Grow Your Nest Egg Faster

Editor’s Note: Today, we’ve got an important article from our friend Marc Lichtenfeld, Chief Income Strategist at The Oxford Club. Marc has a strategy for growing your retirement nest egg faster.

It taps into the power of compound dividend stocks.

You can learn more about this bulletproof strategy by checking out his Easy Income Challenge.

In it, you’ll…

Get easy-to-follow directions for setting up your own dividend portfolio…

Learn how to find winning stocks…

Discover the best ways to maximize your future payouts…

Plus a lot more.

You won’t want to miss this one.

Click here to take the Easy Income Challenge.

– Karim

When I was a kid, I always worked – whether I was shoveling snow in the winter or working at an ice cream store.

I didn’t really have many costs back then. A concert ticket was probably my biggest expense (I remember paying $15 to see Rush).

So I saved my cash for a rainy day. And it started raining when I was in college. The money I earned in high school and during summers kept me afloat (barely) during my junior and senior years.

As a young investor, I was all about trying to build wealth. The lessons from my youth fueled my desire to build a nest egg and ensure I had cash I could tap into if I needed it.

As I got older and built a safety net (six months of expenses in cash), my focus shifted to generating passive income – not because I needed the money, but because it’s a great way to compound wealth.

And eventually, when I’m no longer collecting a paycheck, I want to have pieces in place that will generate income for me.

Most people save and invest in order to draw that money down when they retire. My goal is to create so much income from my investments that I never have to touch the principal.

A very important component of my income investing portfolio is dividend stocks – particularly Perpetual Dividend Raisers. These are companies that raise their dividends every year.

Owning stocks of companies that raise their dividends every year accelerates compounding if you’re reinvesting the dividends, and it helps you stay ahead of inflation if you’re collecting the dividends.

Here’s what I mean…

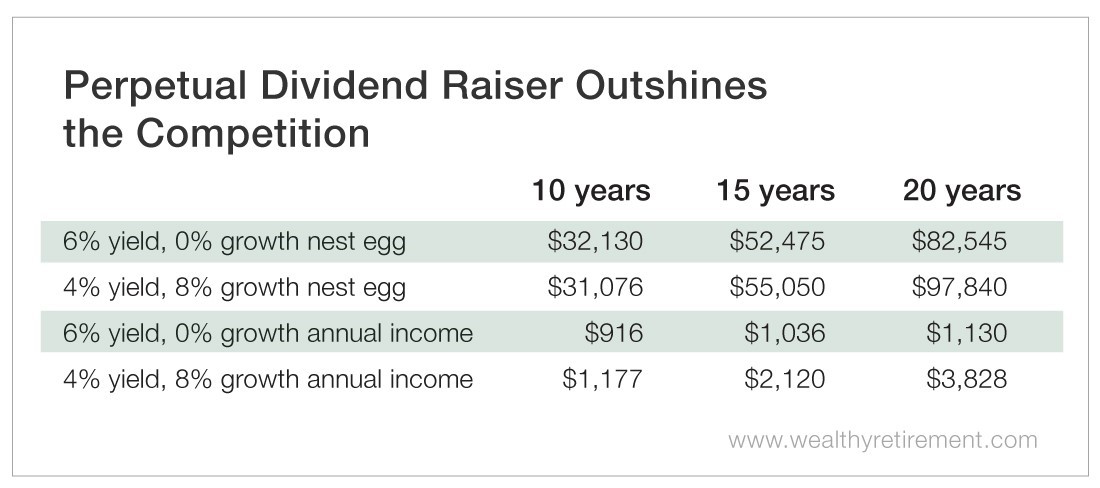

Let’s say you invest $10,000 in a stock that pays a 6% yield but does not grow the dividend.

If the stock appreciates at a pace in line with the historical average of the S&P 500, and if you reinvest the dividend for 10 years, you’ll have $32,130 after 10 years, $52,475 after 15 years and $82,545 after 20 years.

Furthermore, after 10 years, you’re collecting $916. After 15 years, $1,036. And you’ll receive $1,130 after 20 years.

Now, what happens if we start off with a 4% dividend yield, but that dividend grows 8% per year?

After 10 years, the nest egg is slightly lower at $31,076. You’ll have more after 15 and 20 years than you did with the flat 6% yielder. Your totals will be $55,050 and $97,840.

Perhaps more importantly for the investor who starts collecting the income after 10 years, the Perpetual Dividend Raiser generates $1,177 – substantially more than the $916 in the earlier example.

After 15 years, the income rises to $2,120. If you let the money compound for 20 years and then begin receiving the dividend checks, you’ll take home $3,828 – more than three times the amount with the higher-starting, but static, yield.

How about if you need the income today and don’t have time to reinvest the dividend and let it compound?

