This Friday, We’ll Find Out Whether the Bear Is for Real (Here’s Why)

It’s the biggest Wall Street debate of 2022…

Are we in a bear market… or not?

Everyone has an opinion.

On the one hand, I could easily make a case that we ARE in a bear market…

But on the other hand, I could easily make a case that we ARE NOT in a bear market…

There are plenty of facts and statistics to support both arguments.

However, if you’re looking for one final, conclusive and definitive answer, I’m here to tell you it’ll come this Friday.

Specifically, the answer will be revealed when some of the major financial stocks report earnings.

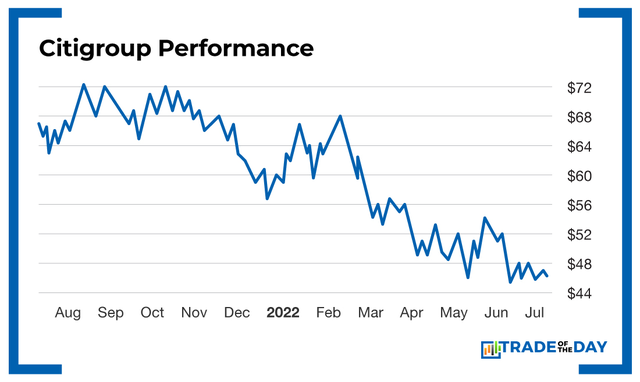

You see, as I’ve been telling War Room members for weeks, financial stocks are cheap right now. Very cheap. For example…

- JPMorgan Chase (NYSE: JPM) trades at 1.3X book value.

- Bank of America (NYSE: BAC) trades at 1.1X book value.

- Goldman Sachs (NYSE: GS) trades at parity to book value.

This means that if Goldman were liquidated tomorrow, the value of its assets at auction would be equal to the value of all of its shares at their current price.

Historically speaking, buying financials at these levels has been a savvy idea.

What’s more, all of these major financial institutions recently passed this year’s Federal Reserve stress tests – which means that they’re prepared to withstand any further market weakness (should we see any).

JPMorgan and Morgan Stanley are scheduled to report earnings before the open on Thursday. Their results will give us a good idea of whether or not the financial sector is close to a bottom.

But here’s why Friday is so critical…

Before the open on Friday, the following financial stocks are scheduled to report their earnings:

- Wells Fargo

- Bank of New York Mellon

- BlackRock

- Citigroup

- PNC Financial Services Group

- State Street.

Here’s what I’m looking at…

Action Plan: Of these companies, Citigroup (NYSE: C) will be the stock that determines whether the bear market is for real. You see, of all these financial stocks, Citigroup is the cheapest. It trades at 50% of book value – the lowest valuation of any major financial company right now. If Citi can rally off earnings, then we’ll have a good idea that the market bottom is close. If Citi CANNOT rally, then we’ll know that there is more downside ahead – and that we’re in a bear market.

To me, Citi’s reaction to earnings this Friday this will be the clearest, cleanest and most telling illustration of whether or not we’re in a bear market. No matter what happens, it’s critical that you’re prepared to trade this reaction accordingly – which is exactly what we’ll be doing inside The War Room. If you’d like to get in on the action, then you’re invited to join our elite group of traders right now.

Monday Market Minutes

- Target Range Up! Wells Fargo upgraded Range Resources (NYSE: RRC) to “Overweight” and moved its price target up from $44 to $49. The bank thinks the recent weakness is overdone, reflecting updated oil and gas price outlooks, as well as higher inflation expectations. Tracking.

- Twitter Drama? With Elon Musk terminating his $44 billion bid to buy the social media giant, there could be an elongated court battle ahead. Make sure you’re positioned if any major news triggers a tech sell-off.

- Energy Stocks in Play. If energy corrects more, there could be a lot of potential in the sector for next winter. If there’s no resolution in the war between Russia and Ukraine, expect prices to take off – especially in the natural gas sector.

- Earnings Season Kickoff. A number of high-profile reports are coming this week. Expect inflation and discretionary spending to be front and center. We’re positioning ourselves in The War Room for what Barron’s tech writer Eric Savitz says “could be the most important tech earnings period in years.”

- Jolla Jumps! La Jolla Pharmaceuticals (Nasdaq: LJPC) went up 82% this morning after the company announced it had entered a definitive merger agreement whereby Innoviva (Nasdaq: INVA) will acquire La Jolla for $5.95 per share and an incremental $0.28 per share for additional cash proceeds.

More from Trade of the Day

The No. 1 Insider Stock for 2024?

Jul 26, 2024

Why I’m Buying This 3-month Trigger Catalyst

Jul 24, 2024

Jul 23, 2024