Why Defense Stocks Are Breaking Out While Tech Stalls

Wall Street analysts are still treating defense like it’s 2019.

RTX trades at tepid analyst ratings while sitting on multi-year backlogs. Lockheed Martin breaks through technical resistance with barely a Wall Street upgrade in sight. Northrop Grumman posts record orders, and the Street yawns.

Meanwhile, the fundamentals are screaming: Global military spending hit $2.7 trillion in 2024, heading toward $3.6 trillion by 2030. The U.S. defense budget is pushing toward $1 trillion for FY2026 – a 13% increase. NATO allies are committing to 3.5-5% GDP targets, with Europe leading the charge.

This isn’t your typical defense cycle. R&D budgets are up 27% to $179 billion as warfare shifts to tech-driven systems: drones, hypersonics, AI-enabled platforms. The stuff that requires private sector speed with public sector scale.

From a Behavioral Valuation standpoint, this setup is textbook: Prices breaking higher among top defense names while analyst sentiment lags fundamentals. That’s exactly how sector re-ratings begin – and it means this bull run is just getting started.

The Behavioral Valuation Breakdown

Let’s start with the macro.

Geopolitical tensions haven’t cooled – they’ve escalated.

Venezuela’s military activity near the Guyana border has the U.S. repositioning assets in the Caribbean.

NATO allies in Europe are under pressure to boost military budgets, while Russia continues to provoke.

China–Taiwan tensions are rising again with increased naval pressure and flyovers.

After years of depleting stockpiles in Ukraine and Israel, the U.S. is pouring money into replenishment efforts.

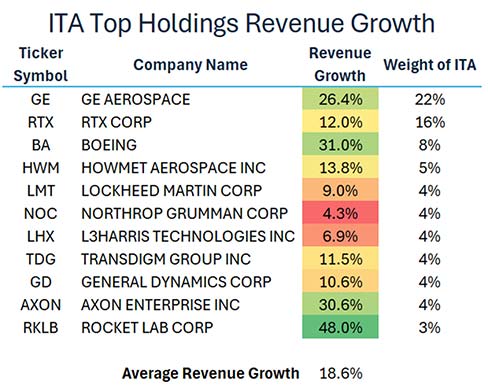

That includes a record $900+ billion defense budget for FY2026, with FY2027 proposals targeting $1.5 trillion. These aren’t temporary spikes – this is structural spending that’s driving 18.6% average revenue growth among top defense firms, absolutely dwarfing the S&P 500’s 5.2%.

This is long-cycle growth with massive government backing. That alone should be enough to put these stocks on every trader’s radar. But the technicals are what really push this from watchlist to action.

What the Technicals Say About the Defense Stocks

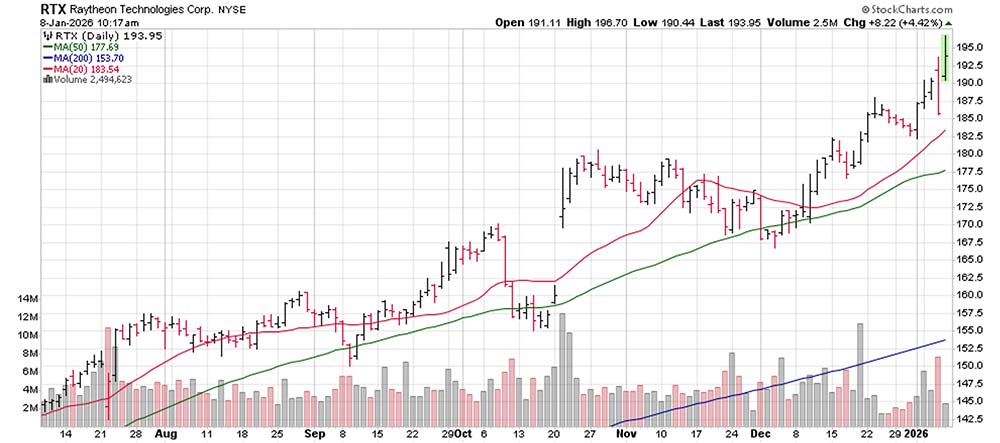

The iShares U.S. Aerospace & Defense ETF (ITA), which holds a basket of top-tier defense contractors, is now in a confirmed multi-timeframe bull market.

Short-term? The 20-day and 50-day moving averages are sloping upward with tight consolidation ranges breaking to the upside. This confirms that short-term traders are taking every opportunity to “buy the dip” on these stocks.

Intermediate-term? ITA continues to hold above its 200-day moving average, signaling that the long-term trend is intact and accelerating.

This is not a hope-and-hold pattern. This is a textbook uptrend.

