The Great Rotation is Coming

Hey gang.

With Jerome Powell and the Fed set for another FOMC meeting on July 29th, there’s a lot of speculation on rate cuts right now.

Some reports say we could see a rate cut as early as September.

Other officials are saying we could see cuts earlier than that.

Who knows.

I don’t have a crystal ball.

I can’t predict exactly when the fed will cut rates.

And if anybody says they do – they’re probably lying.

But the good news is – there’s still a way to profit off the fed’s decision.

Which Sectors Benefit from Rate Cuts

Often times – when the fed makes cuts – you’ll likely see more money flowing into certain sectors.

Here are a few sectors to look at…

Housing, and any sector that has a heavy tie to lending – generally improves.

Consumer sectors also improve as buyers have less debt and can spend on electronics, cars and travel. This also benefits retailers and restaurants.

Healthcare companies also benefit as less borrowing costs allow them to spend more on research and development. Smaller regional banks and utility companies also benefit from lower borrowing costs.

How I Target These Sectors for Gains

One thing I can do to target these sector rotations early on is by using my “Sector Strike” strategy, which is outperforming the S&P 500 by 22x this year!

Here are a few past examples of my “Sector Strike” strategy in action.

When it comes to trading these sector movements, I look for chart examples with established momentum.

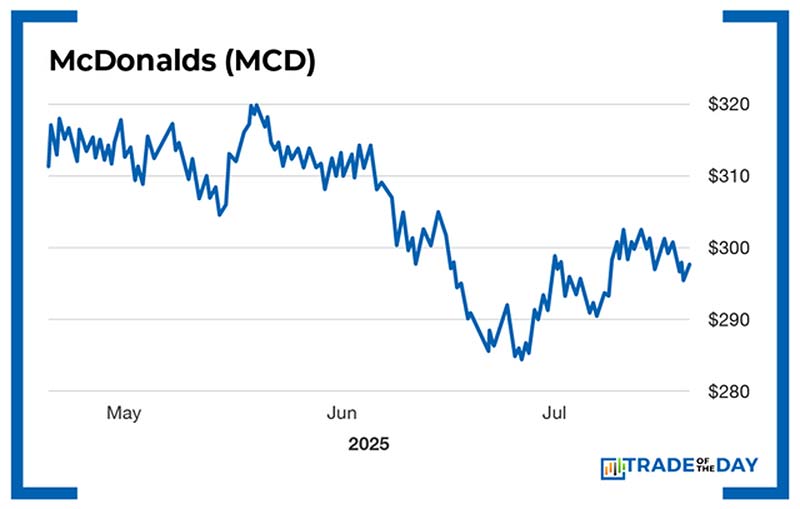

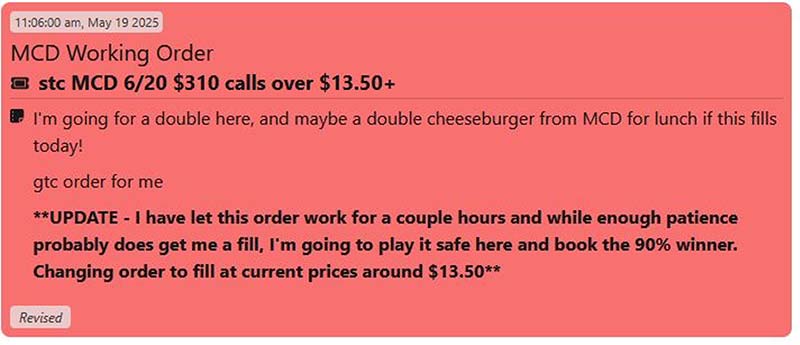

One recent example was on McDonalds (MCD).

My S.A.M. Scanner picked up several squeezes and a very bullish chart on MCD back in May.

In this case, I bought MCD between $307-$310, starting around $310 and looking buy on a pullback.

I closed the trade for an 90% winner in 7 trading days.

