “opposite of the narrative of near-term pressure with longer-term upside,” he adds. Tusa believes the “growing narrative” that Max is a negative today, and anything reported will be “better than feared” with future upside “is not supported by the math.” There is more to the GE story that will need to be watched into and out of earnings, with many of these items positive but timing-related near term, and unsustainable longer term, contends the analyst.

Tusa has a $5 price target on the shares.

On the flip side, Morgan Stanley’s analyst who has a $14 target thinks otherwise:

Morgan Stanley upgrades GE to overweight on “best-in-class” Aviation franchise. Morgan Stanley analyst Joshua Pokrzywinski upgraded General Electric (GE) to Overweight from Equal Weight with a price target of $14, up from $11, telling investors that he sees its Aviation unit as a “best-in-class franchise” and that he believes the risk from the continued grounding of the Boeing (BA) 737 Max appears limited. Meanwhile, risks from Power, pension, and Long-Term Care are declining, said Pokrzywinski. In total, he sees upside for GE’s free cash flow in 2021 given his conviction in the Aviation franchise as the Max disruption subsides and his view that the cash trajectory for the Power unit is improving.

Action Plan: This type of sentiment makes for a perfect strangle play. Basically, no one knows how it’s going to play out, and that is one of the key ingredients for volatility!

Going into a strangle play, both the put and the call option contain premium for risk, time and volatility. Once an event occurs, those premiums begin to shrink. Time is always shrinking as expiration approaches. So if there isn’t an increase in risk or volatility or a major move in the underlying shares, the play is toast.

Join me in The War Room for plays like this General Electric strangle!