And it’s not just the ETF. Nearly every top holding – Lockheed Martin (LMT), Northrop Grumman (NOC), General Dynamics (GD), Raytheon (RTX), and Boeing (BA) – is trading near all-time highs.

Contrast that with the Magnificent Seven, where most names are now in short-term technical breakdowns, with bearish RSI divergences and failed retests of support. The smart money is rotating, and it’s rotating into defense.

Bullish Volatility from the White House?

On Wednesday, the White House made a politically charged announcement where President Trump threatened to halt dividends and share buybacks from defense contractors unless they met his “demands”. That announcement failed to dent the trend.

ITA shares rallied in after-hours trading and gapped higher the next morning. The reason is simple: the market has adopted the “TACO” (Trump Always Chickens Out) trade.

Over the past year, we’ve watched as these rhetorical threats have failed to materialize into lasting policy – particularly when national security and jobs are on the line. The result? Institutions are ignoring the noise and buying the fundamentals.

Government Stake in a Defense Company Coming?

Traders are finding signals in unexpected places on the potential future of the defense sector.

On Kalshi – a federally regulated event-based prediction exchange – there’s a contract betting on which companies the U.S. government will take a stake in before 2027.

As of today, the top three names are: Lockheed Martin (LMT), privately held Anduril, and Boeing (BA).

“Bets” on all three have spiked this week while gaining “trading” volume. This suggests that the “market” is seeing a potential repeat of what happened in 2025 when the government took partial ownership of U.S.-based rare earth companies MP Materials (MP) and USA Rare Earth (USAR). Those stocks exploded over 200% in just months. If similar stakes are taken in defense companies, the upside could be just as aggressive.

Analyst Upgrades Expected on the Defense Stocks

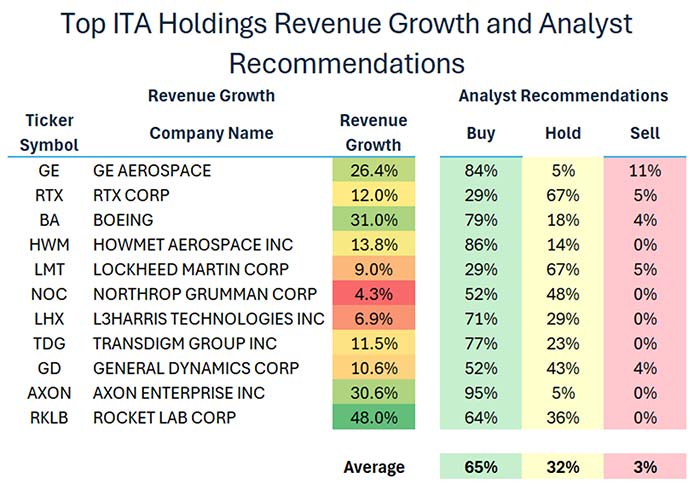

From a sentiment perspective, the defense sector still isn’t a crowded trade. Despite the bullish price action, Wall Street hasn’t fully bought in.

The top holdings in ITA carry an average “Buy” recommendation of just 65%.

One of the ETF’s largest holdings, Raytheon, is rated a Buy by only 26% of analysts, even after rising 65% over the last 12 months. That makes it one of the most underloved outperformers in the market.

As revenue growth ticks back into the double digits, upgrades will come fast.

Raytheon alone accounts for nearly 17% of the ITA’s weighting, so upgrades here will have a portfolio-wide impact.

![]()

YOUR ACTION PLAN

The Behavioral Valuation model is flashing green for defense.

Strong fundamental growth, bullish technical trends, and low analyst buy-in point to sustained upside in 2026.

A price target of $350 for the ITA ETF is a reasonable projection based on the current trajectory, representing 50% upside from today’s levels.

For investors looking to play this move, there are several angles.

The most direct route is buying ITA outright for significant returns that are likely to outpace the S&P 500 and Nasdaq 100 indices.

Long-term options on the ITA are thinly traded, with the furthest expiration currently only available through July 2026.

This limits flexibility for options traders with the bid-ask spreads remaining quite wide, so slippage is a concern.

For those seeking more specific exposure, Lockheed Martin and Raytheon remain two of the strongest names in the group with breakout technical setups and untapped upgrade potential.

In a market desperately searching for direction, defense stocks are marching higher with clarity.

This is a trend where you can trade with confidence.

You can catch more of my insights on MTA Live and our YouTube Channel.

More from Trade of the Day

Two Footwear Stocks Ready to Follow CROX Higher

Feb 18, 2026

Are the Banks Destroying Your Savings?

Feb 16, 2026

Palantir Is About to Collapse. Again.

Feb 13, 2026