China Is Risky… but There’s a Way to Play It

There is little reason to invest in Chinese companies right now.

Political clouds, issues with Taiwan, a lack of transparency in accounting and general negative sentiment are all reasons to stay away.

I get it. I have been against investing directly in China for almost 25 years. Sure, I will trade Chinese stocks now and again. But invest in them? No way!

In fact, my views on the subject have been strong enough for the Chinese to deny me entry to the country unless I signed an affidavit saying that I would not write anything that portrays the nation in a negative light.

But here’s the undeniable thing… China is growing, and so is the country’s thirst for automobiles, especially cheap electric cars.

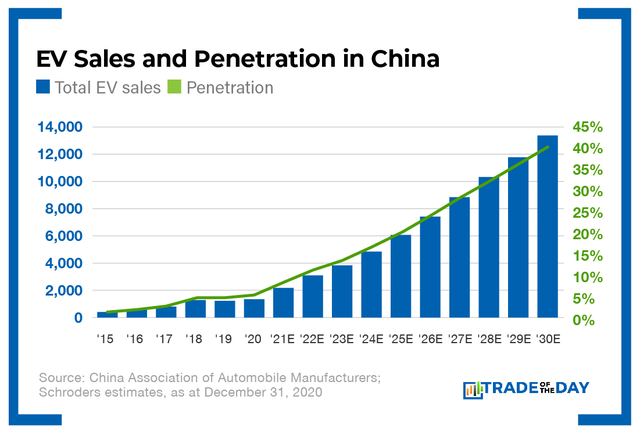

The chart below shows that electric vehicle (EV) demand is expected to more than double from current levels… and do so quickly. If prices continue to come down, that number could increase. There is currently a mini electric car on the Chinese market that sells for around $5,000.

So should we invest in a Chinese auto manufacturer? No way. The competition is cutthroat, and it’s only going to increase. And, as I said earlier, I don’t want to invest in any Chinese companies.

So how can we profit from the Chinese EV market?

The answer is to buy the company that mines the critical elements for the cars – all of them.

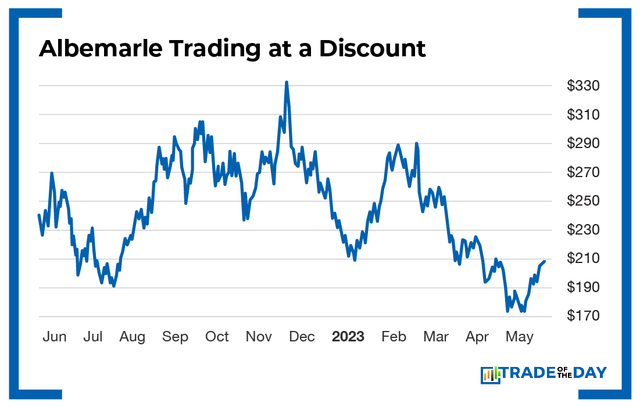

Lithium miner Albemarle (ALB) has seen its shares get rocked recently. A dip in demand during the COVID lockdowns in China at the end of 2022 caused the company to fall short of estimates. That makes now an ideal time to pick up the shares at a near-40% discount.

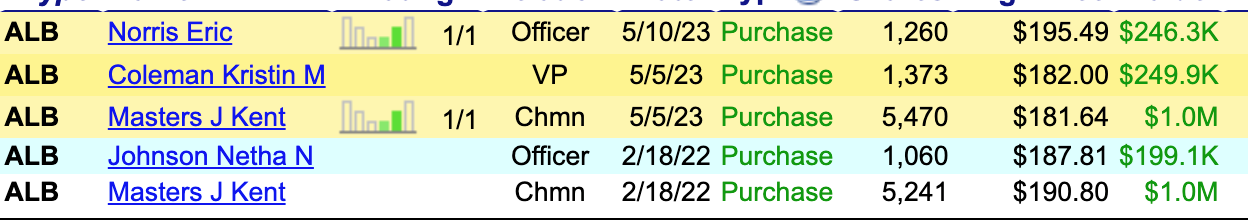

Don’t take my word for it. The insiders at this profitable company have been picking up a ton of shares recently. They are confident in the futures of lithium, EVs and China. Albemarle is a major supplier of lithium to Chinese automakers. Check out the insider buying graphic below.

![]()

YOUR ACTION PLAN

China is at the forefront of the race to produce affordable EVs. But the country is also involved in a sinister plot. China has its sights set on Taiwan, a leading manufacturer of semiconductor computer chips. If China has its way, it could spell economic disaster for Americans and create crippling spikes in the prices of tech products that would make today’s inflation look like a walk in the park.

More from Trade of the Day

When it Comes to Positioning – Size Matters

Apr 18, 2024

The One Strategy I’m Leaning on in a Choppy Market

Apr 18, 2024

One Crucial Wartime Trade to Make Now

Apr 17, 2024

Apr 17, 2024