Another Meme Stock Meltdown…

Another day… another earnings winner.

Rinse and repeat.

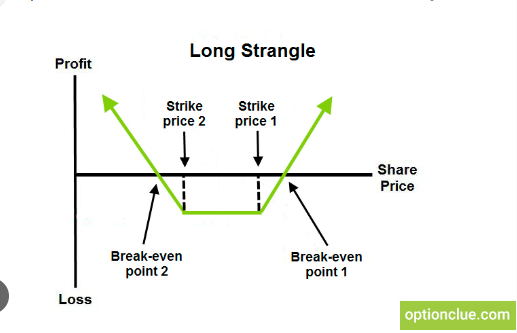

Don’t get me wrong, trading earnings is risky, especially if you’re doing it like this:

They fall in love with a stock and its story so much they’re willing to gamble their hard-earned money ahead of earnings.

They are left heartbroken when things don’t turn out their way:

If you want to succeed in the stock market, it’s crucial to detach from personal biases and make decisions based on risk vs. reward.

Let price action dictate your next move, not what some random person on a message board or talking head on CNBC tells you.

And stop trying to guess where a stock will go before earnings.

Even if you do get lucky, ask yourself if it’s a repeatable process.

I didn’t take my trading account from $37K to $2.7 million in four years, betting on red at the casino.

So, how am I avoiding the pitfalls associated with trading earnings?

First, I don’t trade into the event. That eliminates the volatility crush in options after an earnings announcement and their binary nature.

Instead, I wait to see how the stock reacts after the big move.

Will it hold onto it, trade sideways, or give it back up?

Believe it or not, I prefer a stock to trade sideways after it has a big earnings beat.

Why?

Because it’s absorbing the move and consolidating…and possibly setting up for the next leg higher.

That’s precisely what happened with Pinterest (PINS) after its shares surged by 16% following its Q1 earnings.

This is why I bought the May 17, $40 calls and $39.5 calls a few days ago…

And I sold them yesterday and today for some solid profits.

And that’s how I play earnings.

I find the setup, define my risk, and take the trade.

This approach has given me an 87.5% win rate on my trades this year.

That said, there are plenty of earnings this week, including Upstart, Lyft, Arm Holdings, Aribnb, Robinhood, Wynn Resorts, and some bitcoin miners.

This is why I’ll be utilizing my One Ticker Payouts strategy to take advantage of them potentially.

Now, I can’t say with certainty I will play any of them. They must fit my criteria.

But if any of them have a strong earnings surprise, and exhibit sustainable momentum, you better believe I will be looking for ways to play them like I did with PINS.

As long as there is a clear trend, I will be willing to try my One Ticker Payouts strategy.

Are you frustrated with watching your hard-earned money disappear in the market during earnings trades?

There are still tons of plays left, with major earnings announcements still to come from Nvidia, Airbnb, and Arm Holdings.

It’s the perfect time to explore a new approach.

Discover the One Ticker Payouts strategy and position yourself for success this earnings season.

Click here to learn more and transform your approach to earnings trades!a

More from Trade of the Day

LEAP into Spreads for Potential Triple-Digit Winners

May 17, 2024

My Two Favorite LEAP Strategies for Making Money

May 16, 2024

A Backdoor Way to Trade Nvidia

May 16, 2024