The Craziest Trade You’ll Ever See (I Guarantee It!)

What I’m about to show you is a real trade, and I’ll attempt to go through what this trader was thinking and why they got positioned the way they did.

As a warning, the implications are quite ugly.

After explaining the trade, I will tell you what you should do instead.

The Trade…

In recent market sessions, a trader bought 50,000 VIX March $150 call options. They’re trading for around $0.19 per contract.

Let’s break this down…

Basically, in my view, this person spent $950,000 to essentially protect themselves against Armageddon.

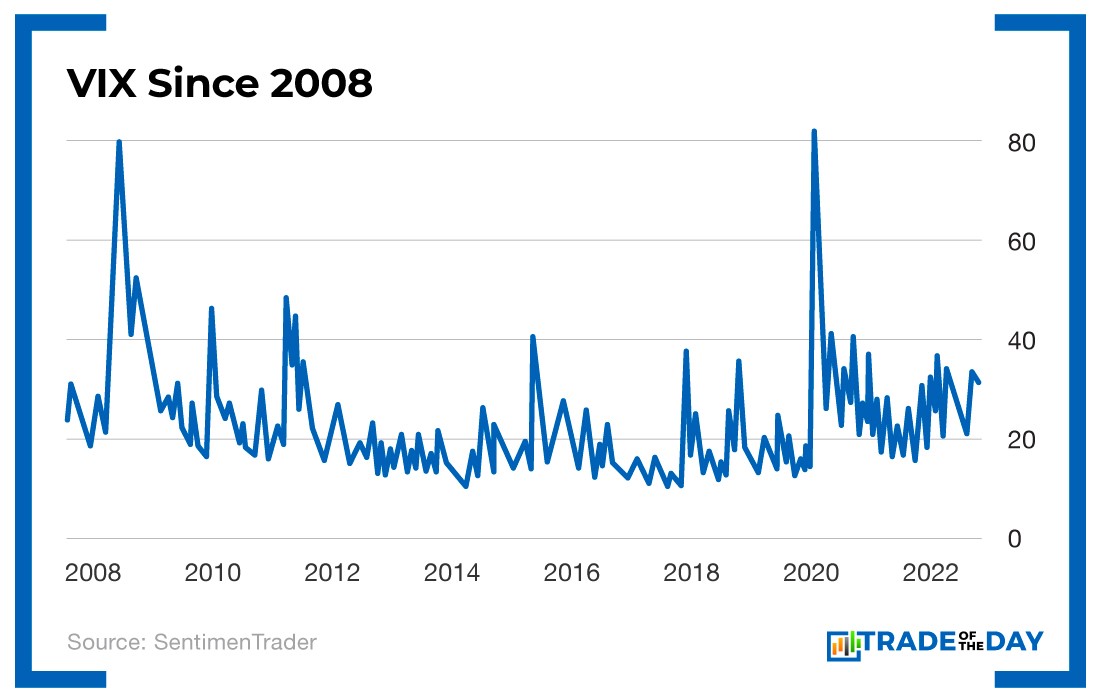

Why do I think that? Well, right now, the VIX is at 31.

At the height of the COVID crash in March of 2020, it broke 80. At the very peak of the Great Recession, it broke 80 as well (in November of 2008).

Just so we’re clear, the VIX has never gotten to 150.

The two biggest market panics over the last two decades saw the VIX spike to 80.

But right now, someone thinks that it won’t spike back only to those all-time highs – it’ll DOUBLE the highest levels we’ve ever seen.

The only thing I can think of to explain this trade is that the buyer is preparing for nuclear war. For this trade to pay off, the world would need to end.

And if it does… what good would hitting a huge VIX winner be, anyway?

This is a very morbid topic, so I won’t continue down this rabbit hole.

What the Trader Should Have Done…

There are better, less apocalyptic ways to protect your portfolio and profit from market panics.

We do it every day in our real-time chat room, The War Room – we go live and in-depth every day the markets are open. Had this trader been chatting with our community, he would have been armed with better ideas – ones that wouldn’t have had him betting on a VIX level that wasn’t even hit in the last major market meltdowns.

And next week my partner Bryan and I are opening the doors of The War Room so anyone can try – TOTALLY FREE.

This could potentially be the BIGGEST event of the year for the security of your portfolio…

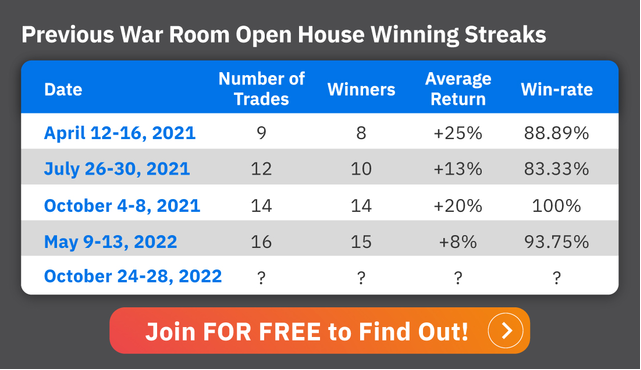

Don’t believe me? Well, just check out our previous Open House track records…

Each time we’ve opened the doors to the room, attendees have walked out with at least eight winners, and we’ve maintained at least an 80% win rate.

We teach and use strategies in The War Room that win regardless of the market.

This past week, we went nine for nine, with a 27.59% average weighted gain. The Nasdaq lost 2% over the same time span.

And next week we’re gonna amp it up!

I’m going to show you the VERY BEST insider play in the market right now. I’ve also got a strategy to play the next Fed meeting, the next CPI number AND the elections – all using ONE play designed to take advantage of whatever happens.

And it’s free. Totally free. No credit card required. Sign up for the event and enjoy your experience in the best real-time platform on the market today.

Don’t take my word for it – take theirs!!

“Second week of trading in The War Room. Scored a 191% gain on EA $112 call overnight – in at $4.05 and out at $11.80. WOW!!!” – Charles

“Hot damn, Bryan! Just closed out my very first trade as a guest in The War Room. In yesterday MARA, 4/16/21, 52 CALL at $1.89; out this morning at $4.10. That’s a 117% profit! Yippee!!!” – Joe S.

“I know this is not the thread… but Bryan wants us to brag. Just came in from golfing and sold DELL for 181% GAIN (just four trading days). Thank you, Bryan!” – Josh

Those are all real people making real trades based on what they saw in The War Room for FREE. This does not happen often, but when it does, attendees have had incredible opportunities to lock in wins, including overnight doubles. For FREE!

Action Plan: Don’t miss your chance. Sign up now and join us for a FREE week. There is no cost to join and no delayed billing. Join us here, and I will see you LIVE in The War Room next week.

Monday Market Minutes

- Buffett’s “Inevitables.” Warren Buffett looks for companies that have underlying businesses that are going to grow at a consistent rate over time. Some candidates that qualify for this designation include COP, HON, ODFL and TMO – all of which could be buyable on the dip.

- AWK Save Haven? It might be time to renew our interest in American Water Works (AWK), which was a great safe haven for us earlier in the year – and could become one once again as the Dow Jones Utility Average trades below its June lows. Tracking.

More from Trade of the Day

The No. 1 Insider Stock for 2024?

Jul 26, 2024

Why I’m Buying This 3-month Trigger Catalyst

Jul 24, 2024

Jul 23, 2024