How to Identify and Trade a “Gift Gap”

Last week, we received a unique pattern that I call a “Gift Gap.”

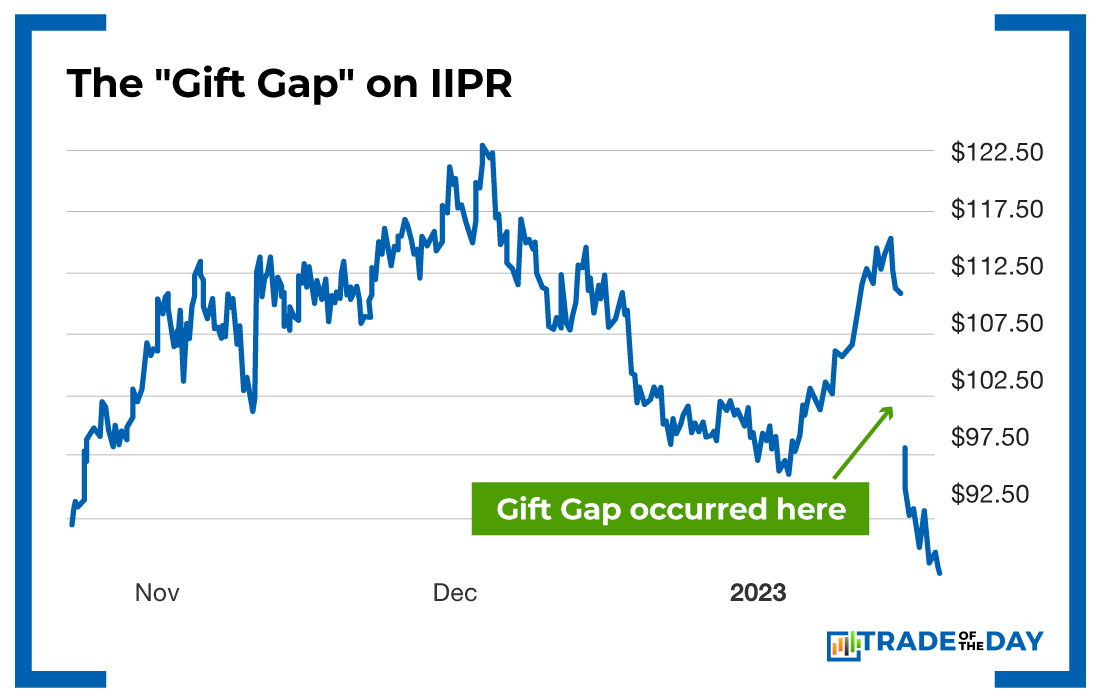

It occurred on a company called Innovative Industrial Properties (IIPR).

Today, I’m going to explain what a “Gift Gap” is – and show you exactly how to profit off it.

Here’s the rundown…

Last week, IIPR dropped $18.79 (a 16.95% haircut) after its operating, investment and capital markets activity for the fourth quarter and the 2022 fiscal year was not met kindly on Wall Street.

As you probably know, Innovative Industrial Properties is the first and only real estate company on the New York Stock Exchange that’s focused on the regulated U.S. cannabis industry.

You’ll see below that last week’s drop created a massive gap in the chart.

This void from $110 down to $97.50 is what I call a “Gift Gap.”

Now, here’s the thing…

When it comes to gaps of this size and magnitude, they eventually get filled back in at some point.

When this “backfill” move happens, you want to be ready.

Why?

Because when a stock moves back up into a gap, there’s very little built-in resistance.

In other words, once a stock moves back into a gap, there’s no resistance to push it lower – which typically leads to a nice, tradeable upside recovery move.

I see it all the time.

If you’re patient enough to wait for the right moment, these “Gift Gaps” could result in big trading winners.

Looking specifically at IIPR, let’s break down how to play it…

![]()

YOUR ACTION PLAN

If Innovative Industrial Properties (NYSE: IIPR) can move back above $97.50, that would be the trigger to make a play on the “Gift Gap.” A move above $97.50 would push IIPR back into the void created by the big sell-off, which currently has no built-in resistance all the way up to $110. That’s a nice $13 move – which could certainly lead to a big intraday call play winner.

Do you want more trading ideas like this coming at you live… every single trading day? Then you’re invited to join our War Room trading community.

So you can see if membership is right for you, we invite you to explore The War Room HERE.

MONDAY MARKET MINUTE

- More Gold! Gold has advanced for five straight weeks – and moved higher in 10 out of the last 12. This indicates the Fed’s future moves are bearish for stocks, and traders are seeking cover.

- Ferrari Making a Leap?Barron’s is now bullish on Ferrari due to the company’s new lineup of SUVs and electric vehicles. But relative to other car brands such as Toyota and Ford, Ferrari deserves a higher valuation due to the premium of its brand.

- Vaccine Maker Handing Out Gains. The health sector remains the safest in what’s been a volatile start to 2023. We took a winner on Moderna (MRNA) last Friday in The War Room… and reloaded for two more wins today!

- Salesforce Gets Big Investment. The leading sales software company saw a 3% premarket rise after it was reported that activist investor Elliott Management made a multibillion-dollar investment in the company.

More from Trade of the Day

When it Comes to Positioning – Size Matters

Apr 18, 2024

The One Strategy I’m Leaning on in a Choppy Market

Apr 18, 2024

One Crucial Wartime Trade to Make Now

Apr 17, 2024

Apr 17, 2024