Is This Sector Hotter Than Tech?

Some would argue that this will be the fastest-growing sector for years to come. It’s not tech, but it uses tech…

It’s gambling, without having to leave your couch. No drive or flight to Vegas or Atlantic City needed.

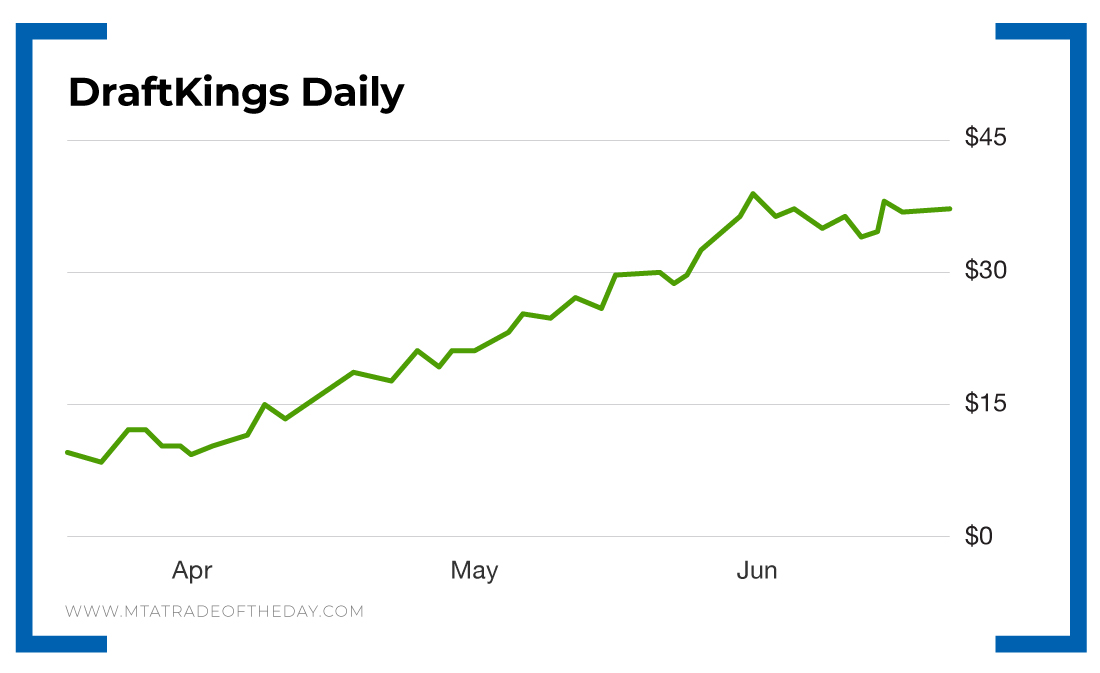

This week, War Room members jumped out of a quick four-day trade on DraftKings (Nasdaq: DKNG) with solid double-digit gains!

DraftKings – a digital sports entertainment and gaming company – could be a dominant player in the realm of betting. The company provides users with daily fantasy sports, sports betting and iGaming opportunities through business-to-consumer (B2C) and business-to-business (B2B) offerings.

B2C offerings:

- Daily Fantasy Sports – a peer-to-peer platform in which users compete against one another for prizes.

- Sportsbook – includes sports betting – which involves a user placing a bet on an event at some fixed odds (proposition) determined by the company.

- iGaming – an online casino, which includes a suite of games available in land-based casinos such as blackjack, roulette and slot machines.

B2B offerings:

- Sports betting and iGaming services for various gaming operators and government-run lotteries.

DraftKings has been on a tear since the beginning of the pandemic, up more than 300%. And this is with the near-term prospects of sports betting up in the air, as there are few live sporting events to bet on.

But investors look forward, not backward. And if you are looking to play the legal betting market as it opens across the country, then DraftKings is the way to go.

Buying the shares on a pullback into the low $30s is a good move if you can get them. The upside for this billion-dollar business could be massive in the years ahead, and this is truly one of those “ground floor” opportunities.

While I like the long-term prospects, DraftKings has great volatility, which makes for a perfect War Room play.

Action Plan: For a stock like this, I like to use spreads, which allow me to reduce some of that extra premium for volatility.

By using a spread, I reduce my cost and risk, but I also cap my upside. Since members are trading DraftKings for short-term profits, the upside cap is not as low as you might think. For members, that upside was a 4-to-1 potential gain!

In The War Room, we make trades on “regular” companies and up-and-coming juggernauts like DraftKings. Join me now and get in ahead of the crowd!

More from Trade of the Day

TikTok Ban Will Hurt This Stock

Apr 29, 2024

My Go-To Plays for Safety + Long-term Profits

Apr 26, 2024

My Favorite Way to Hedge Choppy Markets

Apr 25, 2024

The Story Behind My 10 Bagger on RILY

Apr 25, 2024