Do Your Stocks Meet These 5 Success Factors?

Give Caesar his due!

Unless you’re Apple or Microsoft, you have to give the market what it wants. Last year, and every year since 2009, the market wanted unlimited growth driven by unlimited quantitative easing.

Now we have the opposite.

The market still wants growth, but it wants it in an era of quantitative tightening.

Simply put, the Fed is not printing unlimited money anymore. Instead, it’s actually raising interest rates, which has the effect of taking money out of the system.

What does this mean for you as an investor?

The truth is…

The game has changed.

The market will be focused on these five factors for success moving forward:

- Growing revenues. No longer can companies report shrinking revenues to get into the elite growth club. Now they have to show that they can grow revenues or at least not shrink them in a more normalized market.

- Positive cash flow. Earnings are important, but so is cash flow. The market wants to see that companies are producing enough cash to pay their bills without having to go to the equity or debt markets.

- Earnings or a solid path to earnings. In the end, a company that can’t show it can make money over a reasonable time frame is doomed to fail.

- Valuations in line with historical industry, market and company norms. Outsized valuations like 20 to 50 times sales are history.

- No more SPACs. More than a year ago, I wrote in The War Room that there were more SPACs than there were good ideas. Now 90% of those very same SPACs – many of which should not have gone public – are trading at a fraction of their highs. SPAC is the new “bad word” on the Street.

Action Plan: Look over your portfolio now and weed out the trash. You still have time, and you owe it to yourself to take off the rose-colored glasses. This market is unforgiving, and it’s time to adjust. Sure, there will still be some land mines in your portfolio, some mistakes from the past. But the key to becoming a better investor is to master the ability to adjust to the times… and the times have changed!

If you want us to help you make trades in real time, join us in The War Room. We’ve been navigating these choppy markets to great success. So far, we’ve posted bear market gains as high as 70% in six minutes! We also posted total returns of 115.8% in 12 days during the beginning of the Russia-Ukraine conflict. And last month, we rang the register 50 times at an 80.6% win rate. Imagine making winning trades in a bear market. How much better off would your portfolio be when the market finally recovers? Don’t you think it’s time you started turning things around?

Click here to get access to The War Room today.

Fun Fact Friday

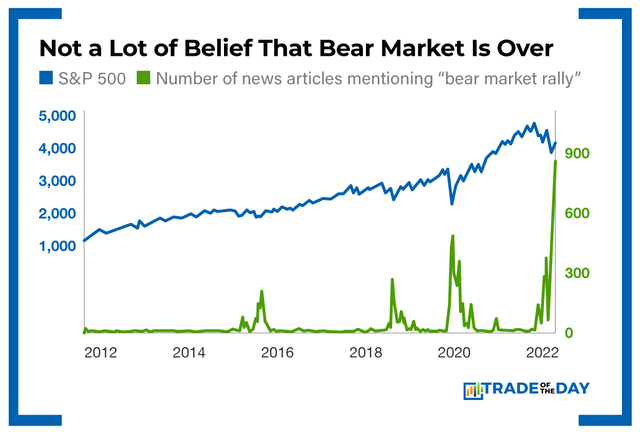

There have been a lot of news articles talking about “bear market rallies” recently. Below, you’ll see how a surge in articles mentioning that phrase typically coincides with market bottoms. This could be an indication that the market is at or near the bottom.

More from Trade of the Day

The No. 1 Insider Stock for 2024?

Jul 26, 2024

Why I’m Buying This 3-month Trigger Catalyst

Jul 24, 2024

Jul 23, 2024