Buy Alert: The Coming Travel Surge Is Not Priced Into These Stocks

In the movie Groundhog Day, Bill Murray repeats the events of the day over and over again as a penalty for his cynicism. In doing so, he is able to benefit from the repetition of events.

We have the same opportunity. You see, we are for the most part U.S.-centric traders. Our familiarity with names and brands is deeply linked to what we buy and sell in the market. And, let’s face it, the New York Stock Exchange and the Nasdaq are the biggest markets in the world, and the U.S. is considered the center of the financial universe.

This leaves an opportunity for the savvy investor. You see, what happens in the U.S. and to U.S. stocks is often replicated overseas. Today, I am going to share a perfect example of how you can profit.

It’s no secret that Americans can’t wait to travel. Everyone I know wants to get on a plane and go SOMEWHERE! The problem is that we also want to travel safely and not risk getting COVID-19 on the plane or at our destination.

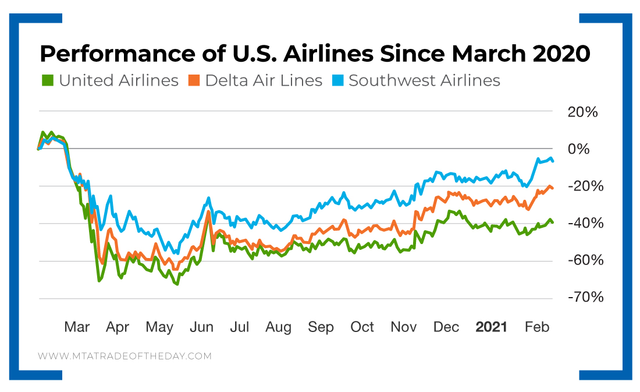

That’s the problem… a lot of pent-up demand and no supply. This will change, and when it does, travel will skyrocket. The coming tourism surge is already priced into U.S. stocks, especially travel-related shares.

But you know where it’s not priced in? Foreign travel shares.

So here’s the play.

Action Plan: Buy shares of foreign airlines that will also make money when travel opens up. There’s a whole list of them out there, and in The War Room, members just bought two stocks that I think will take off! Out of respect to our members, I can’t share their names.

With a little legwork, you’ll find companies that operate in Europe and Asia that could mimic the moves U.S. carriers have made. Better still, join me live in The War Room and you’ll have all the exact information in real time at your fingertips today! Click HERE to get started.

More from Trade of the Day

My Favorite Way to Hedge Choppy Markets

Apr 25, 2024

The Story Behind My 10 Bagger on RILY

Apr 25, 2024

A Silver Lining From Last Week’s Underperformance

Apr 24, 2024

How One Conversation Led to $100,000

Apr 23, 2024