This Trade Could Be Golden!

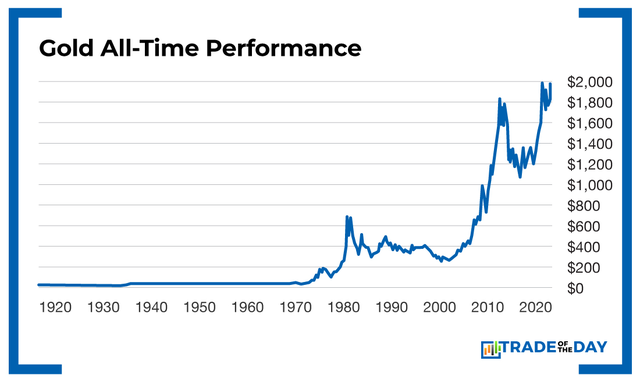

Gold is about $100 away from a new all-time high, and that might be just the start.

If it breaks its previous record (around $2,069 per ounce), it could shoot even higher.

Is it shooting up due to inflation fears… or something else?

Inflation is certainly a fear, but gold didn’t move up last month or even two months ago.

So why now?

Well, first you have to look at the Russian invasion of Ukraine.

The invasion itself is contributing little. It’s the sanctions on Russia that are the real culprit.

Russia has been buying gold for years, including making big purchases up until the invasion.

Russian leaders knew sanctions would freeze some of the country’s assets, but they weren’t counting on reserves being frozen or banks being hit with massive sanctions.

Plus, liquidity has dried up and the ruble is rubble. Sure, crypto is an option, but that entails reliance on the internet or some wallet at a brokerage firm – both of which could be unsafe.

Gold is heavy, but it’s portable too.

I think gold is rallying as other global players observe the sanctions on Russia and say to themselves, “We better buy some extra gold for our reserves.”

It’s probably not a bad idea – especially if you’re a bad actor and still part of the global monetary system.

But the truth is…

The way to make money from gold is to buy the miners that are leveraged to the price of the metal.

As it moves higher, their profits swell because their fixed costs don’t change.

And they also get the opportunity to lock in higher prices with futures contracts, basically guaranteeing a profit.

It’s good to be a miner today!

But not all miners are alike. Some are highly indebted, and others have costs that exceed their selling prices… In other words, some miners are in business only to pay their own salaries and bonuses! In The War Room, we separate the wheat from the chaff.

Action Plan: We have taken profits on gold plays 20 or 30 times in The War Room over the past three years. And right now, we have another play going that is already in the money and looking to move even higher.

In fact, this week we had 11 out of 12 trades close as winners! See how you can be a part it and get our 322 winning trades guarantee here!

Fun Fact Friday

Geopolitical markets are not for the faint of heart, but there is some reason to be optimistic. Glenview Trust’s chief investment officer Bill Stone took a look at 29 different geopolitical crises, starting with World War II. He found that, on average, stocks were higher three months after a geopolitical shock. And following 66% of such events, they were higher after only one month. If you’re worrying about stock market volatility due to the Russia-Ukraine conflict, fear not. We’ve got you covered. This week we used a unique trading methodology in The War Room that resulted in three monster winners! Discover the secrets here.

More from Trade of the Day

The partnership built on useful disagreement

Dec 17, 2025

Why Santa Could Bring the Bulls Soon

Dec 16, 2025

One of The Best Trades I Ever Made (1,130% Winner)

Dec 12, 2025