The Best Small Cap Technology Play Out There

Editor’s Note: You don’t have to be a hockey fan to understand the meaning behind one of Wayne Gretzky’s most memorable quotes: “You miss 100% of the shots you don’t take.“

As Oxford Club Chief Investment Strategist Alexander Green explains in today’s guest article, investors miss 100% of the winning stocks they don’t buy.

And here’s one shot you’re going to want to take…

Cancer has often been a death sentence – but that’s changing thanks to the ingenuity of the scientists at this one tiny company with a low share price.

Now tens of thousands of people have a new lease on life.

Science magazine calls this medical breakthrough a “homing device” that leaves healthy cells alone…

And BioWorld simply calls it a “landmark” new FDA-approved drug…

Go here to learn more about the stock you don’t want to miss.

– Ryan Fitzwater, Associate Publisher

Twenty years ago, I heard a stand-up comic ask the audience, “What’s the definition of a sports nut?”

The punch line: “Anyone who can name a hockey player other than Wayne Gretzky.”

Longtime fans of the sport will scoff. But let’s be honest…

“The Great One” was to hockey what Bob Marley was to reggae: the category killer.

In his 21 years, Gretzky scored 894 goals and had 1,963 assists. (No player in history has as many goals and assists combined as he has assists alone.)

Asked over the years how he managed this feat, Gretzky gave two answers that have become legendary.

- “You miss 100% of the shots you don’t take.”

- “I skate to where the puck is going to be, not where it has been.”

For investors, there is a lot of wisdom in those words.

Just as you miss 100% of the shots you don’t take, you miss 100% of the winning stocks you don’t buy.

How many millions of investors watched the parabolic rise in value of stocks like Apple (AAPL), Amazon (AMZN), Netflix (NFLX) and Tesla (TSLA) – all up more than 100-fold – and never thought the time was right to invest in them ever?

They missed 100% of their potential shots.

Skating to where the puck was – rather than where it is going to be – is called “performance chasing” in the investment world.

Twenty-three years ago, investors chased dot-com stocks. They crashed and burned.

A decade later they rushed to make furious above-market bids on residential real estate. The property market imploded.

(And there is good evidence that another property bubble is developing today.)

Crypto speculators – I refuse to call them “investors” – chased Bitcoin and other digital currencies into the stratosphere. Now most are sitting on big losses.

Over a year ago, investors fell in love with “disruptive” tech companies that were not only pre-earnings but pre-revenue.

Result? Cathie Wood’s Ark Innovation ETF (ARKK) – a good proxy for the “no price is too high to pay” approach to investing – fell from grace.

These investors all ignored Gretzky’s sage advice. They skated to where the puck had been rather than where it was going to be.

This is a perennial problem.

Today, for example, most investors are chasing the same small group of “value stocks,” the new investment du jour that has outperformed the market in recent months.

True, there is still some upside here.

But Oxford Club Members picked up value stocks like CVS Health (CVS), Energy Select Sector SPDR Fund (XLE), Arch Capital (ACGL) and Berkshire Hathaway (BRK-B) more than a year ago.

Now we’re sitting on big profits and cashed out on others.

We didn’t buy them because they were in favor but precisely because they were out of favor.

Want to skate now to where the puck will soon be?

Then invest a few dollars in one of the most promising and undervalued sectors in the market right now: small cap medical technology.

There are three good reasons to expect big returns here in the weeks and months ahead.

- Healthcare is recession-resistant. It doesn’t matter whether the economy is expanding or contracting, whether inflation is hotter or colder, or whether interest rates are rising or falling. People who need medical attention will seek it and find it. You can take economic forecasting off the table. The demand for medical services is largely inelastic.

- Innovation is constant. New medical devices are protecting, extending and saving our lives. Virtually all are patent protected. That stops competition, puts a moat around profit margins, and drives strong top- and bottom-line growth.

- It’s the perfect contrarian investment. Technology stocks have been hit hard this year. But small cap tech stocks – including those in the medical field – are lying in the bargain bin, unloved and undervalued. And therein lies a huge opportunity.

![]()

YOUR ACTION PLAN

I recently pinpointed a medical technology stock that has all the makings of a superb investment.

In my latest presentation, I explain why medical technology is where the puck is going to be – and reveal the name (and ticker symbol) of one of the most exciting innovators in the sector.

The only question Wayne Gretzky would ask at this point is “Will you take the shot?”

Click here to discover this medical technology stock.

Good investing,

Alex

FUN FACT FRIDAY

Fed Uncovers a “Secret Profit Window”? Nothing says “Fun Fact” more than digging into inflation data, right? But hear us out, because this could impact you…

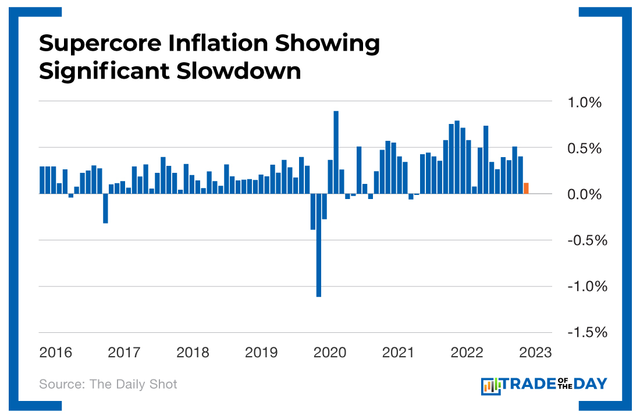

While the latest consumer price index data showed inflation dropped modestly, something called supercore inflation is showing a more significant slowdown. Supercore inflation refers to workers charging more for their services, including things like haircuts, electrical work and gardening. The prices for those services are typically less volatile than food and energy prices – and according to the orange bar on the chart, they seem to be moving in the right direction. So that’s a good thing.

The latest inflation numbers are likely to lead to a pause in interest rate hikes for a while… and we just uncovered a buried Fed report that unlocked a Secret Profit Window for investors.

More from Trade of the Day

When it Comes to Positioning – Size Matters

Apr 18, 2024

The One Strategy I’m Leaning on in a Choppy Market

Apr 18, 2024

One Crucial Wartime Trade to Make Now

Apr 17, 2024

Apr 17, 2024