Place Your Bets, Apple Earnings Tonight

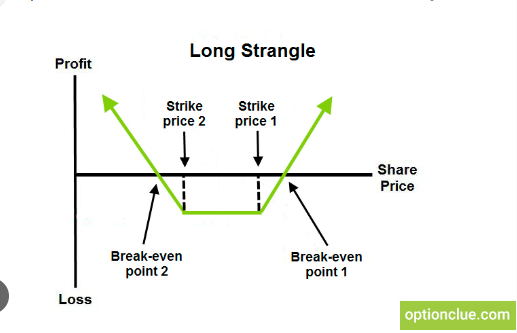

Take a look at the image below…

As of March 2024, 27 Wall Street firms are dedicating analysts to cover Apple (AAPL).

Despite the intense scrutiny on Apple, does anyone truly know how the stock will perform after it releases earnings?

According to the options market, market makers expect a +/- 4% move.

But how right have the market makers been this earnings season?

Let’s take a look.

For example, they predicted:

- A 12.8% move in SMCI the other day, yet it overshot by 18%.

- A 7.7% move in SBUX, but it declined by 17.87%

- They predicted a 7.7% move in AMZN, yet it only closed at 2.28%.

Whether you’re bullish or bearish…understand that trading earnings is a gamble.

In many cases, an all-or-nothing bet.

But most importantly, it’s not a repeatable process.

That said, I love trading earnings stocks.

Just not ahead of the earnings announcement.

I wait for the dust to settle and find my levels…then execute.

That’s precisely what I did in CVNA this morning. The options market was implying a 16.1%, and like many stocks this earnings season, they were dead wrong, as the stock surged by 35%.

As traders, we have three objectives.

- Find setups

- Define risk

- Take shots

And some of the best setups can be found right after a company releases earnings.

Which is exactly what my One Ticker Payouts strategy is all about.

It capitalizes on earnings plays while eliminating some of the aspects that make earnings trading so risky, such as the “volatility crush” and the all-or-nothing gamble.

I prefer to navigate the aftermath when the smoke has cleared, but the opportunity remains ripe.

I don’t just jump into a play if the stock is raging…I want to see if it can consolidate after making the big move.

If it can hold the move and trade sideways, that’s an indication that it might be ready for another leg higher.

And that’s something I saw in CVNA this morning.

If it’s jumping around…I don’t want to touch it.

I want to focus on clear trends, whether bullish or bearish. It doesn’t matter…just as long as the trend is clear.

This approach is the reason I have a 87.5% win rate with all my One Ticker Payout trades in 2024.

So… will I be trading Apple ahead of earnings?

Not today…

But if it surprises with earnings and exhibits sustainable momentum after tomorrow’s earnings announcement, you better believe I’ll be looking at some potential trades.

And, of course, I’ll utilize the One Ticker Payouts strategy if I decide to trade it.

If you’re tired of giving money to the market from earnings trades, then it’s time to look at a different way to play them.

We’re still very early into earnings, with some big names still remaining, like Nvidia, Apple, and Coinbase.

More from Trade of the Day

My Two Favorite LEAP Strategies for Making Money

May 16, 2024

A Backdoor Way to Trade Nvidia

May 16, 2024

Your Free Access to Our NVDA Super Trade Event

May 14, 2024