Can Average Investors Beat the Market?

Editor’s Note: In less than a year, Oxford Club Chief Trends Strategist Matthew Carr’s two best stocks went up 586% and 316%.

But only 455 people were signed up to receive the alerts on these companies.

Matthew wants to make sure that no one misses these kinds of gains again…

So he is giving away one FREE bonus year of access to his record-setting Trailblazer Pro research service.

Normally, this service costs $4,000 for a single year… so you’ll want to take advantage of this!

Click here to claim this offer now.

– Karim Rahemtulla, Head Fundamental Tactician, Monument Traders Alliance

Wall Street money managers LOVE to say, “Regular investors can’t beat the market.”

I get it. That statement helps justify their jobs.

They sing this as gospel, despite the unsettling fact that 90% of professional money jockeys can’t beat the market.

I mean, logically, if their full-time job is devoted to outperforming the market, and they can’t do it, then how can a retail investor – who’s only a part-time trader – hope to accomplish it?

Of course, the mainstream media doesn’t get it either.

There are articles that make my blood boil, like the one I saw years ago on CBS News titled “You Can’t Beat the Market, So Stop Trying.”

Or what I think is the worst advice – though I’ve seen it countless times – “Hunker down in bonds and savings accounts.”

Savings accounts?!

I’d rather take an America’s Funniest Home Videos-worthy shot to the family jewels!

And considering the potential prize money, that might have a more profound impact on my retirement.

Picking Out the Bad Apples

Oftentimes, the only course of action is to ignore the talking heads.

Especially when they start speaking out of both sides of their mouths.

Though, as investors, we’re subject to the volatility that the words falling from their lips cause.

Let’s take COVID-19 vaccine maker Moderna (Nasdaq: MRNA) as a prime example.

In mid-August, shares trailed lower over value concerns. And this move added to the steep drop they endured after hitting all-time highs earlier in the month.

Now, a 24.5% dip isn’t something we can easily wave off, like a sudden, unpleasant smell.

But Moderna has outperformed the S&P 500 by an astronomical amount in 2021. In fact, the index’s 22% gain appears as a nearly horizontal line next to Moderna’s 259% run. And keep in mind that Moderna shares skyrocketed 434% in 2020.

The issue analysts are having is that their consensus price target for the vaccine maker is $295.83. Even after the recent pullback, shares would still need to fall another 21% to come in line with that level.

Here’s the deal…

From Wall Street’s perspective, Moderna is one of 70 companies in the S&P 500 that analysts consider overvalued.

GASP!

That seems like a lot. But in reality, it’s only about 14% of the index. If 14% of an apple has a bruise, you simply avoid that part and eat around it.

The other 86% is good. And for the S&P 500, that’s about 430 companies. That’s a buffet for retail investors to feast on!

Doomsday Patrol Is Ready to Roll

“If it bleeds, it leads.” That’s an age-old adage for news organizations.

As humans, we have a fascination with disaster, drama and panic. We gorge ourselves on negativity like the empty calories from a box of Twinkies.

It satisfies some primitive part of our being.

Good news is easily cast aside, as it has no place in the dark narrative that so many people want to cultivate.

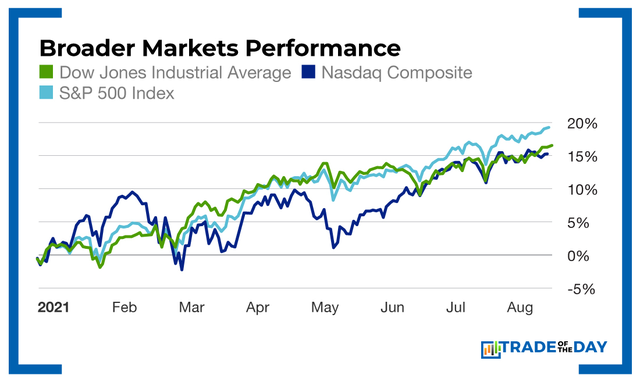

Amid that narrative, you might not realize that the broader U.S. indexes are hitting all-time highs.

The Dow, Nasdaq and S&P 500 have once again soared by double digits year to date.

And this is a trend I forecast all the way back before the election in November 2020.

Part of it is the impact of my modern presidential cycle. The other is booming business across the board.

But this is when the doubt seeps in. When is the other shoe going to drop?

During market runs like this, the doomsayers crawl out from their bunkers to preach that it’s all going to end in ruin.

I remember reading in the Financial Times in October 2009 that the stock market was overvalued by more than 40%.

That was a little more than seven months after the market bottom following one of the worst collapses in Wall Street’s history.

Similar threats were repeated in 2010 by CNN and in 2011 by Robert Shiller in The Wall Street Journal, not to mention countless other mainstream outlets.

It was a chorus for more than a decade until COVID-19 finally dragged the bull to the ground in March 2020. And then all those doomsayers said smugly, “See, we told you so.”

I’ve been in the financial business for two decades. I’ve seen the heights of euphoria – where every warning is ignored – and the gut-wrenching despair of the lows.

This is neither.

As of August 17, 88% of S&P 500 companies have beaten second quarter earnings and revenue expectations.

And in 2022, for the first time in a decade, every single S&P 500 company will be profitable.

So don’t let the negativity fool you.

Throughout my career, I’ve learned the most important lesson for financial freedom…

You can do it.

Anyone can.

The average investor can beat the market.

We accomplish it by attacking when the world feels like it’s on the cusp of ending, then nibbling at the peaks.

We listen to the data and plan for what’s ahead.

We focus on individual companies that have plenty of upside ahead.

The bull market isn’t dead. But now it’s time to be more selective than we were a year ago.

That means focusing on quality, not hype. And recognizing when mainstream negativity is an ally.

Here’s to high returns,

Matthew

More from Trade of the Day

My Favorite Way to Hedge Choppy Markets

Apr 25, 2024

The Story Behind My 10 Bagger on RILY

Apr 25, 2024

A Silver Lining From Last Week’s Underperformance

Apr 24, 2024

How One Conversation Led to $100,000

Apr 23, 2024