3 Important Stock Catalysts

Editor’s Note: Today, we’ve got an important guest article from our friend Marc Lichtenfeld, Chief Income Strategist at The Oxford Club. Marc has been studying Dividend Aristocrats for years. Dividend Aristocrats are S&P 500 companies that have increased their dividends each year for at least the last 25 years.

And now Marc is coining a new term: “Earnings Aristocrats.”

Earnings Aristocrats are companies that have beaten earnings estimates for 25-plus straight quarters.

And in Marc’s latest presentation, he reveals just how powerful – and profitable – Earnings Aristocrats can be. In fact, Marc believes some Earnings Aristocrats could double your investment in less than 24 hours.

But you’ll have to act fast. The deadline to join – before Marc’s earnings season kicks off – is at midnight ET tonight. So get in now before it’s too late!

Click here to see Marc’s Earnings Aristocrats presentation.

There’s a big difference between trading and investing.

When you invest in a stock, you should be going in with a long-term view. You can certainly change your opinion as time goes on if events warrant it.

But you shouldn’t plan to hold a stock for years and then get spooked by one bad earnings report (unless something extraordinary happens, like fraud).

Trading is different. A trader is often looking for a specific catalyst.

Oftentimes, traders view earnings reports as important catalysts. It’s not uncommon to see a stock surge after reporting a quarterly earnings beat.

TransMedics Group (Nasdaq: TMDX) recently surged more than 30% in one day after reporting stronger-than-expected results for the fourth quarter of 2021. The stock is now 114% higher than it was the day before earnings were announced.

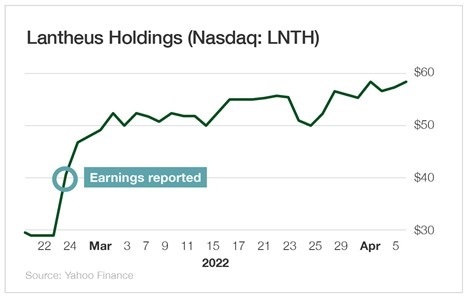

In February, Lantheus Holdings (Nasdaq: LNTH) spiked 39% in one day after reporting stronger-than-expected earnings. The stock has now more than doubled from its pre-earnings price.

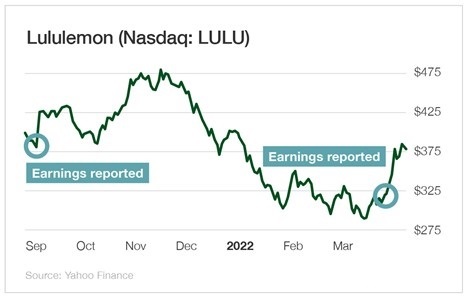

Lululemon (Nasdaq: LULU) did it twice in the past three quarters, jumping 11% in September and 10% in March on better-than-expected earnings results.

It’s important to have near-term catalysts for your stock. Otherwise, you have no reason to believe the price will quickly move higher – other than “It’s a good stock,” which isn’t a valid rationale at all.

Without a reason to expect a stock to jump in the near term, your investment could be dead money. It could just sit there, doing nothing. If you’re putting your money to work in the market in the short term, you want the trade to be completed fairly and quickly.

Make your money, get out and move on to the next one.

Below are a few potential catalysts that you can look for to get your stock moving quickly.

Earnings. Most companies announce earnings dates in a press release a few weeks before the report comes out.

If the company you’re interested in has not yet announced its earnings report date, simply add three months to the last quarter’s report date and you’ll likely be pretty close.

Companies will begin to report first quarter earnings in the next couple of weeks. So now is the perfect time to stock up on companies that have a track record of beating expectations.

Analyst upgrades. When a new “Buy” or “Sell” recommendation is issued, stocks can move significantly. So I want to give my trades the best opportunity to be upgraded. To do that, I find stocks that analysts hate.

If most analysts already have “Buy” ratings on a stock, the chances of an upgrade are slim. The bandwagon is full.

But if most analysts rate the stock a “Hold” or “Sell,” you can sometimes get a nice move higher when they upgrade it. Look for stocks that don’t have many existing “Buy” recommendations.

Short squeeze. If a stock is heavily shorted (traders bet the stock will fall so they sell it first and buy back later), every tick higher in the price of the shares is causing pain for the shorts.

Eventually, when the losses get to be too much, the shorts exit their position by purchasing the stock.

That creates more demand and pushes the price even higher. As the price climbs, more shorts buy the stock and you can get a powerful move from all the extra demand for the shares.

Look for stocks with more than 10% of the float (the numbers of shares available for trading) sold short.

Stocks typically don’t make big moves for no reason. You need a catalyst that will push your stock higher in the near term.

If you can’t find one, you may want to find a different stock.

Good investing,

Marc

P.S. I track all these catalysts and many more in my Predictive Profits VIP Trading Research Service. I recently identified several companies that have beaten earnings estimates for 25-plus straight quarters. I call them Earnings Aristocrats.

I believe they have the potential to double your investment in less than 24 hours this earnings season.

This offer will expire at midnight tonight. So don’t miss out on the next earnings catalyst!

More from Trade of the Day

A Golden Buying Opportunity Zone

Apr 15, 2024

Apr 12, 2024

Five Reasons to Use Stop Losses

Apr 11, 2024

Your Blueprint For Trading A Whippy Market

Apr 11, 2024