KDP Insider Just Bought $1.4 Million Worth of Shares Before Earnings

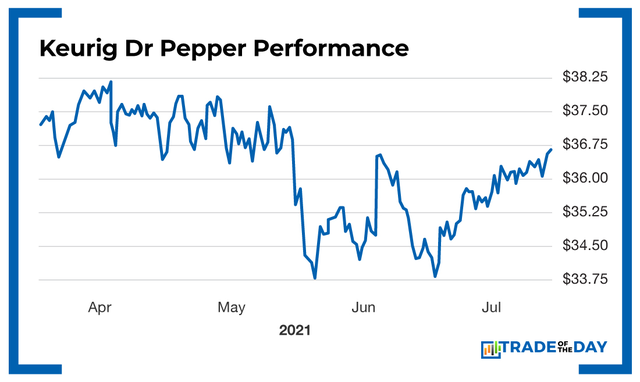

According to information from the Securities and Exchange Commission, Keurig Dr Pepper (Nasdaq: KDP) Chief Supply Chain Officer Tony Milikin bought $1.4 million worth of the company’s stock between June 29 and July 11, paying an average price of $35.96 per share.

As my War Room colleague Karim has noted countless times in Trade of the Day…

There are a lot of signals investors look for to determine whether to buy a stock. However, I believe one stands out above all others…

Insider buying – the legal kind.

And in today’s beaten-down market, insider purchases – especially those made in clusters – are one of the key signals we should be focused on.

The best part for Keurig Dr Pepper specifically… is that Milikin is not alone.

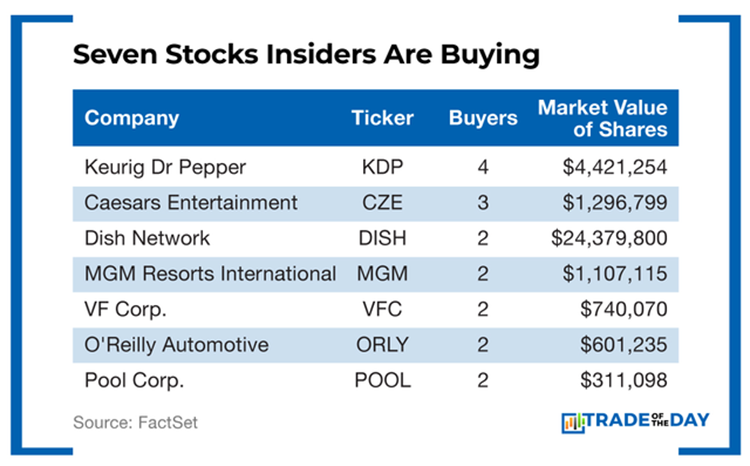

Over the past three months, Keurig Dr Pepper has seen four insiders buy more than 120,000 shares, valued at $4.4 million.

According to Barron’s and FactSet Research Systems, Keurig Dr Pepper has seen the most insider purchases among S&P 500 companies over that time frame. Here are the top companies that saw at least two insiders purchasing their shares:

So far this year, the owners of brands such as Dr Pepper, 7Up and Yoo-hoo have dropped only 1%, far outpacing the S&P’s drop of 19%.

With Keurig Dr Pepper earnings coming up on July 28, perhaps these recent insider buys are a sign of more strength to come.

Action Plan: Because PepsiCo (Nasdaq: PEP) recently reported strong earnings, it’s logical to think that Keurig Dr Pepper will as well. Combine that with the recent insider buys, and Keurig Dr Pepper is certainly a stock to track – or even buy – going into earnings on July 28. If you want to learn more about the power of insider buying and see how we’ve used it to maintain a 92% win rate, check out the latest training from Karim.

Bonus Insights! I was recently featured in an interview by our friends at The Oxford Club – which they’ll provide to their top-level members in the days ahead. But because you’re a Trade of the Day member, I also wanted to share my responses with you. You can see them below.

Bryan, what’s your No. 1 concern about the market right now?

My main concern – and it’s not even close – is how the market will react to no longer having quantitative easing (QE). As I’m sure you know, QE is where central banks create money – and then purchase assets using this printed money. Since QE measures were introduced (in response to COVID-19) – a span running from March 2020 to July 2022 – the size of the Federal Reserve’s balance sheet has shot up, reaching around $8.91 trillion (as of July 5). But in November 2021, the Federal Reserve announced that it would begin to “taper” these large-scale asset purchases by $15 billion per month. How the market will react to no longer having this stimulus money is one of the biggest unknowns that the U.S. financial system has ever had to deal with. It’s an experiment without an answer – which is why it’s my No. 1 market concern.

What do you think of crypto?

Am I allowed to use curse words in my reply? In all seriousness, I do not believe in crypto. I’ve been a skeptic about all things cryptocurrency-related since day one, unapologetically calling altcoins the “Beanie Babies of Wall Street.” I will accept any invitations to debate this subject – anytime, anyplace.

Are you bullish or bearish about the remainder of the year? Why?

With inflation at a 40-year high, the markets would be very hard-pressed to end the year in the green. While I do believe we’ll see a fourth quarter rally, I still think 2022 will end as a down year. However, volatility will be rampant, and that’ll create numerous short-term trading opportunities for those who know where to look – and exactly how to capitalize on it properly.

What’s your favorite strategy to implement in a volatile market?

If you can isolate and identify “W” patterns on a 3-minute chart, you can play call options with great success. If you can isolate and identify “M” patterns on a 3-minute chart, you can play put options with great success. These two patterns are all you need to generate a daily income stream that’ll last a lifetime – no matter which direction the markets are heading.

Can you explain how that works and provide an example that’s worked for your readers?

For that, you would need to access my new training video on the “Perfect Timing Pattern.” I just posted it, and it’s totally free to watch. I go through all the details of the strategy in that free training video.

If you could give Chairman’s Circle Members one piece of advice, what would it be?

Join The War Room– and log in every morning 30 minutes before the open (9:30 ET). The market intelligence you’ll get in that 30-minute premarket discussion could make you more money than you’ve ever dreamed possible. But you have to be in the room to get your piece of the action. It’s really as simple as that.

Monday Market Minutes

- More Interest Rate Hikes Ahead? After last week’s chatter about a full-basis-point cut, it now seems like the Fed may raise rates by 0.75 percentage points for the second straight month when it meets on July 26-27. The strength in banks and in the markets in general over the past few days will put more pressure on the Fed to raise rates quickly. Tracking.

- Taiwan Semiconductor Manufacturing (NYSE: TSM) remains in a powerful position after a strong earnings report. Customers like Apple, Qualcomm and Advanced Micro Devices rely on its semiconductor processing technology, and the company just upped 2022 guidance – it’s now projecting 30% year-over-year growth.

- Goldman Sachs (NYSE: GS) reported second quarter earnings of $7.73 per share, which easily surpassed the consensus estimate of $6.58 a share. In a different twist, Bank of America fell $0.02 below estimates – but its revenues came in slightly above Wall Street forecasts.

- General Electric (NYSE: GE) recently revealed the names of the three distinct companies that will be created by its upcoming split. The companies will operate in the energy, aerospace and healthcare sectors. The healthcare company is the best of the bunch, with energy as the sleeper and aerospace as the steady one.

More from Trade of the Day

The No. 1 Insider Stock for 2024?

Jul 26, 2024

Why I’m Buying This 3-month Trigger Catalyst

Jul 24, 2024

Jul 23, 2024