Do You Have Trading Discipline?

When I began my career investing on Wall Street, I had no discipline when it came to trading or investing.

Like almost everyone else, I was a gambler – and I was on the inside!

I would hear about huge gains on CNBC and CNN Money and watch Lou Dobbs get really excited about the market every day.

Reality quickly set in. I lost money more often than I made it.

My account balance at the end of my first year was lower than where it began.

Yet seemingly everyone else was making money…

The truth, however, was that most people were just like me – losing or barely keeping their heads above water. It was a rigged game.

By the time I placed my order, others on the inside had already made their money. I was dependent on the news, and that meant I was getting in on plays well after many, many other people had already gotten in.

That was pre-internet, when news came out on TV or in Money magazine or Barron’s.

As a trader, if you rely on news that is older than a few minutes, you are at a disadvantage.

To combat this disadvantage, I had to develop a trading style and methodology that was independent of the news of the day. It had to be a strategy that worked in my favor so that the news-of-the-day crowd would make ME money.

The strategy I came up with takes advantage of volatility.

You see, the most important component of an option’s price, after length of time on the contract, is volatility. When volatility picks up, options’ premiums pick up as well. That is where I step in as an options seller – not as a buyer.

Before I ever sell an option, I need to know that it fits my strict parameters. Otherwise, I am just gambling again.

I use tools like a probability calculator and look at the company’s fundamentals.

Then I ask myself…

What price would I pay for this stock? Would I be a buyer at current prices, or do I want to get a huge discount on the share price today?

The answers to those questions form the crux of my put-selling strategy, which has a 97%-plus success rate going back to May of 2019 and an 80%-plus success rate going back many more years.

I don’t care what the market says right now…

I care what my calculator says should happen with an 80% probability.

Can you say that with confidence? That you expect 80% of your trades to work?

Not many can.

Action Plan: This strategy is just one example of how discipline has served War Room members well – extremely well, I’d say, seeing as we’ve had only two losing trades (one was a 3% loss) and 64 winners with this strategy since May of 2019.

If you want a piece of this put-selling profit parade, join me in The War Room now!

I will teach you not only how to sell puts but how to sell them profitably, time and again! Click here to get started.

Friday Fun Fact

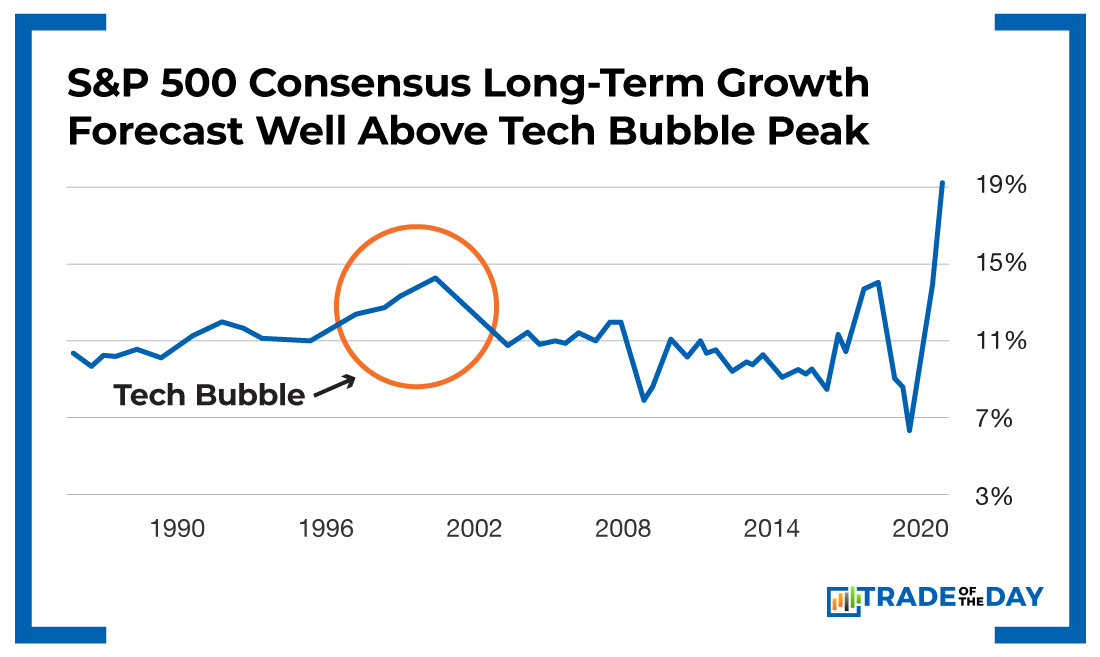

The consensus long-term growth expectations for the S&P 500 are at record highs. Think that’s too much enthusiasm? If you are worried, you can protect yourself from a future pullback – while still maintaining upside exposure. Learn how to WIN if stocks go UP… or DOWN. They just have to move! Our latest presentation shows you how – click here.

More from Trade of the Day

My Favorite Way to Hedge Choppy Markets

Apr 25, 2024

The Story Behind My 10 Bagger on RILY

Apr 25, 2024

A Silver Lining From Last Week’s Underperformance

Apr 24, 2024

How One Conversation Led to $100,000

Apr 23, 2024