We Called the Bottom on COST

Last week, I mentioned Costco (COST) was on my radar for a trade in The War Room.

But here’s the thing…

This trade actually wasn’t working out.

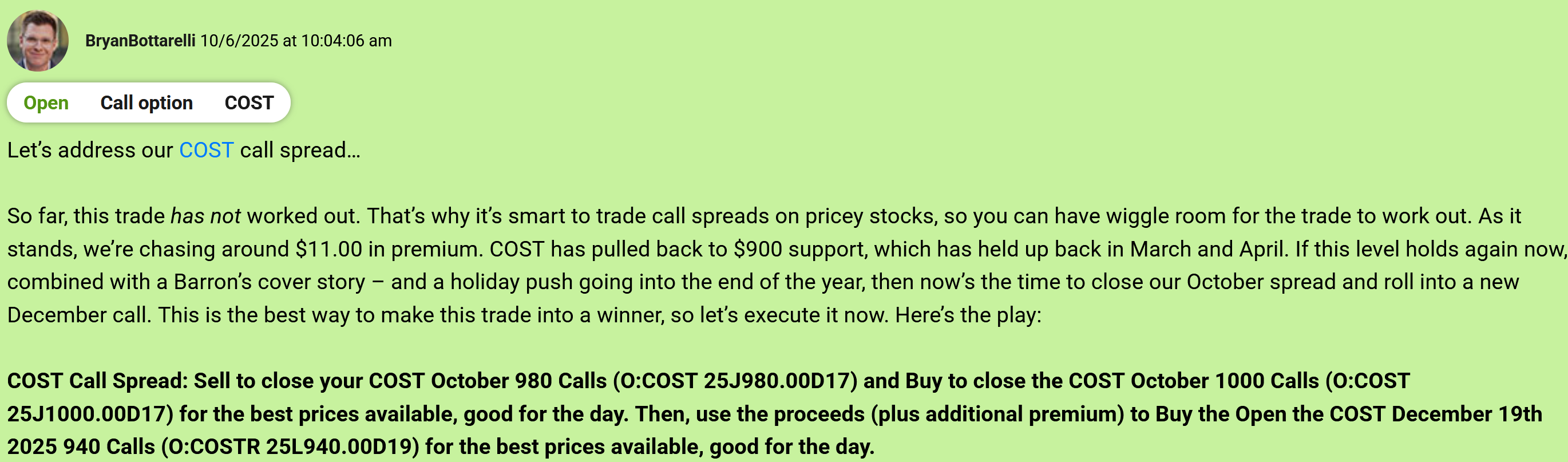

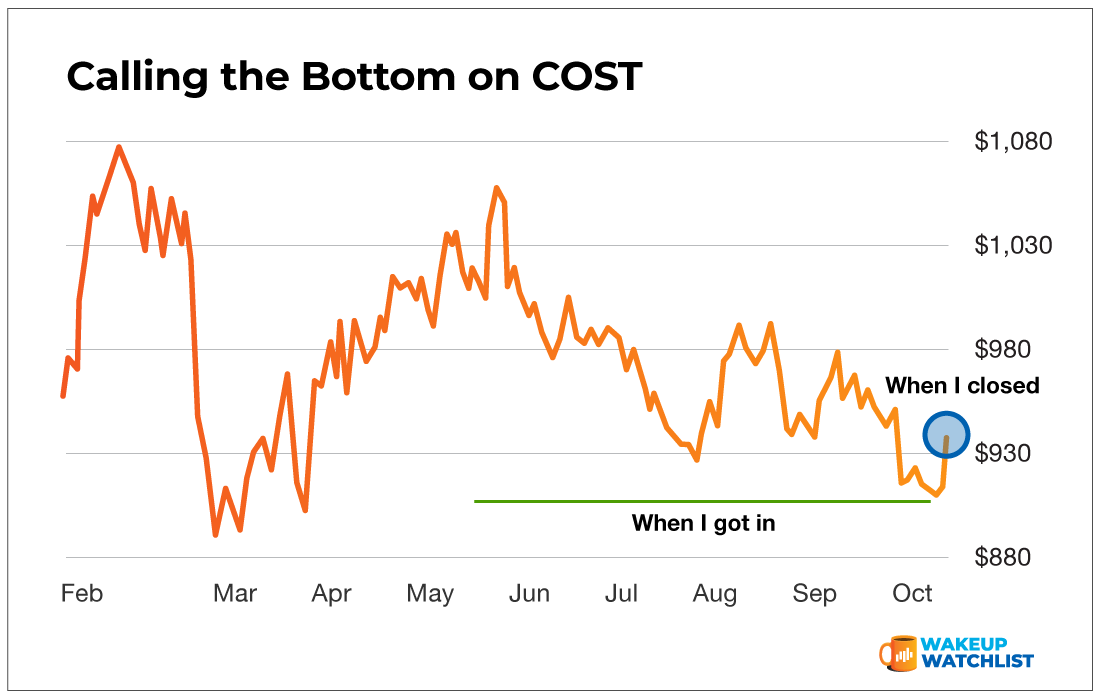

You see… back in June I got positioned on COST on a call spread.