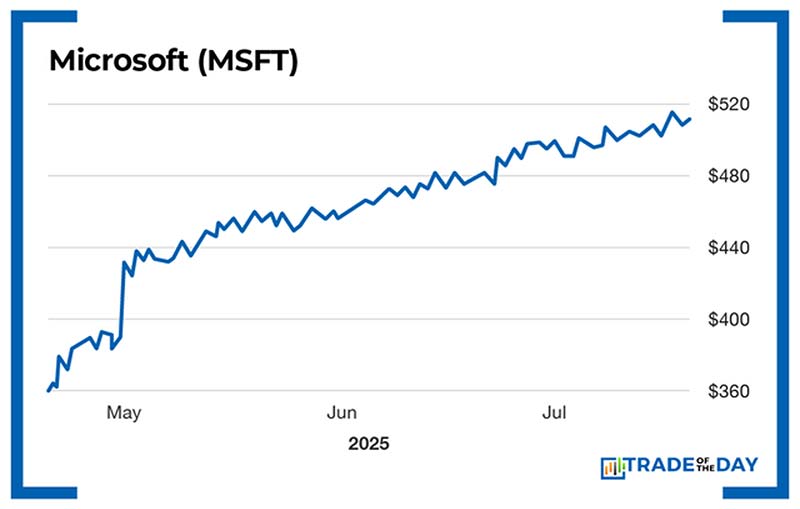

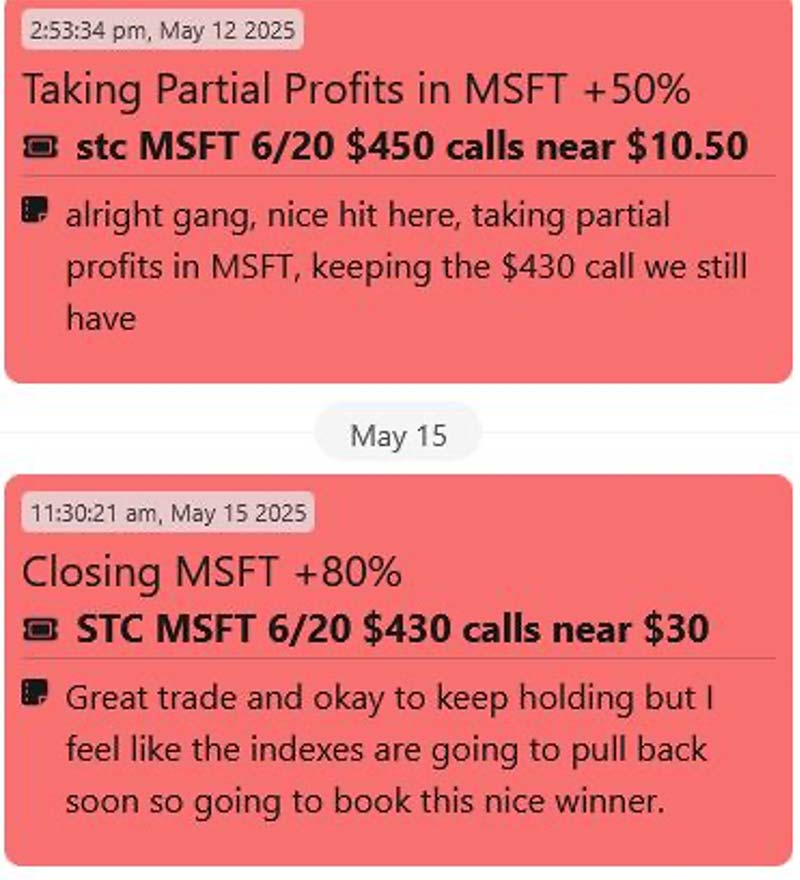

Another chart that I really liked ahead of the last FOMC meeting was Microsoft (MSFT).

Microsoft had CRUSHED earnings and they were nearing all-time highs. So I bought a higher delta option (for those with bigger accounts) and a lower delta option (for those with smaller accounts).

I closed the trade for multiple double-digit gains, with one trade closing for an 80% gain in 8 days and another for a 50% gain in 5 days, respectively.

Look, I totally understand if you want to remain light and nimble ahead of potential volatile events like the FOMC.

But the lesson here is… while it’s important to not get over aggressive and “guess” where the market is headed, there are plenty of buy opportunities when you know where the money is moving.

![]()

YOUR ACTION PLAN

Use these exact thresholds – NFLX needs 11.4%+, TSM needs 8%+, AA needs 12%+, ASML needs 9.4%+, WFC needs 6.9%+.

Risk small amounts, take profits when you have them, and don’t chase these setups with money you need for anything else.

More from Trade of the Day

How My “Lotto” Strategy Makes 1,000% Gains Possible

Feb 20, 2026

Why Smart Traders Avoid These Stocks Like the Plague

Feb 19, 2026

Two Footwear Stocks Ready to Follow CROX Higher

Feb 18, 2026