The Perfect Bear Market Strategy

In bull markets, I like to sell puts. In bear markets, I LOVE to sell puts.

When you sell a put, you are obliged to buy shares of the underlying stock at the strike price at which you sell the put – which you usually do only if the stock closes at or below that price at expiration or at any time prior to it. For taking on that risk, you are paid a premium – call it rent for the obligation.

Using a very specific formula, I have been able to achieve a win rate of over 90% on my put sells since May 2019. I was shooting for only 80%.

That was in a bull market. The bear market should be even better.

So why is a bear market better for put sells?

Well, I like to buy stocks cheap. And when I sell puts, I shoot for a discount to market price of 20% to 50%. This means the strike price at which I sell the puts is 25% to 50% below the current price.

So in a bear market, those price levels are 25% to 50% below an already discounted price. If I get put in a bear market, you can bet the stock is beyond cheap!

That being said, a fast transition between a bull and bear market, like we’ve seen, can whipsaw some put sells – and mine are no exception. That’s why it’s key that we follow two general guidelines to maintain a win rate above 80%.

- We will sell puts only on companies that we want to own.

- We will sell puts with a goal of covering our position before expiration… usually long before expiration.

In a volatile market with a downward bent, we’ll pick up more premium and have shorter holding periods.

The opposite is also true. In a less volatile, upward-trending environment, we will have fewer opportunities.

I try to find a balanced combination of volatility, premium and expiration.

When we sell a put on a stock, if the share price stays the same, goes up or doesn’t go down much, the option value can decrease quickly.

The goal is to buy that put back when we hit 20% to 50% of the potential return.

For example, if we sell a put for $1, we will buy it back when the price drops to $0.50 to $0.70. If it’s a $0.20 put, we may hold until expiration, and sometimes we may take a 30% or 40% return. But rarely will we hold beyond 50%.

We will also take advantage of time value to get the return we want when we sell longer-term puts. Time value is one of the biggest factors in options prices, especially options with expirations that are further out. Regardless of the stock’s performance, a long-term put will lose time value every day.

Action Plan: Bear markets scare the heck out of investors. But I think they are the best times to establish positions in stocks for the future. In a bear market, stocks are cheap and hated. The two best words an investor can hear!

Selling puts is just one of the winning strategies we’ve used in The War Room to maintain an impressive track record – even in the midst of this bear market. For a limited time, we are offering a $500 discount on War Room membership. Click here to learn more!

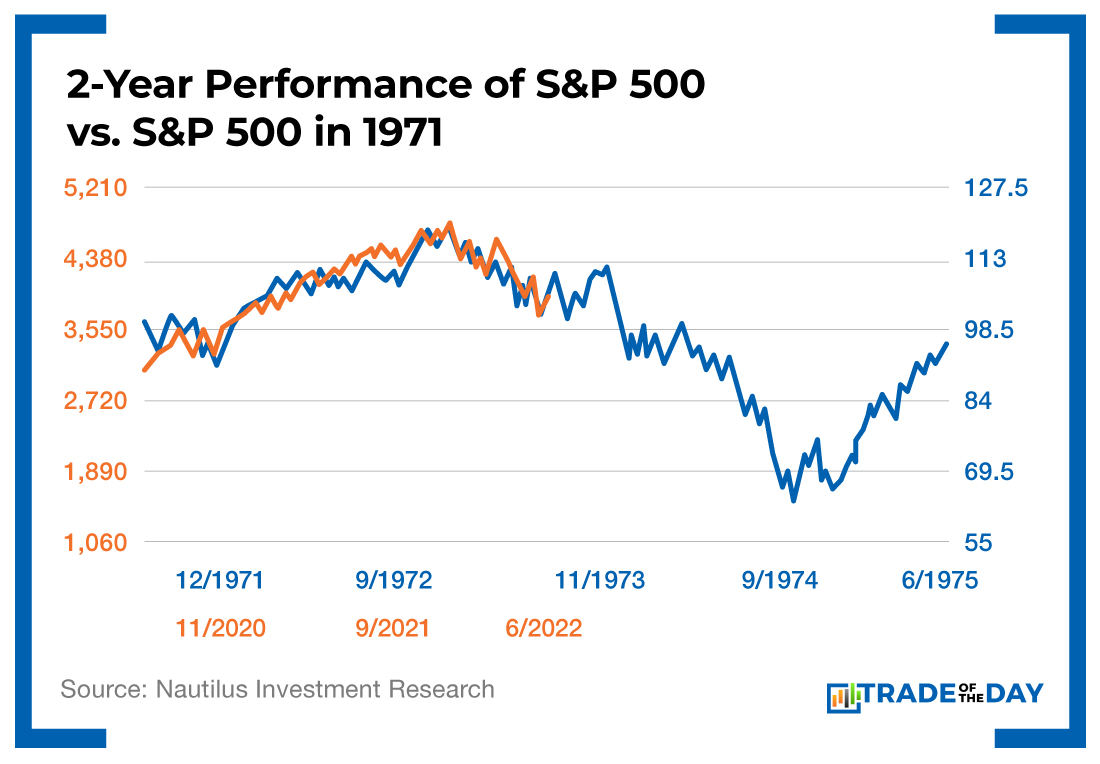

Friday Fun Fact: Stagflation is persistent high inflation combined with high unemployment and stagnant demand in a country’s economy. Today, many experts believe we could be heading toward the kind of stagflation that occurred in the 1970s. Are we looking at a repeat of 1973? If history is a guide, markets have more room to drop.

More from Trade of the Day

The No. 1 Insider Stock for 2024?

Jul 26, 2024

Why I’m Buying This 3-month Trigger Catalyst

Jul 24, 2024

Jul 23, 2024