A $10,000 investment in a stock that yields 6% and doesn’t grow its dividend will generate $600 in income every year.

The 4% yield that grows by 8% every year starts off paying you $400 per year.

By year seven, you’re making $637 – more than the 6%-yielding stock.

At year 10, you’re collecting $799 – 33% more than the $637 paid by the 6%-yielding stock.

After 15 years, you’re collecting just about double the amount of the other stock with $1,159, and five years after that, your income is $1,726 – nearly three times the amount of the 6% stock.

This is a perfect illustration of why I strongly recommend Perpetual Dividend Raisers for long-term investors.

Your nest egg will grow faster, and you’ll receive more income than if you chased yield and bought stocks that paid higher dividends but didn’t grow those dividends.

Though the money I earned in high school and over summers helped me get through college, it was a sickening feeling to draw down those reserves, knowing there wasn’t much left for a real emergency.

Perpetual Dividend Raisers help ensure I never have that experience again. Owning stocks that generate more income every year should help me avoid draining the nest egg at a rapid pace.

Action Plan: To learn how to build a bulletproof passive income stream and compound your wealth using dividend stocks, check out my Easy Income Challenge.

In it, I show you – through easy-to-follow directions – how to set up your own dividend portfolio.

Including how to find winning stocks…

How to maximize your future payouts…

And plenty more.

Click here to take my Easy Income Challenge.

Fun Fact Friday:

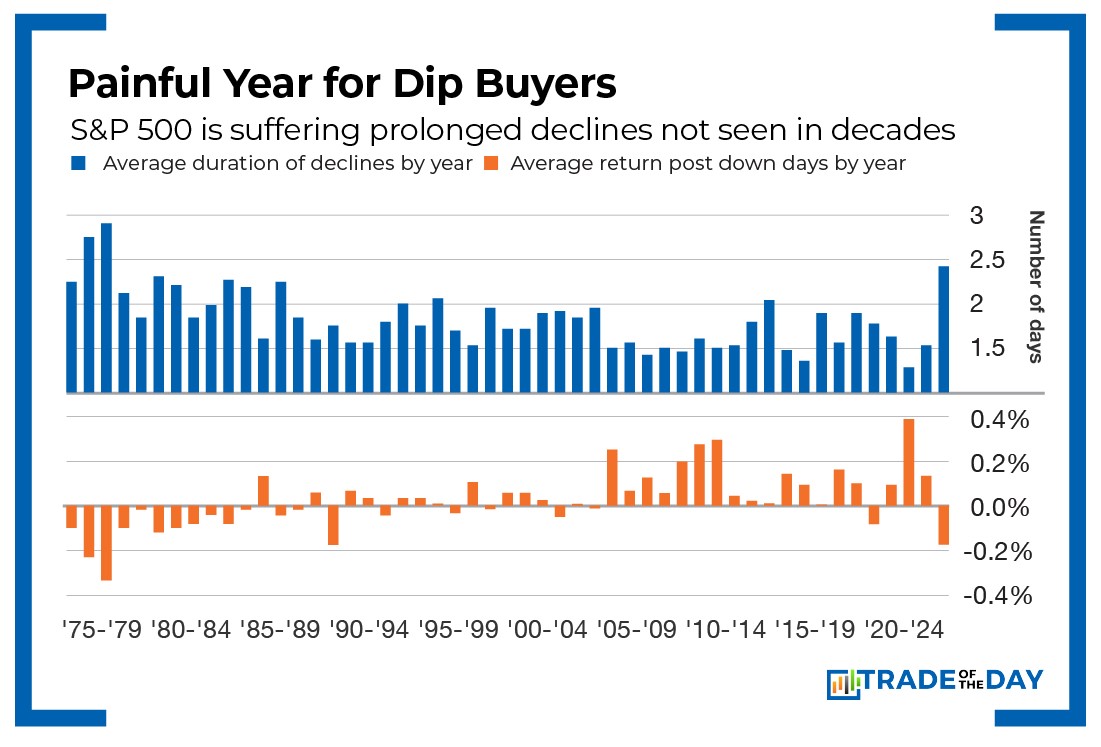

Dip buyers have been getting punished this year. There have been prolonged declines not seen in decades. That’s why you can no longer dip-hunt with a shotgun. We’ve been telling you that it’s time to pull out the sniper rifle and target only the best-of-breed value stocks. We’ve got one – trading for under $2 – you should set your sights on ASAP. An announcement on May 12 could send this stock rocketing higher. Discover more about The Last Great Value Stock.

More from Trade of the Day

My Go-To Plays for Safety + Long-term Profits

Apr 26, 2024

My Favorite Way to Hedge Choppy Markets

Apr 25, 2024

The Story Behind My 10 Bagger on RILY

Apr 25, 2024

A Silver Lining From Last Week’s Underperformance

Apr 24, 2024