But COST had been trading sideways for months.

While this might’ve been a sign to cut my losses, the beauty of the call spread is it gives you the flexibility to roll into another month.

So to keep the hopes of a winning trade alive, I rolled our October calls into a new December call.

COST was nearing its $900 support level. So I knew if COST could fill the gap around $940, the trade would become a winner.

Then yesterday, the Wall Street Journal reported COST sales were climbing in September and early October.

This gave us the bounce we were looking for.

COST moved up over $940, and the trade became a winner.

This is a good example of how call spreads can turn a non-performing trade into a winning trade by executing a roll.

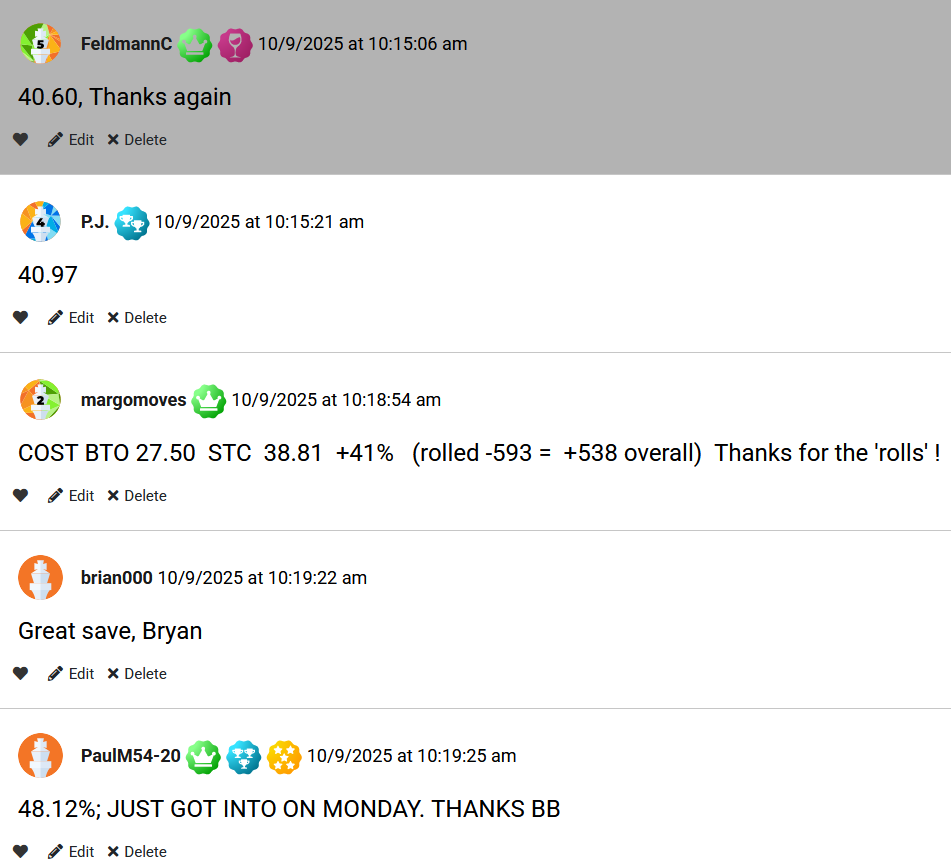

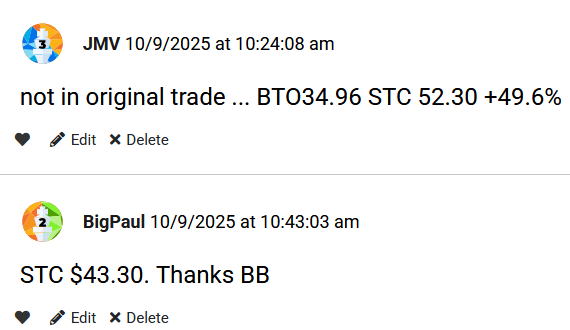

Several War Room members were in on the trade.

Here’s what they had to say…

As a watchlist subscriber, did you get a chance to get in on this trade? I hope you did.

Action Plan: Call Spreads are just one of the many strategies I use to make consistent winning trades in The War Room.

Now, with earnings season about to begin, there’s another powerful trading strategy I want you to know about. This method gives traders the opportunity to double their money in less than 24 hours.

More from Wake-up Watchlist

OPEX Week or Not – I Have a Chart That’s Flying High

Feb 20, 2026

5 Trades. 5 Winners. Same Ticker.

Feb 18, 2026