Motorcycle Company Rises With Banks

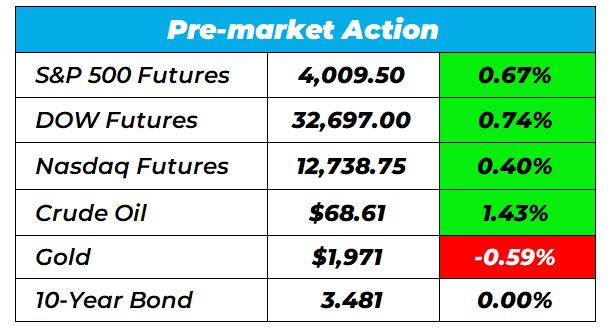

Good morning Wake-up Watchlisters! While you’re sipping coffee you’ll see stock futures rose on Tuesday as banks continue to see relief (more on that below). Investors are also waiting on the outcome of the Federal Reserve’s latest monetary policy meet, which is expected to include a 25-basis-point rate hike on Wednesday.

With the markets still volatile, it’s important to consider alterative investment ideas. Right now our friend Marc Lichtenfeld has an unusual way to potentially bank massive income from the oil and gas surge. This is NOT a stock, bond or private company, and it’s a way you could collect monthly income over and over again… for life.

Click here to see why the average return on this unusual class of investments was 196% last year.

Here’s a look at the top-moving stocks this morning.

First Republic Bank (NYSE: FRC)

First Republic Bank is up 22.17% premarket after a broad recovery in the banking sector across Europe and the United States. Fellow regional lenders Bancorp and PacWest Bancorp are also rising. JPMorgan Chase Chief Executive Officer Jamie Dimon is gathering a new plan to aid First Republic. The move would potentially convert $30 billion in deposits that a group of US banks injected into a capital infusion

We’ve been avoiding the panic and buying these bank dips in The War Room. Last week we took a 38% winner on SCHW and are looking for more trading opportunities.

If you want to get in on the action, click here to learn more about overnight trading.

New York Community Banccorp (NYSE: NYCB)

New York Community Bancorp is up 5.69% premarket after Wedbush upgraded it to outperform from neutral based on expected earnings boost from its acquisition of Signature Bank’s loan and deposit portfolio, as announced by the Federal Deposit Insurance Corp. New York Community Bancorp’s Flagstar unit will operate Signature Bank’s 40 branches starting Monday.

Nio Inc. (NYSE: NIO)

Nio is up 1.15% premarket as some investors believe it might be time to get back into the Chinese electric vehicle maker stock. According to The Motley Fool, its market demand remains high. Plus, Nio is transitioning to a new technology platform and still preparing its factories to produce new models. If the company can ramp up production and launch new products this year as planned, it could see a boost in its margins.

While many electric vehicle stocks have struggled as of late, the truth is the EV market is still seeing high demand. And right now there’s a $25 startup our friend Andy Snyder wants you to know about. Its car has a 1,080 horsepower engine and goes from zero-to-60 in 2.5 seconds. The Wall Street Journal says it could be the next Tesla.

Click here to unlock this $25 EV stock.

Harley Davidson (NYSE: HOG)

Harley Davidson is up 3.81% premarket as the motorcycle company continues to behave like a bank. There’s a reason for this. Harley trades with banks during times of stress, and their consumer finance operations are very large. A small bank is attached to each manufacturing organization. Although Harley is a manufacturing company, it does not carry the same risks as banks and does not have any deposits that can be withdrawn.

Those are the biggest stock movers for today.

Happy trading!

The Wake-Up Watchlist Research Team

More from Wake-up Watchlist

Apr 23, 2024

Electric Vehicle Company Drops…

Apr 22, 2024

Sony in Talks to Takeover Media Company

Apr 19, 2024

Apr 18, 2024